S&P 500 rally boosting our open profits

S&P 500 rally boosting our open profits

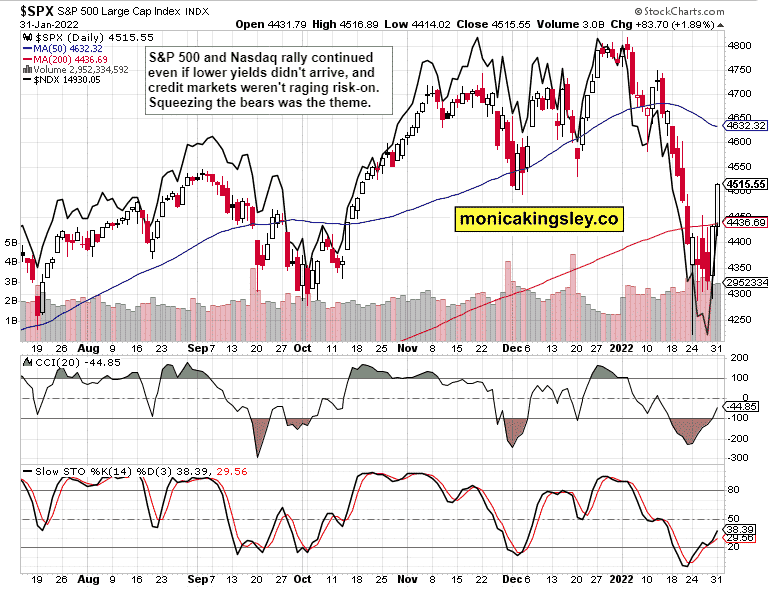

S&P 500 pushed sharply higher, squeezing not only tech bears even if yields didn‘t move much – bonds actually ran into headwinds before the closing bell. With my 4,500 target reached, the door has opened to consolidation of prior steep gains, and that would be accompanied by lower volatility days till before the positioning for Friday‘s non-farm payrolls is complete as talked on Sunday.

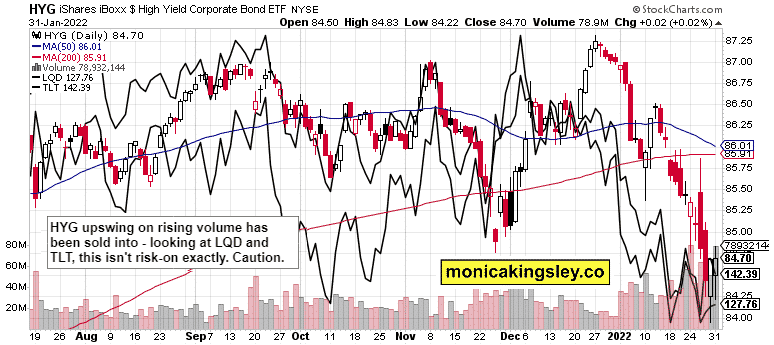

So, we have an S&P 500 rally boosting our open profits while the credit market‘s risk-on posture is getting challenged, and divergencies to stocks abound – as I wrote yesterday:

(…) any stock market advance would leave S&P 500 in a more precarious position than when the break above 4,800 ATHs fizzled out. But a stock market advance we would have, targeting 4,500 followed by possibly 4,600.

We‘re getting there, the bulls haven‘t yet run out of steam, but it‘s time to move closer to the exit door while still dancing. But the key focus remains the Fed dynamic:

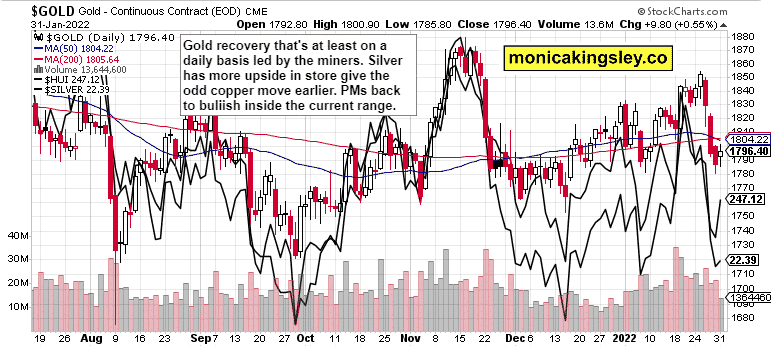

(…) Fed‘s Kashkari … helped mightily on Friday – that implicit rates backpedalling was more than helpful. Pity that precious metals haven‘t noticed (I would say yet) – but remember the big picture and don‘t despair, we‘re just going sideways before the inevitable breakout higher. Back to rates and the Fed, there is a key difference between the tightening of 2018 and now – the economy was quite robust with blood freely flowing, crucially without raging inflation. With the Fed sorely behind the curve by at least a year, it‘ll have to move faster and have lower sensibility to market selloffs caused. Stiff headwinds ahead as liquidity gets tighter.

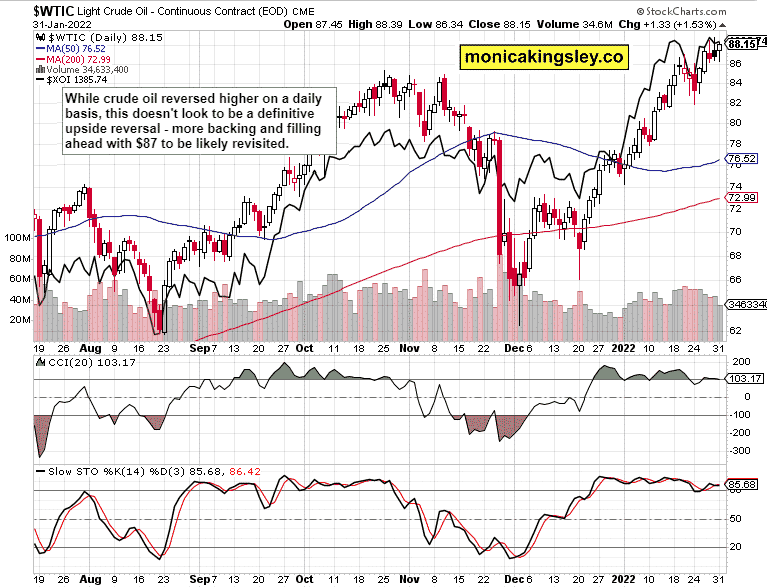

Suffice to say that precious metals did notice yesterday, and copper looks ready to work off its prior odd downswing. Remember that commodities keep rising (hello the much lauded agrifoods) while oil enteredd temporary sideways consolidation. Look for other base metals to help the red one higher – the outlook isn‘t pessimistic in the least as the recognition we have entered stagflation, would grow while the still compressing yield curve highlights growing conviction of Fed policy mistake.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 bulls proved their upper hand yesterday, and the question is where would the upswing stall – or at least pause. Ahead soon, still this week.

Credit Markets

HYG caught a bid yesterday too, but the sellers have awakened – it appears the risk-on trades would be tested soon again. Bonds are certainly less optimistic than stocks at this point, but the S&P 500 rickety ride can still continue, and diverge from bonds.

Gold, Silver and Miners

Gold and silver retreat was indeed shallow, did you back up the truck? The chart hasn‘t flipped bearish, and I stand by the earlier call that PMs would be one of the great bullish surprises of 2022.

Crude Oil

Crude oil bulls rejected more downside, but I‘m not looking for that to last – however shallow the upcoming pullback, it would present a buying opportunity, and more profits on top of those taken recently.

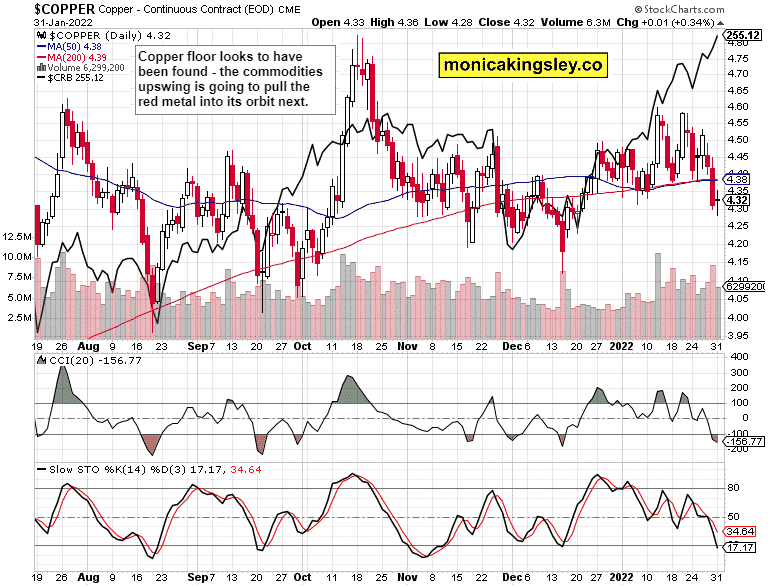

Copper

Expect copper‘s recent red flag to be dealt with decisively, and for higher prices to prevail. Other base metals have likewise room to join in as $4.60 would be taken on once again. At the same time, the silver to copper ratio would move in the white metal‘s favor after having based since the Aug 2020 PMs top called.

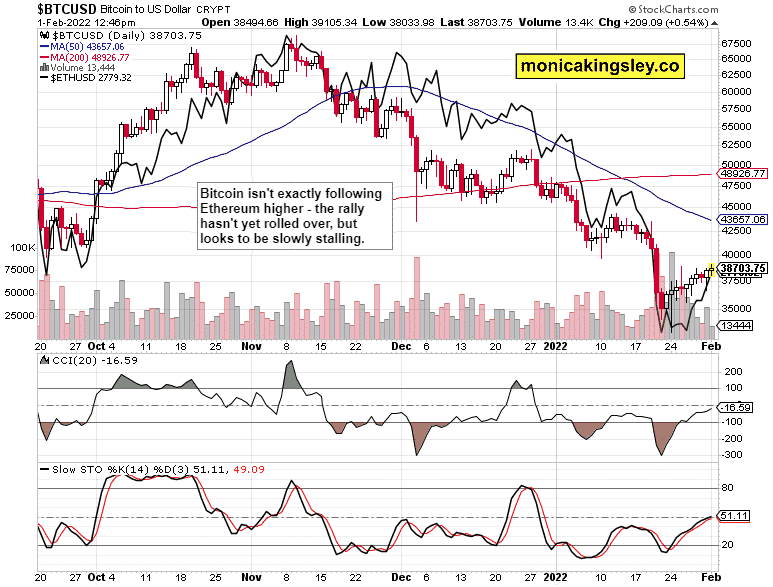

Bitcoin and Ethereum

As stated yesterday, crypto bulls are putting up a little fight as the narrow range trading continues – I‘m not looking at the Bitcoin and Ethereum buyers to succeed convincingly. Time for a downside reversal is approaching.

Summary

S&P 500 bulls made a great run yesterday, and short covering was to a good deal responsible. Given the credit market action, I‘m looking for the pace of gains to definitely decelerate, and for the 500-strong index to consolidate briefly. VIX is likely to keep calming down before rising again on Friday. Should credit markets agree, the upcoming chop would be of the bullish flavor, especially if oil prices keep trading guardedly. And that looks to be the case, and the rotation into tech can go on – $NYFANG doing well is one of the themes for the environment of slowing GDP growth rates, alongside precious metals and commodities embracing inflation with both arms.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

The post S&P 500 rally boosting our open profits appeared first on FinanceBrokerage.

0 Response to "S&P 500 rally boosting our open profits"

Post a Comment