Global Financial Markets Stumbling Again

Global Financial Markets Stumbling Again

S&P 500 rebound goes on reflexively, but stormy clouds are gathering – I‘m looking for the bears to reassert themselves over the next couple of days latest. The credit markets posture is far from raging risk-on even though select commodities are recovering (what else to expect in a secular commodities bull) and precious metals suffered a modest setback (not a reversal though). Crypto recovery is nodding towards the risk-on upturn that is though likely to get checked soon.

It‘s great that tech was the driver of yesterday‘s S&P 500 upswing, but for how long would it keep leadership now that attention is shifting back towards inflation. Yesterday I wrote that:

(…) rebound looks approaching as stocks might lead bonds in the risk appetite. When the East European tensions get dialed down, S&P 500 can be counted on to lead, probably more so when it comes to value than tech. That‘s why the tech participation is key as it would make up for the evaporating risk premium in energy. Or precious metals – these are likely to rise once again when the spotlight shifts to the inadequacy of Fed‘s tightening in the inflation fight.

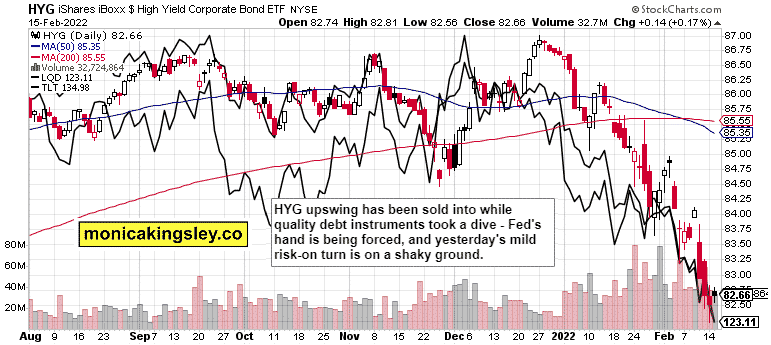

So far the stock market advance hasn‘t met a brick wall, but value upswing has been sold into (unlike tech‘s). Energy stocks lost, but are likely to come back – and the next microrotation might not be powerful enough to carry S&P 500 higher. Anyway without a HYG upswing, stock bulls are facing stiff headwinds.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

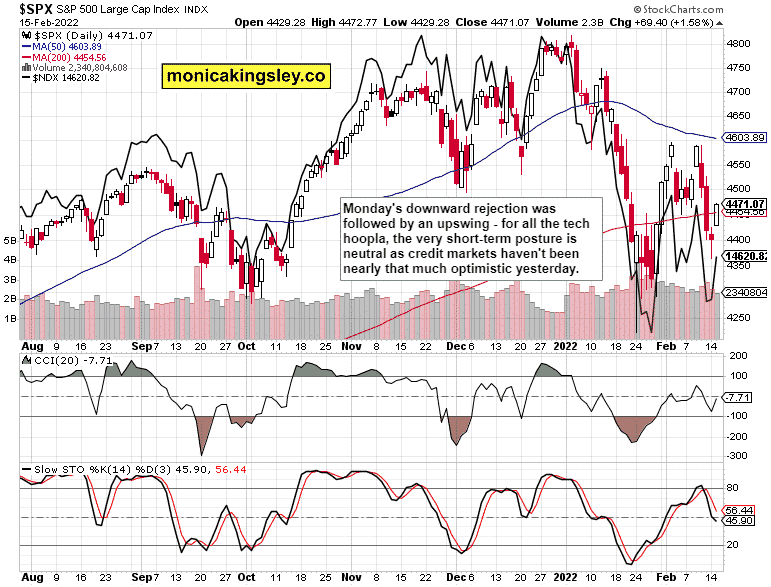

S&P 500 and Nasdaq Outlook

S&P 500 rebounded on low volume but that wouldn‘t be an issue in a healthy bull market – the trouble is that this 2022 price action isn‘t very healthy.

Credit Markets

HYG didn‘t trade on a strong note, and the rise in yields continues almost unabated. This is what I meant yesterday by saying that we may be though nearing the point of credit market reprieve – as much as that‘s compatible with rate raising cycle.

HYG didn‘t trade on a strong note, and the rise in yields continues almost unabated. This is what I meant yesterday by saying that we may be though nearing the point of credit market reprieve – as much as that‘s compatible with rate raising cycle.

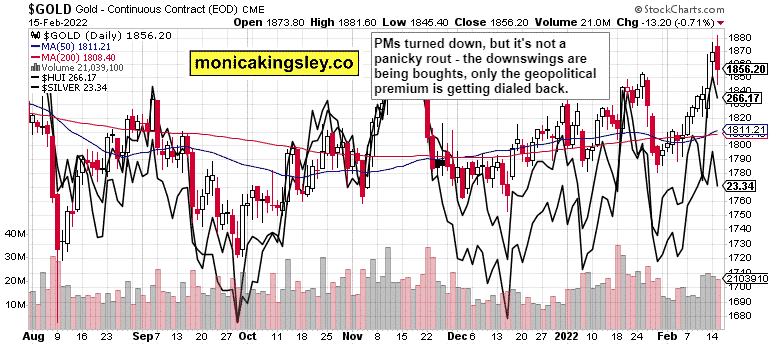

Gold, Silver and Miners

Precious metals suffered a temporary setback – they easily gave up some of the safe haven gains, which isn‘t surprising. The bulls though haven‘t lost control, and that‘s key.

Precious metals suffered a temporary setback – they easily gave up some of the safe haven gains, which isn‘t surprising. The bulls though haven‘t lost control, and that‘s key.

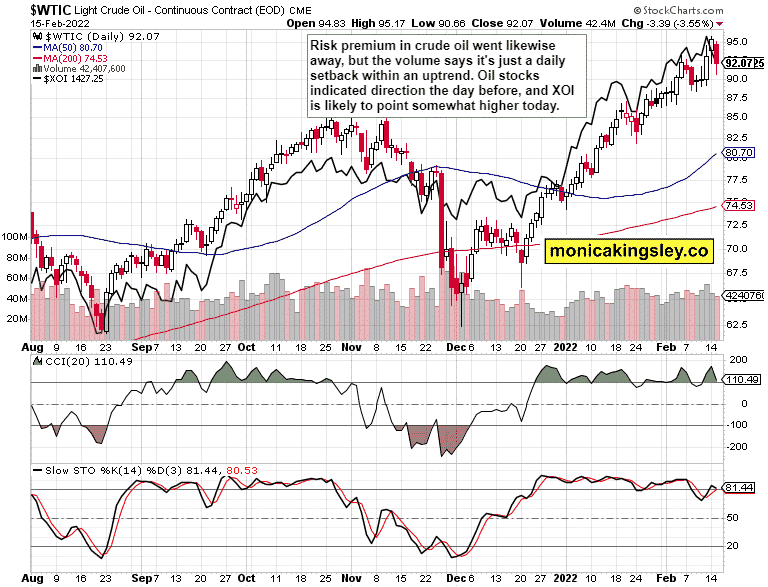

Crude Oil

Crude oil dip was bought, and there wasn‘t much bearish conviction to start with. The general uptrend is likely to continue, and $90 appears likely to hold over the next few days definitely.

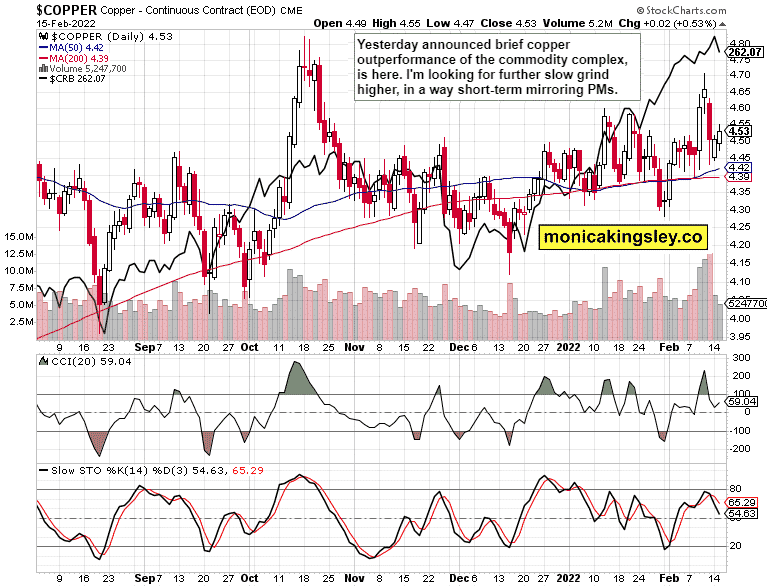

Copper

Copper is now in for some backing and filling, but managed to catch up with other commodities a little yesterday. The red metal remains range bound, but making good bullish progress.

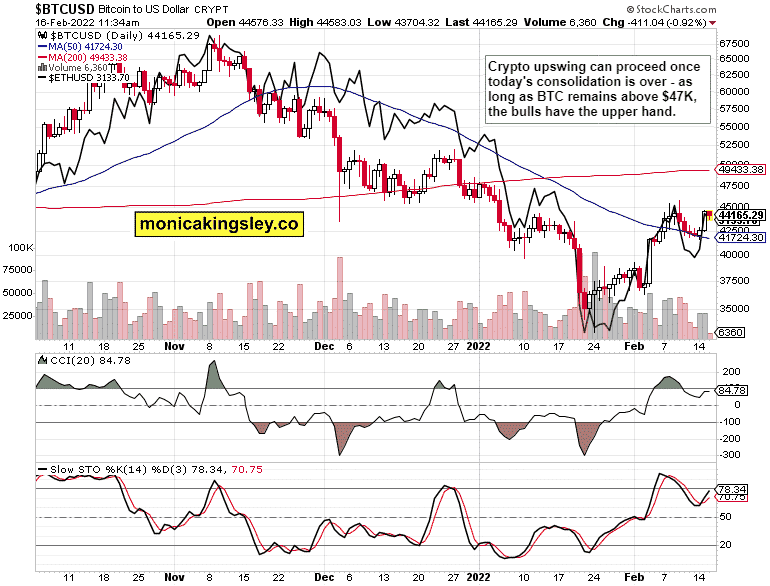

Bitcoin and Ethereum

Cryptos are paring back yesterday‘s advance, and unless the mid Feb lows give, they‘re likely to muddle through with a modest bullish bias till the attention shifts to the Fed again.

Summary

S&P 500 bulls‘ opportunity seems slipping away with each 1D or 4H candle, and I‘m not counting on the credit markets to ride to stocks‘ rescue. The commodities bull though is likely to carry on with little interference – and so does the precious metals bull as the yield curve keeps compressing. Slowdown in economic growth with rampant inflation and the realization that the Fed tightening hasn‘t had the effect, is awaiting, and would usher in strong gold and silver gains.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

The post Global Financial Markets Stumbling Again appeared first on FinanceBrokerage.

0 Response to "Global Financial Markets Stumbling Again"

Post a Comment