Crisis of the Turkish Lira

Crisis of the Turkish Lira

Today, the Turkish lira fell another 8% after President Erdogan defended the central bank, which sharply lowered the reference interest rate last week. He said he would win his “war for economic independence” despite numerous criticisms and pleas to reverse the course.

Today, the Turkish currency fell to 12.49 lira against the dollar. The currency reached a new low after slipping during the last 11 consecutive sessions. It faced a loss of 40 percent of its value this year. As well as a drop of 20 percent since the beginning of last week.

According to the British agency, Erdogan pressured the central bank to turn to an aggressive cycle of monetary easing to stimulate exports, investments, and job creation. This was despite rising inflation to close to 20 percent and accelerating depreciation of the national currency, which erodes wages.

The former deputy governor of the central bank, Semih Tumen, called for an urgent return to the policy protecting the lira’s value.

We must immediately abandon this irrational experiment that has no chance of succeeding. “We must return to a quality policy that protects the value of the Turkish lira and the prosperity of the Turkish people,” he wrote on Twitter.

The lira is recording by far the worst result among emerging market currencies this year. This is mainly due to, as analysts say, “reckless and premature monetary easing.”

Against the euro, the Turkish currency sank to a new record low of 13.4035 lira.

The yield on the reference 10-year government bond rose above 21 percent for the first time since the beginning of 2019. According to data from the Trade Web, the value of Turkish government bonds denominated in dollars fell by more than one cent in today’s early trading.

Istanbul’s Stock Exchange

Due to the lira’s fall, the main stock index in Istanbul’s stock exchange jumped 1.5 percent due to unexpectedly cheap estimates of their value.

Last Thursday, the Central Bank of Turkey lowered the reference interest rate by 100 basis points to 15 percent. This is significantly below inflation of almost 20 percent and indicated its further reduction. Since September, the central bank has cut the reference interest rate by 400 points. Analysts say this is a “dangerously wrong policy.”

Given the profoundly negative real returns, virtually all other central banks have begun tightening monetary policy or are preparing to do so.

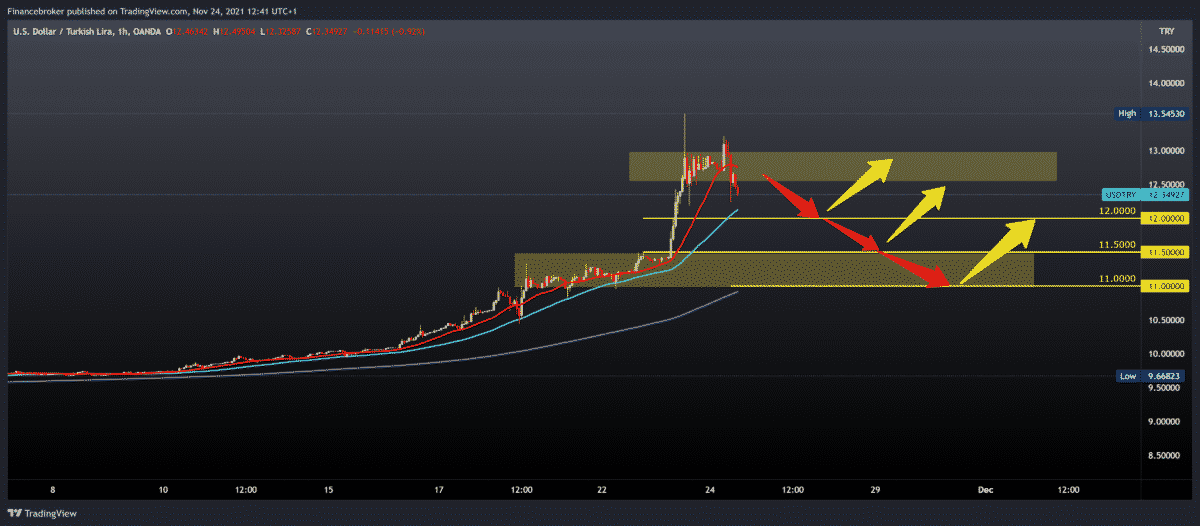

Tehnical analysis for USD/TRY

The fall in the value of the Turkish lira yesterday reached a historic level of 13.5453. After that, we have a retreat to 12.5000 due to a sudden jump. Looking at the hourly time frame chart, we see that the USDTRY has fallen below the MA20 moving average. Thus, directing us to the MA50 moving average of around 12.0000.

Based on the previous history of the chart, we see that these two moving averages are a good indicator of the movement of the value of the Turkish lira.

As we said, our first support is at 12.0000. If it does not last, the next one is at 11.5000. That is a place of the previous consolidation of the break towards the previous maximum. Our MA200 is in the zone around 11.0000.

The post Crisis of the Turkish Lira appeared first on FinanceBrokerage.

0 Response to "Crisis of the Turkish Lira"

Post a Comment