S&P 500 – As Good As It Gets

S&P 500 – As Good As It Gets

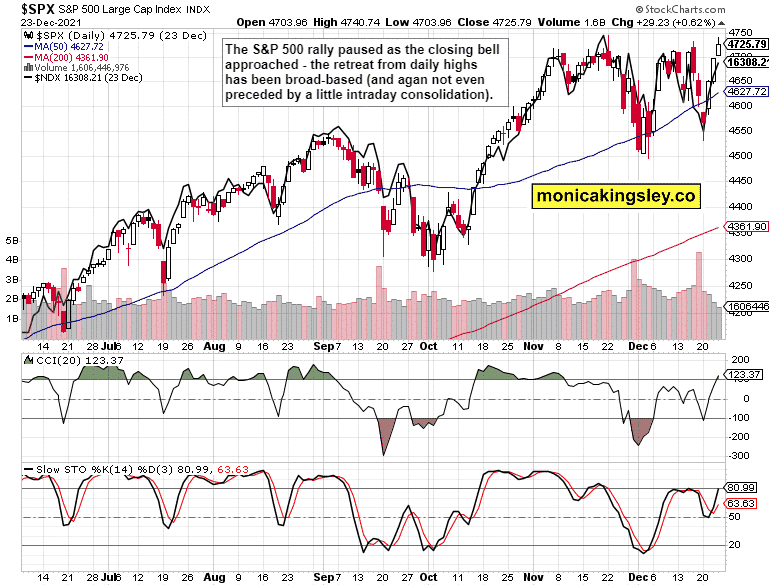

S&P 500 and risk-on assets continued rallying, pausing only before the close. Santa Claus delivered, and the final trading week of 2021 is here. With the dollar pausing and VIX at 18 again, we‘re certainly enjoying better days while clouds gather on the horizon – Thursday‘s inability of financials to keep intraday gains while yields rose, is but one albeit short-term sign. The Fed is still accomodative (just see the balance sheet expansion for Dec – this is really tapering), didn‘t get into the headlines with fresh hawkish statements, and inflation expectations keep rising from subdued levels.

Importantly, bonds prices aren‘t taking it on the chin, and the dollar hasn‘t made much progress since late Nov. Both tech and value are challenging their recent highs, and the ratio of stocks trading above their 200-day moving average, is improving. The same for new highs new lows – the market breadth indicators are picking up. We haven‘t seen the stock market top yet – the rickety ride higher isn‘t over, Santa Claus rally goes on, and my 2022 outlook with targets discussed that a week ago.

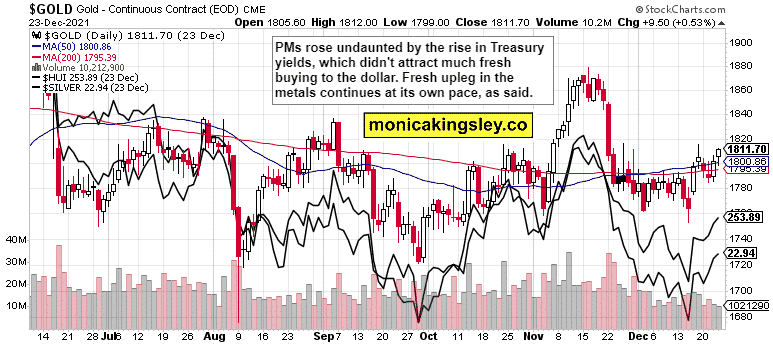

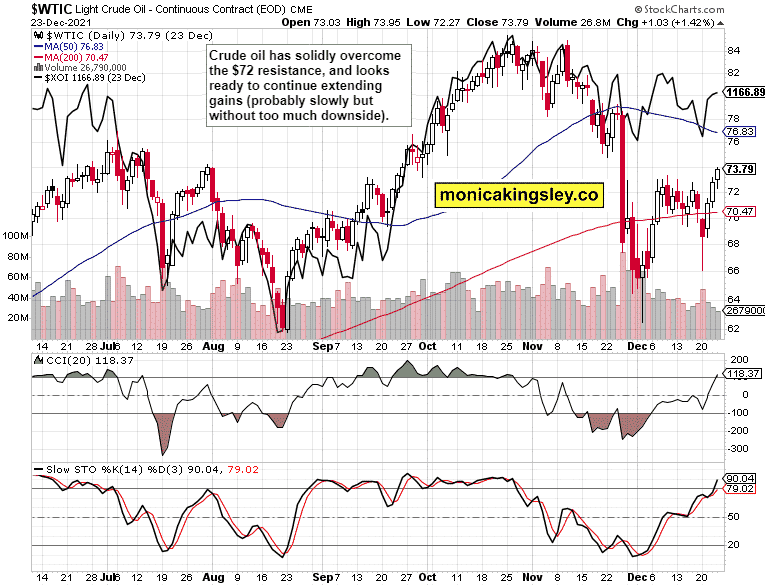

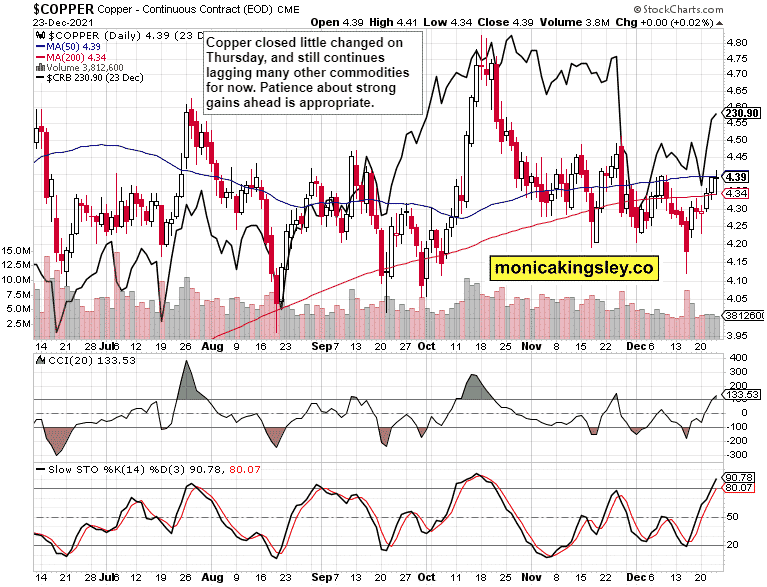

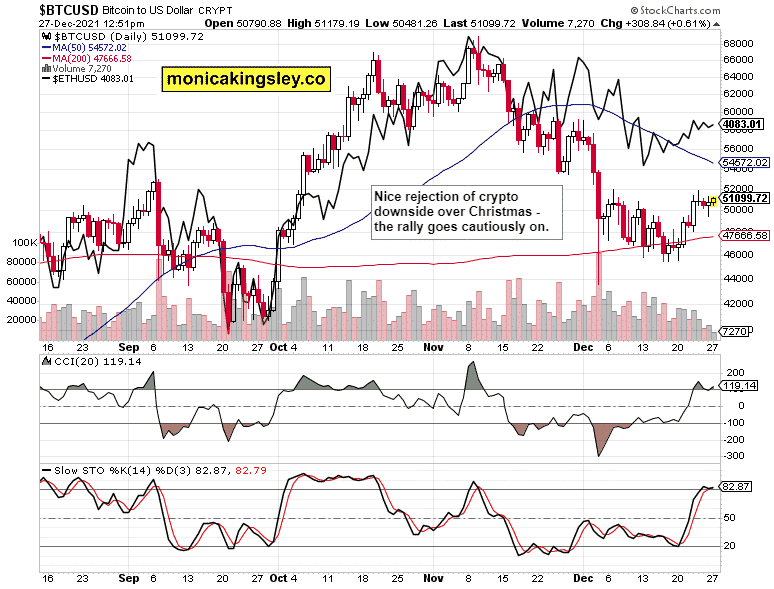

Precious metals are extending gains, and aren‘t yet raging ahead – the picture is one of welcome strength returning across the board. The same goes for crude oil finally rising solidly above $72 as the omicron fears are receding in light of fresh incoming data including South African policies. It‘s only copper that‘s now reflecting the prospects of real economy slowdown. At the same time, the crypto rebound last week served as a confirmation of broad risk-on advance. Still more to come, as per Thursday‘s article title.

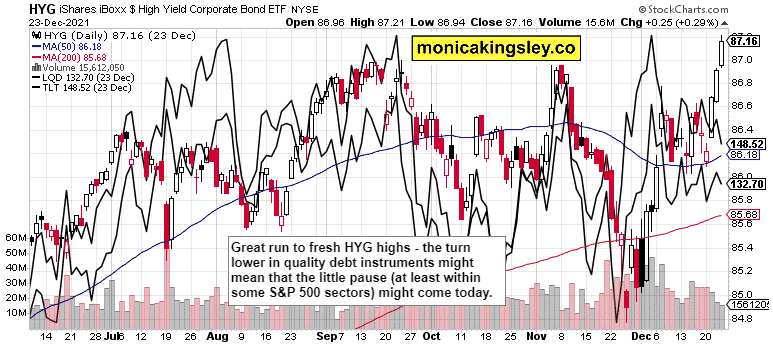

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 is within spitting distance of ATHs, and the bulls haven‘t said the last word in spite of the approaching need to take a rest. It‘s rally on, for now.

Credit Markets

HYG has finally overcome the Sep highs, but its vulnerability at current levels is best viewed from the point of view of LQD underperformance. Investment grade corporate bonds could have been trading higher compared to the progress made by TLT.

Gold, Silver and Miners

Gold and silver are looking up, and so are miners – the upswing isn‘t overheated one bit, and can go on as we keep consolidating with an increasingly bullish bias.

Crude Oil

Crude oil once again extended gains, and even if oil stocks are a little lagging, the medium-term bullish bias in black gold remains. The path of least resistance is once again up.

Copper

Copper at least closed unchanged – the fresh steep rally indeed seems more than quite a few weeks ahead. But the table for further gains is set.

Bitcoin and Ethereum

Bitcoin and Ethereum are entering the final trading week of 2021 in good shape. The rising tide of liquidity is still lifting all boats in a rather orderly way.

Summary

Thursday brought a proper finish to the Christmas week, and we‘re not staring at a disastrous finish to 2021 across the board. Short-term extended, but overall very positive bond market performance is aligned, and we can look for positive entry to 2022 in stocks, precious metals, oil, copper and cryptos alike. Shrinking global liquidity, no infrastructure bill, and consolidating dollar complete the backdrop of challenges that would make themselves heard well before Q2 2022 arrives. I hope you had Merry Christmas once again, and will also enjoy the relatively smooth ride while it lasts – 2022 will be still a good year, but with its fair share of corrections.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

The post S&P 500 – As Good As It Gets appeared first on FinanceBrokerage.

0 Response to "S&P 500 – As Good As It Gets"

Post a Comment