Bitcoin and the rocked crypto market

Bitcoin and the rocked crypto market

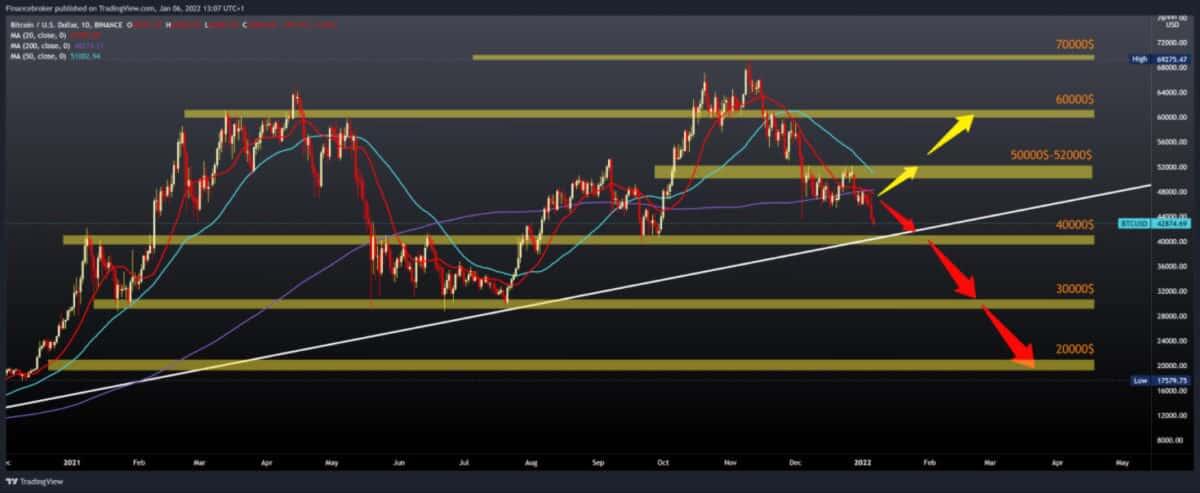

Bitcoin chart analysis

The price of Bitcoin broke the previous support zone to $ 46,000, dropping to the current $ 42,767. Bitcoin also managed to break below the December low of $ 43,423. We are now looking at a lower support zone at $ 40,000, and we hope that with additional support in the lower trend line, the price will return to the bullish trend. The price has been in a bearish trend since reaching an all-time high of $ 69275, and the current price has lost 38% of its value.

The current Chinese war against cryptocurrencies may be partly responsible for such a situation. Energy demand began to grow when cryptocurrency mining companies moved from China to Kazakhstan in early 2021 and jumped again when China declared mining illegal this May. Electricity was relatively cheap in Kazakhstan, making it a haven for companies hoping to make more profit from crypto operations.

Kazakhstan is currently trying to make up for electricity shortages. Authorities in the country are asking the Russian energy company to replenish the national electricity grid and will charge registered miners a fee of one tenge (about $ 0.0023) for each kilowatt-hour starting in 2022.

Bullish scenario:

- We need a new positive consolidation to turn the price towards the bullish trend again.

- We need to get above the MA200 moving average and above $ 48,000.

- Then we can expect that with a smaller break, the price will continue towards the previous high at $ 52,000. An additional resistance at that point is the MA50 moving average.

Bearish scenario:

- We need to continue the negative consolidation and withdraw the price to the $ 40,000 support zone.

- Additional potential support in that zone is our lower bullish trend line.

- A potential break below would open the door to the next support at $ 30,000.

Market news

The sale of cryptocurrencies comes after the minutes of the Fed meeting in December indicated a possible shift towards more aggressive inflation management policies and an end to support for the pandemic. Stock markets fell after the announcement, and Nasdaq recorded its biggest daily decline of 3.3% since February.

Initially fueled by rising fuel prices, widespread unrest in Kazakhstan could penetrate and destabilize cryptocurrency markets. As of August, it accounts for 18% of the bitcoin hashrate – a measurement of the computational power of the mining network – according to the Cambridge Center for Alternative Finance. According to the data, the Central Asian state is second only to the United States in terms of bitcoin mining, and rising energy costs, policy changes, or unrest could disrupt the market.

Bitcoin owners suffered a major blow yesterday after the BTC fell more than 7% within two hours. Overall, crypto market capitalization has fallen by more than $ 200 billion in the last 24 hours. Due to the latest decline in the crypto market, liquidations have risen to record levels. According to data released by Coinglass, more than $ 24 million in long cryptocurrency trading positions have been liquidated in the last 700 hours. The number includes liquidating long Bitcoin positions worth approximately $ 300 million.

The post Bitcoin and the rocked crypto market appeared first on FinanceBrokerage.

0 Response to "Bitcoin and the rocked crypto market"

Post a Comment