Degiro Review

| General Information | |

|---|---|

| Broker Name: | Degiro |

| Broker Type: | Stock |

| Country: | Netherlands |

| Operating since year: | 2008 |

| Regulation: | FCA |

| Address: | Rembrandt Tower - 9th floor, 1096 HA, Amsterdam, The Netherlands |

| Broker status: | Active |

CONTENT

- General Information & First Impressions

- Fund and Account Security

- Registration at Lynx

- The Trading Accounts

- Lynx’s Trading Platform

- Funding and Pricing

- Trading Products at Lynx

- Leverage and Other Crucial Trading Information

- Customer Service at Lynx

- Conclusion

Degiro Review 2021 – One of the most awarded broekrs

General Information & First Impressions

Degiro is an online brokerage with quite some experience and is already relatively well-known in the online trading sphere. It was founded in the Netherlands in 2006 and offers users access to around 50 exchanges worldwide. That makes Degiro’s trading library quite broad, housing all major asset classes besides cryptocurrencies on a non-CFD basis. And while a lot of traders know about Degiro, it’s always good to have insight into the current state of the service. Our Degiro review will tell you about how the broker holds up against other brokerages in 2021.

One thing we were surprised about was that the initial impression was slightly underwhelming, at least for us. While the broker’s website is fantastic visually, it seems to have suffered functionally for it. It’s disorganized, with exact trading conditions, for example, being challenging to locate. Degiro’s website leaves out a lot of crucial info, and if it weren’t a famous broker already, that’d suggest it’s a scam. One other critical thing that’s missing is any contact info besides emails, which indicates poor communication.

To be fully candid, Degiro’s website looks more like an advertisement of the service than an accurate representation. As we said earlier in our Degiro review, that’s something scammers usually do, not serious companies. The menu navigation is also too fickle and jumpy, meaning getting around the site is a chore at times. However, the worse property is undoubtedly its vagueness and difficulty in locating relevant info.

And we didn’t even get started on the new user experience. We expect people new to online trading to be nearly entirely lost on degiro.co.uk. The website doesn’t follow a logical structure or try to divvy up its info and is instead a big pile of pictures and text. All that leads to an underwhelming first impression.

Fund and Account Security

Bouncing off from that slightly languid note, the security at Degiro seems to be under control. As we said earlier in our Degiro review, it’s one of the more well-known European brokers. If it were a scam or acted maliciously towards its customers, we’d have known by now. Instead, it offers robust proof both in the ways of fund and account security and trustworthiness.

That starts from the broker’s regulator, which is the well-known Financial Conduct Authority. Most European traders will recognize the FCA as one of the more capable financial business regulators. That means Degiro has very little leeway if it were to attempt some shady business practices. To maintain that license and avoid heavy fees, the broker needs to have strict security measures and treat customers fairly.

However, there’s no indication of Degiro’s ill intent towards its customers. Earlier in our Degiro review, we mentioned that it presents itself as scams do. And while that’s slightly unseemly, the broker has no other scam hallmarks. It’s a veteran brokerage with a firmly built reputation, a history of fair behavior, and a lack of controversies.

Degiro has received a fair bit of negative ratings through trust review sites. We looked through those, and they mostly relate to poor communication. And while that’s not a strictly security-related issue, users might feel like they’re getting scammed if the broker doesn’t respond to them. As we hinted earlier in our Degiro review, communication seems to be a major problem for the broker.

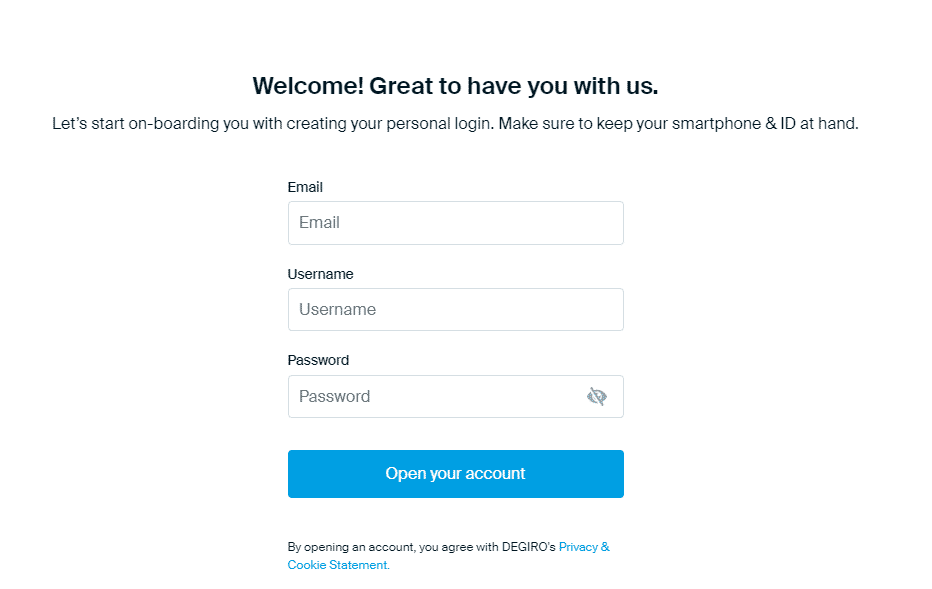

Registration at Degiro

One concern we’ve seen about Degiro is that it’s a relatively slow experience. Some users don’t mind that, but in the modern world, brokers have sped up without compromising service quality. That slowness extends to Degiro’s registration, which requires your full personal info, including tax data and such.

From Degiro’s side, we see why that is; the broker’s live accounts don’t need a deposit, so account creation needs to be rigid. However, that creates difficulties for people who just want to look around. Also, account verification seems to be on the slower side for Degiro, possibly causing missed trading opportunities.

We feel like Degiro could trim down its registration process to feel less overwhelming while keeping a good portion of the detailedness. As-is, the process is slower than we’d like and may turn some traders, especially newer ones, off from the service.

The Trading Accounts

As we said in the previous portion of our Degiro review, the live accounts don’t require a deposit. While that’s still not as useful as a demo account, it makes the service more welcoming towards newer users. However, that’s where it conflicts with itself since the service is otherwise somewhat confusing for newer traders. Be that as it may, we think it’s great that Degiro doesn’t require a massive deposit just to get you started.

Less great is that Degiro doesn’t have different account types. That might alienate two groups; luxury traders and specific investors. Luxury traders might be used to the prestigious features they get elsewhere with higher deposits. As for specific investors, they may not get good enough conditions that pertain to their particular trading method.

However, the single account type does create an even playing field. For most retail investors, the lack of multiple variations shouldn’t be too much of a bother.

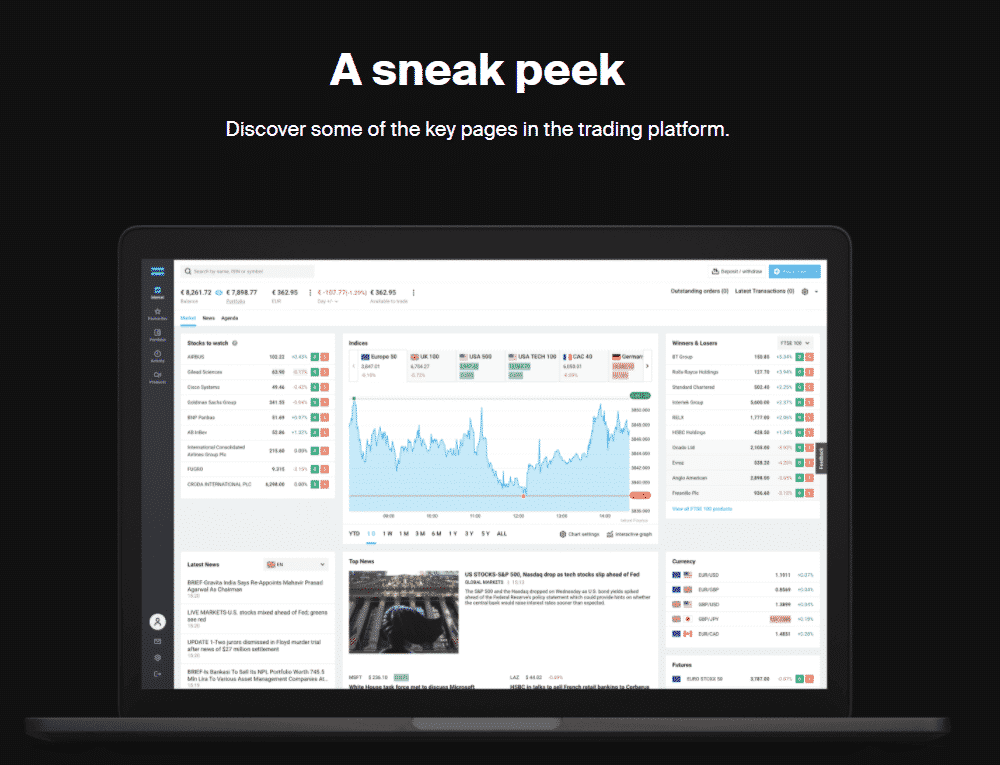

Degiro’s Trading Platform

While we couldn’t get access to the Degiro platform because of the complicated registration, it looks like a solid tool. It’s an all-in-one experience, with news, portfolios, and an economic calendar integrated into the software. The interface also looks intuitive enough, making it simple to adapt once you decide to join Degiro. It provides users with some additional safety features, such as face and touch ID login options. The broker also claims for it to have solid analytical functionality.

The issue we already complained about earlier in our Degiro review is a lack of clarity. You can’t test the platform out before you sign up, and there’s no exact functional rundown. So the platform may lack some features you’re accustomed to and regularly use while trading.

As you’ve probably concluded when we mentioned touch and face ID, there’s also a mobile app version of the platform. It looks like there’s also a web version, although the broker isn’t entirely transparent on that either.

Funding and Pricing

Degiro funds itself via fees instead of spreads, which is a matter of preference for traders. We have an issue with how the broker presents its pricing. It uses cherrypicked data in its “compare to other brokers” page to make itself look better. The fees are already relatively low, so there’s no need for underhanded tricks like that. But again, the broker opts not to show precise info in favor of shameless self-promotion.

Degiro is also unclear about where it charges fees. For example, we found out it has a connectivity fee on pure chance. It charges you a bit more if you’re connecting with an exchange outside your home country. Overall, the costs themselves are passable, but Degiro’s method of presenting them is massively frustrating.

As for deposits and withdrawals, we could find very little about what currencies they support or how quick they process. Some sources say the payments go through in 2-3 days. It seems like Degiro supports bank account and e-wallet transfers without any credit card options.

Trading Products at Lynx

As we said near the start of our Degiro review, the broker can connect you to around 50 exchanges. That grants users access to a large portion of relevant tradeable financial assets from around the world. Note that trading is slightly more expensive if you’re accessing a non-domestic exchange. Additionally, Degiro offers no crypto option, which may be a complete turnoff for modern traders. Here are the asset classes at degiro.co.uk:

- Shares

- ETFs

- Currencies

- Leveraged Products

- Bonds

- Options

- Futures

Leverage and Other Crucial Trading Information

We couldn’t find any relevant information about leverage or any other secondary trading conditions. We could barely find info on the primary ones with how secretive Degiro is.

One thing we should note is that the broker has an educational experience that covers some basic concepts. It goes over trading itself, as well as each particular asset class that Degiro has in store. It also includes some things such as exchange operating times. The education experience is nice but not broad by any stretch of the imagination, lacking more specialized reading and video materials.

Customer Service at Lynx

As we outlined multiple times earlier in our Degiro review, communication is a significant issue for the broker. Many of its negative reviews come from users not being able to solve problems regarding their accounts and investments. That checks out with the fact that Degiro displays only its email as a way to contact the broker, and we all know how slow that can be.

The lack of any instant-reply communication types, such as a phone or live chat, makes the broker seem lazy. We know competent customer support teams are difficult to create, but they’re a necessity in online trading. Otherwise, users may get locked out of thousands of dollars with few ways to resolve the issue.

We managed to find a phone for Degiro, but even that may be outdated. Unfortunately, if you have an issue while using the broker’s services, you may be left to your own devices for quite some time.

Phone: +31 20 261 3072

Email: clients@degiro.co.uk

Conclusion

Degiro does have some high points, such as experience, security, and relatively good pricing and asset variety. However, it’s proof that just because a broker looks good on paper doesn’t mean it’s good in practice. Communication is so crucial in modern brokerages since issues often arise in online trading. And if a broekr can’t respond in a timely manner, that creates a massively frustrating experience for customers.

Also, the broker is somehow vague and overly complex at the same time. It shoves a lot of information down users’ throats but it’s all clutter. As for the actually important things, the broker lets you guess or sign up and find out. That’d be somewhat fine if you didn’t need to turn in so much personal info before signing in.

Degiro also seems to be suffering from a bit of an identity crisis. On the one hand, it looks more beginner-oriented with a $0 deposit requirement and some newbie-friendly features. On the other, it’s massively perplexing for newer users and doesn’t come off as a good introductory brokerage.

While Degiro has some things going for it, there are better alternatives out there. To conclude our Degiro review, we recommend seeking out other options.

The post Degiro Review appeared first on FinanceBrokerage.

0 Response to "Degiro Review"

Post a Comment