S&P 500 got into that precarious position

S&P 500 got into that precarious position

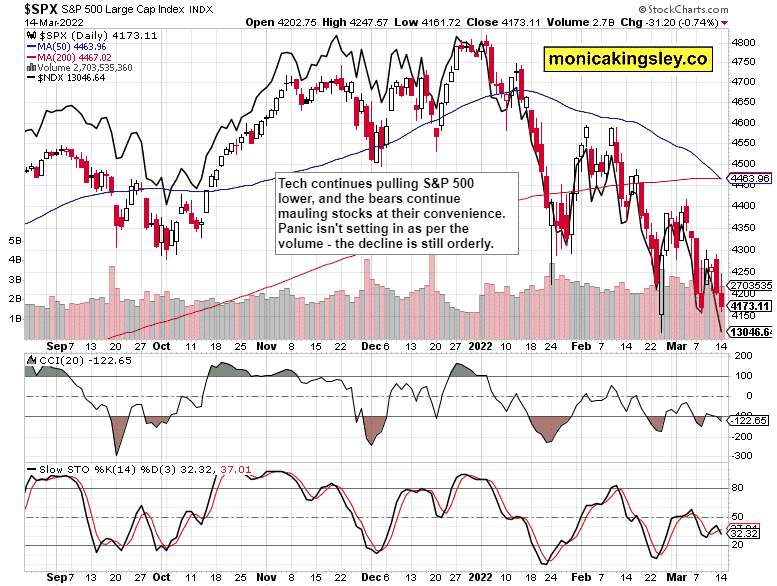

S&P 500 decline was led by tech and made possible by credit markets‘ plunge. The 4,160s held on a closing basis, and unless the bulls clear this area pretty fast today, this key support would come under pressure once again over the nearest days. Interestingly, the dollar barely moved, but looking at the daily sea of red across commodities, the greenback would follow these to the downside.

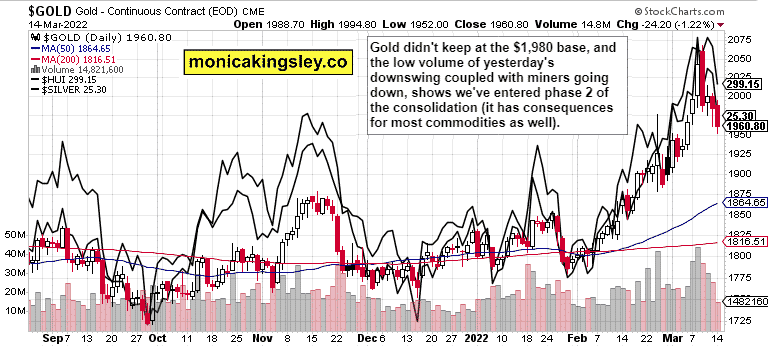

Not that real assets including precious metals would be reversing on a lasting basis here – the markets are content that especially black gold keeps flowing at whatever price, to whatever buyer(s) willing to clinch the deal. Sure, it‘s exerting downward pressure on the commodity, but I‘m looking for the extraordinary weakness to be reversed, regardless of:

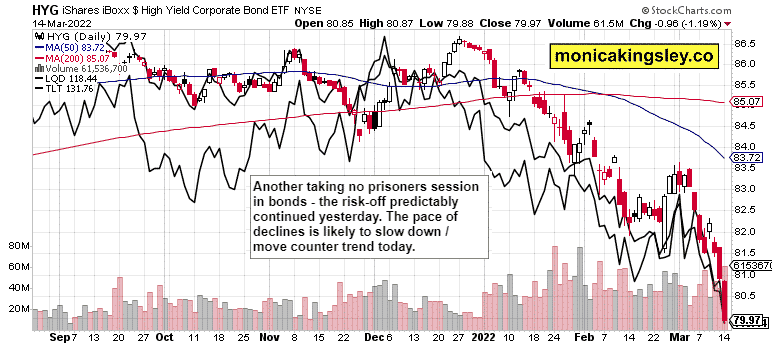

(…) not even the virtual certainty of only a 25bp hike in Mar is providing much relief to the credit markets. Given that the real economy is considerably slowing down and that recession looks to arrive before Q2 ends, the markets continue forcing higher rates (reflecting inflation).

The rising tide of fundamentals constellation favouring higher real asset prices would continue kicking in, especially when the markets sense a more profound Fed turn than we saw lately with the 50bp into 25bp for Mar FOMC. Make no mistake, the inflation horse has left the barn well over a year ago, and doesn‘t intend to come back or be tamed.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 and Nasdaq Outlook

S&P 500 bears won the day, and are likely to regroup next – yes, that doesn‘t rule out a modest upswing that would then fizzle out.

Credit Markets

HYG woes continue, and credit markets keep raising rates for the Fed. The bears continue having the upper hand.

Gold, Silver and Miners

Precious metals haven‘t found the short-term bottom, but it pays to remember that they are often trading subdued before the Fed days. This is no exception, and I‘m fully looking for gold and silver to regain the initiative following the cautious Fed tone.

Crude Oil

Crude oil didn‘t keep above $105 but would revert there in spite of the stagflationary environment (already devouring Europe). With more clarity in the various oil benchmarks, black gold would continue rising over the coming weeks.

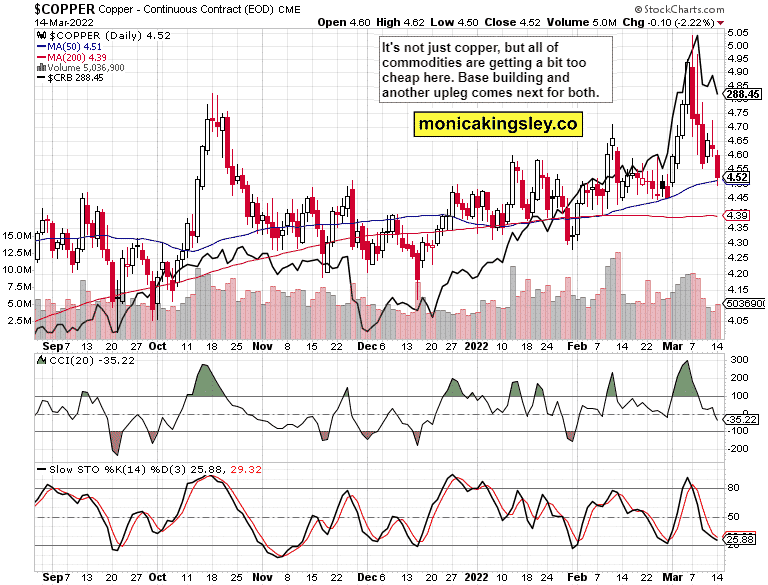

Copper

Copper weakness is another short-term oddity, which I am looking for to be reversed in the FOMC‘s wake. Volume had encouragingly risen yesterday, so I‘m looking for a solid close to the week.

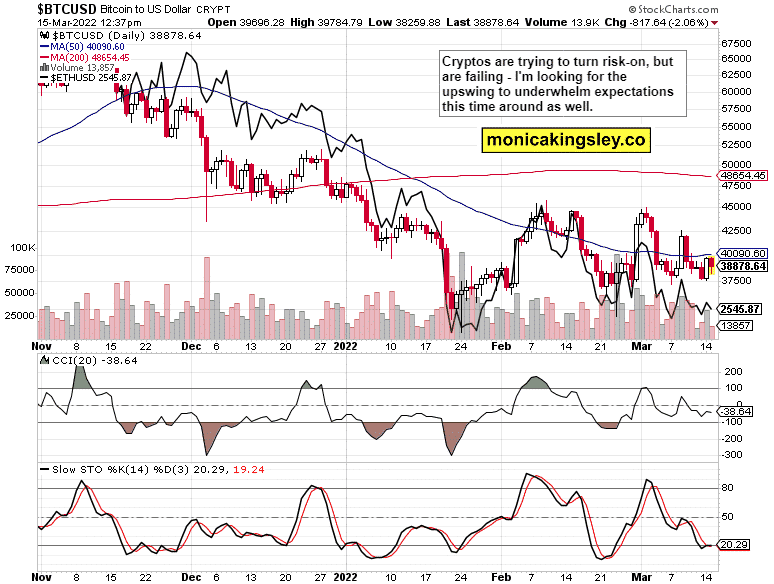

Bitcoin and Ethereum

Cryptos are very modestly turning higher, but I‘m not expecting too much of a run next. As stated yesterday, I wouldn‘t call it a risk-on constellation throughout the markets.

Summary

S&P 500 got into that precarious position (4,160s) yesterday, but managed to hold above. Given the usual Fed days trading pattern, stocks are likely to bounce a little before the pronouncements are made – only to continue drifting lower in their wake. That‘s valid for the central bank not making the U-turn towards easing again, which is what I‘m expecting to happen in the latter half of this year. Inflation would continue biting, and that means stocks are mired in a giant trading range a la the 1970s. Commodities and precious metals would continue building a base here, only to launch higher in response to (surprise, surprise) stubborn inflation. After all, where else to hide in during stagflations?

Thank you for having read today‘s free analysis, which is available in full at my home site. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

The post S&P 500 got into that precarious position appeared first on FinanceBrokerage.

0 Response to "S&P 500 got into that precarious position"

Post a Comment