EURUSD, GBPUSD currently without serious support

EURUSD, GBPUSD currently without serious support

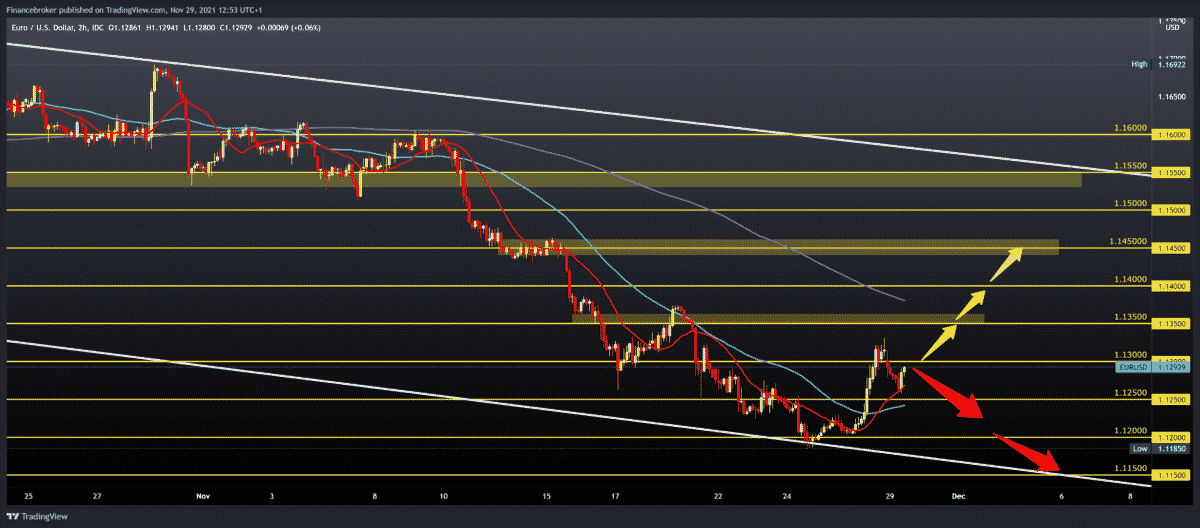

Pair EURUSD is trying to find support and move from last week’s low to 1.11850. Currently, the Euro has found support at 1.12500 and is trying to make a break above 1.13000. The new strain of the coronavirus has shaken the Euro as opposed to the dollar, which is considered a safe haven for investors.

Bullish scenario:

- We need the continuation of positive consolidation above 1.13000 with the support of the MA20 and MA50 moving average.

- The break above us climbs to the previous resistance zone of the bullish trend at 1.13500, and in the area 1.13500-1.14000, our potential next resistance is 1.14000.

- The EURUSD breakout climbs to 1.14500 pre-consolidation from 15 November.

Bearish scenario:

- We need a negative consolidation and withdrawal of EURUSD below 1,125,000.

- The break below us further leads to the next support at 1.12000.

- If the dollar continues to strengthen, the EURUSD decline is evident below 1.11500.

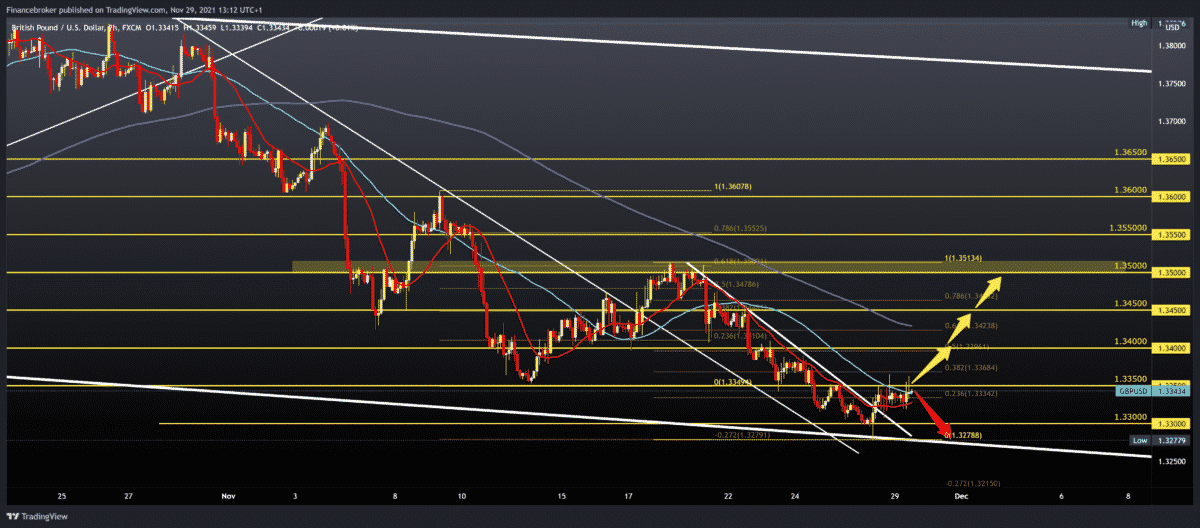

GBPUSD chart analysis

Pair GBPUSD found current support at 1.32780, making a smaller gain moving to 1.33430. With potential MA20 and MA50 support, we could expect a further recovery until further resistance on the chart.

Bullish scenario:

- We need to continue this positive consolidation above 1.33500 to have a more optimistic picture on the chart.

- Our first next resistance is at 1.34000 at 50.0% Fibonacci level, and the break above us leads above 61.8% level to 1.345000.

- At this level, we also get support in the MA200 moving average.

- Our main target and potential higher resistance is our previous high at 1.35000.

Bearish scenario:

- We need the continuation of negative consolidation and the withdrawal of the price below 1.33000.

- Break below the confirmation of this year’s lower low at 1.32779, and further continuation will open the door to new this year’s lows.

Market overview

Japan announced today that it would ban foreigners from entering the country to prevent the spread of this new variant of covid 19.

“To avoid the worst-case scenario and as an emergency precautionary measure, Japan will primarily ban foreigners from entering the country from midnight on November 30,” Japanese Prime Minister Fumio Kishida told reporters. Japan has thus joined Israel in introducing the strictest border measures since the discovery of this variant.

According to him, Japanese citizens returning from certain countries could be quarantined in certain facilities.

The latest move signals a rapid escalation of restrictions since Friday when Japan announced that it would tighten border controls for people coming from six African countries.

The World Health Organization (WHO) has warned that a decision on the severity of omicron, first identified in South Africa, could take “days to weeks,” with a lack of information on whether the symptoms of this strain differ from symptoms of other variants.

Consumer price inflation in Spain has risen to its highest level since 1992, a quick estimate by INA’s statistical office showed on Monday.

Consumer price inflation rose to 5.6 percent in November from 5.4 percent in October. The rate was in line with expectations and reached its highest level since September 1992. Core consumer price inflation rose to 1.7 percent from 1.4 percent in the previous month. On a monthly basis, consumer prices rose 0.4 percent from 1.8 percent in October.

Eurozone economic confidence declined to a six-month low in November, mainly due to deteriorating consumer sentiment, the results of a European Commission survey on Monday showed.

The economic sentiment index fell to 117.5 in November, in line with expectations, from 118.6 in the previous month. This is the lowest result since May.

Weakness in overall confidence was caused by a marked decline in consumer confidence, while sentiment remained largely unchanged in industry and services and improved in retail and construction.

The industrial sentiment indicator reached the level of 14.1, slightly falling compared to October 14.2. The expected level was 13.9.

At the same time, the trust index in services rose to 18.4 from 18.0 a month ago. Economists predicted that the index would fall to 16.6.

The post EURUSD, GBPUSD currently without serious support appeared first on FinanceBrokerage.

0 Response to "EURUSD, GBPUSD currently without serious support"

Post a Comment