Do these sanctions really matter to Russia? Maybe not

Do these sanctions really matter to Russia? Maybe not

After the Russian invasion of Ukraine, the first and yet most effective response by the western countries was imposing sanctions against the Russian Federation. Russia is being cut off from major western financial institutions and markets. Notably, as attacks continue, the list of sanctions is constantly being extended. Sanctions mainly target individuals and banks, oil refineries, and military exports. Major Russian banks are banned from SWIFT.

Well-known companies like Adobe, Amazon, Apple, BMW, Ford, General Motors, Honda, Disney, Goldman Sachs, Google, IBM, Intel, Microsoft, Netflix, PayPal, Samsung, Sony, TikTok, Warner Bros, Ikea, McDonald’s, KFC, CocaCola, Western Union – have left the Russian market or limited operations there.

Yet, businesses and residents of Russia have two core questions: when will it end and how to overcome emerging difficulties?

The answer to the first question is deeply rooted in politics; even an immediate ceasefire and withdrawal of troops from Ukrainian territory may not assure immediate removal of sanctions.

But let’s try answering the second one by telling the stories of some Russian citizens across the globe setting up various schemes to overcome sanctions.

How to Evade Sanctions – Benchmark from Iran

The benchmark is Iran, which has lived under sanctions for decades. Iranian citizens live under double restrictions: one comes from the sanctions imposed by the world, the second by sharia laws imposed by the Islamic government. The government bans many things, including western music, alcohol, and even Hollywood movies. However, Iranians can always fly to almost any destination, grab a drink right at the airport, and return with terabytes of western movies on their hard drive.

Alas, it is not working so well for Russian citizens who are willing to enjoy Cheeseburger at MC; hence, many countries, including the EU, UK, US, and Canada, have banned Russian airlines from their airspace. In exchange, Russia has closed its airspace to airlines from 36 countries, including all 27 members of the European Union. The countries are Albania, Anguilla, Austria, Belgium, Bulgaria, British Virgin Islands, Germany, Gibraltar, Hungary, Greece, Denmark, Canada, Croatia, Cyprus, Czech Republic, Estonia, Finland, France, Jersey, Ireland, Iceland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and the United Kingdom.

So, for instance, if a Russian is willing to go to Germany, they should use a transit country: Armenia, or for instance or Serbia. While not being a member of the EU, Serbia is among the few countries that have left its airspace open for Russian airlines. Small loophole – maybe someone’s hope.

Sanctions are harsh even compared to Iran – Coca-Cola has always been operating in Iran and never left the market even during the Iran-Iraq war. So, Coca-Cola leaving the Russian market is yet another alarm for western companies still operating in Russia and the Russian citizens.

SWIFT, PayPal, MoneyGram, and Western Union are not working in Russia. VISA and Mastercard can be used for purchases only inside Russia and not working abroad. Moreover, Binance founder Changpeng Zhao claimed that cryptocurrencies wouldn’t help Russia evade sanctions.

On March 9, the Russian Central Bank banned banks from selling dollars and euros through the cash register. This ban will be in effect for six months. Russian citizens can only get cash dollars by withdrawing them from a foreign currency account. The maximum amount is $10,000. If the account is in another currency, for example, euros, then dollars will still be handed out within the limit. Everything above this bar is issued in rubles at the official exchange rate of the Central Bank. It is possible to withdraw foreign currency from accounts opened after March 8 only in rubles; however, money received in active foreign currency accounts since March 9 will be issued in rubles.

The restrictions also apply to transfers abroad – one can transfer a maximum of $5,000 (or the equivalent in another currency) to one person per month, including close relatives.

After the ban on currency sale through bank cash desks, groups and chats began to appear on social networks, where people try to buy cash dollars and euros. Groups usually have 1000-2000 users; periodically, they are blocked, but new ones appear in their place. So, some individuals are on their way to adopting a hawala (or havaleh) like informal money transfer system.

What Is Hawala, And how Does It Work?

Havala originated in Hindustan long before the advent of the Western-style banking system (according to various estimates, circa 8th century AD) and is still used by many citizens of the Middle East, Africa, and Asia as an alternative banking tool.

The word “hawala” in Arabic refers to a bill or parcel. A feature of the hawala system is that all financial transactions (moving money, jewelry, or gold from country to country) are carried out without any documentary evidence – the work is based on the participants’ trust in the process.

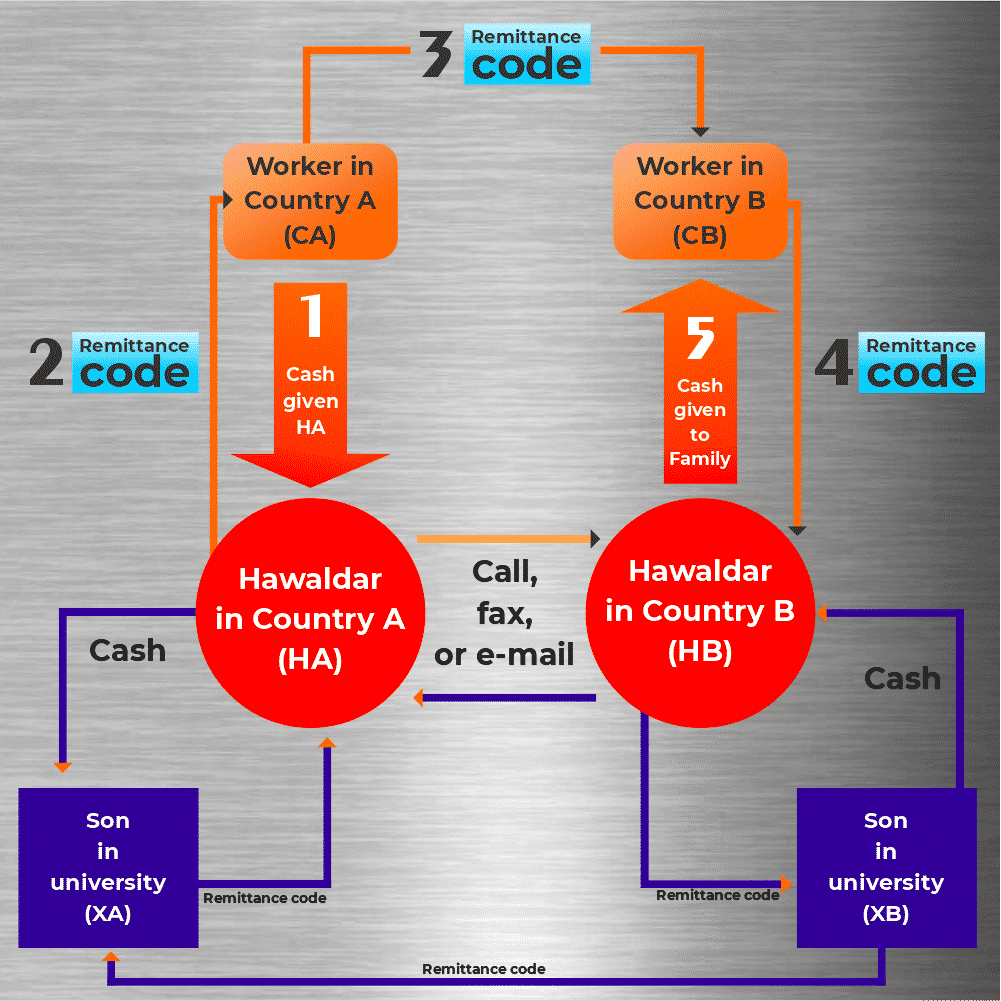

The main link in the hawala system is the “brokers” (participants of the system) – they are called “hawaladars.” It is they who organize transfers between countries. At the same time, the money does not physically leave the state: the sender gives the money to a broker in one country, receives from him a secret code (for example, numbers from one of the bills), which then the recipient in another country must name the second broker in order to receive the equivalent of the initial amount in local currency.

Subsequently, brokers settle among themselves according to a clearing scheme – gold, precious metals, or some services can be provided to close the balance.

The scheme of hawala work is easier to understand with an example.

Suppose that a client (CA) from country A wants to make a transfer to another client (CB) from country B. Hawaladar (the broker; HA) from country A receives money in the currency of country A and provides them with a confirmation code transaction. Then they contact the hawaladar from the second country (HB) by email, fax, or phone and inform them of the transfer’s details and the amount, the equivalent of which in local currency should be given to the recipient CB. To receive money, the recipient must tell the hawaladar the code that the first broker gave to the transfer sender.

The method described above is not the only type of hawala. There are also options for tripartite agreements with brokers. Hawaladars may be part of a network that spans several jurisdictions. Then they use the balance of mutual settlements and correspondents to settle their respective accounts.

According to an Iranian citizen interviewed by FinanceBrokerage: “The concept of Hawala is used among Iranians in a more modern sense now since international transactions are blocked for Iranian citizens, many of the students and workers living abroad use a locally based form of exchange known as Hawala. Basically, if your family wants to transfer you any amount of money, they have no choice but to find someone in the country that you are; that’s where the Hawala comes to work.

I believe using Hawala among Iranians is more a forced political necessity rather than a preferred religious-related custom. As basically, no other means of international banking transactions are working, rather than traditional moving the fund between actual people.”

Also, hawala is an old and well-established system. Russia may need time to create its own hawala-ru; however, it can be done in minimal time with the support of the Russian government and large businesses.

From Gray to Black Markets

Gray and black markets have long and well-established traditions since the USSR. Most consumer goods were not produced in the USSR in quantities adequate to fulfill the demand or were not produced at all. For example, very few pieces of consumer electronics like calculators and video recorders were produced in insufficient quantities. In contrast, others like jeans and chewing gum were not produced at all – but still, everything was smuggled to the USSR.

No wonder Russian citizens are familiar with gray and black market schemes that may help not evade sanctions but get the next iPhone.

Sanction Overcoming Schemas for Companies

- Almost everyone is familiar with the famous Russian Matryoshka doll – a set of decreasing-sized wooden dolls placed inside another. But there is also a scheme called “Matryoshka Firm.” Let’s

Matryoshka – Russian folk toys. also illustrate this: Russian Company (RC) wants to import some Prada garments to Russia, the owner of RC establishes a company in some country where payment getaways are (still open), it can be Armenia for now. So, the Armenian Company (AC) imports goods to Armenia and sells them to RC. In order to hide from the investigation, the number of intermediate companies may increase. Alas, despite being extremely simple – it may not work with well-known brands (such as the mentioned iPhone by Apple);

- Kum (кум) means Godparent in Russian; here’s how it works. If a company needs to import some goods from a brand that is well established and wants to avoid scandals – it must get them from a company that is already dealing with them in some country accessible by country under sanctions. But the rapid increase of purchases in small countries may be suspicious unless the manufacturer company is willing to “close eyes” on it. So one needs a godparent in producer company in order to cope with sanctions effectively;

- Both schemes may work on export – but in such cases, the new exporter country must have exported or produced the mentioned goods before. It also puts the “doll” host country under the threat of falling under sanctions. Also, such goods still appear on the countries trade balance, to avoid this – goods may be smuggled;

- Old but gold – barter. Along with intermediate companies, Iranian businesses use barter agreements when a product or service is being paid with other products or/and services. Gold and diamonds may also be used as a replacement for currency payments;

- Developing their own market – the best and worst advice at the same time: yes, everything will be legal, but it will take time and effort. The USSR has not managed to develop the consumer market at grade any close to the free western market.

Altogether, such schemes increase expenses significantly (some experts claim 25% at least). As a result, the final customer suffers the most. Another considerable business concern is the timing of cash flow.

Sanction Evading Schemas for Individuals

As mentioned above, the final customer may suffer the most due to the increase in the price of particular items and other limitations that affect a particular person directly or indirectly.

So, some people just escape from Russia – mainly youngsters and digital nomads, whose’ work is not tied to physical locations. Another category is business representatives aiming to establish “Matrioshka” in another country. The inflow of foreigners raises concerns in small countries neighboring Russia, e.g., Georgia.

Also, if one is willing to obtain some items that are under the official ban for export to Russia, they may use the mentioned loophole destinations to travel there not only to have double a cheeseburger but also to smuggle or to buy some luxury garments. People who lived in the USSR are extremely familiar with this scheme. The only obstacle is not having enough cash – customs can often be bribed as they used to be back in the USSR and are still being bribed in Iran.

The Pirates of 21st Century

Last but not least: digital products are maybe even more vital today than tangible ones. This refers to software. Here Russians have to worry least. One of the largest torrent trackers that distribute pirated software and digital content, rutracker.net, is offered in Russian and offers pirated digital copies of most operational systems, games, software applications, etc.

So Is It Possible to Escape the Sanctions?

The answer is: yes, but at what cost? An additional 25% increase of the final price and the possibility of legal action. Ones who establish sanctions are aware that the country under sanctions will try to overcome and evade them and that they will manage it at some grade. Businesses and individuals will adapt to new realities sooner or later. However, the development will be seriously hindered for decades.

The post Do these sanctions really matter to Russia? Maybe not appeared first on FinanceBrokerage.

0 Response to "Do these sanctions really matter to Russia? Maybe not"

Post a Comment