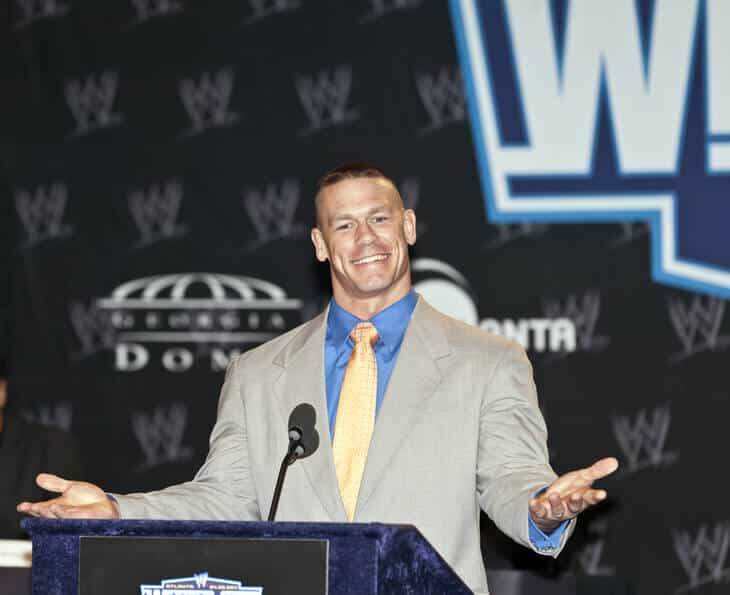

Wrestling legend John Cena NFT: Failure or Success?

Wrestling legend John Cena NFT: Failure or Success?

Since the beginning of 2021, a new form of cryptocurrency has been experiencing dazzling success: NFTs (non-fungible tokens). Issued by a Blockchain, each of them cannot be reproduced, unlike bitcoins. An NFT can therefore be compared to a trading card belonging to only one person at a given time. This existence as a unique object in the Blockchain makes it all its value. If the NFT tends to become popular in the art market, it also applies to other sectors, including gaming, events, sport or entertainment. NFT project can turn out to be a success but also a failure. In this article, we will see all about how the John Cena NFT idea failed.

NFTs are very popular right now. But how one can tell the investment is “without risk.” How do you assess the future value of this or that NFT? So let’s first see one example of failure, which is the John Cena NFT. After that, we will see how to assess the future value of NFTs.

Wrestling Entertainment gave away 500 $1,000 gold level packages with John Cena NFT, but only a small percentage of them were sold.

On September 12, Cena said it was a mistake to sell his WWE NFTs at Florida Supercon 2021

WWE and Cena released two NFT tiers for the wrestler.

Wrestling Entertainment gave away 500 $1,000 gold level packages with Cena’s NFT. But only a small percentage of them were sold. Fans have only purchased 100% of the non-fungible tokens (NFTs) from World Wrestling Entertainment.

According to Cena, it was his mistake to include physical collectables

Cena claimed it was a mistake to offer his WWE NFTs as part of a set that included physical collectibles – a hat, shirt, wristbands, belt, towel, autographed photo and the digital collectible – at Florida Supercon 2021 on September 12. The group provided 500 $1,000 gold level packages with the NFT.

He talks a lot about failure, and that plan was a failure, according to Cena. $1,000, in my opinion, and WWE’s, was a reasonable amount. We were wrong. We were completely wrong. It was a huge failure.

John Cena and WWE offered two tiers of John Cena NFTs for the wrestler: a 24-hour auction of a John Cena Platinum NFT and 500 Limited Edition NFTs released the next day as part of the aforementioned collectables bundle. The NFT Platinum reportedly sold for $21,000, with the highest bidder receiving VIP seats to WrestleMania 39 in Dallas or WrestleMania 39 in Los Angeles, as well as hotel rooms.

John Cena calls John Cena NFT sales a “catastrophic failure”

Professional wrestler and actor John Cena said his fans only purchased 7.4% of his non-fungible tokens from World Wrestling Entertainment or WWE.

Speaking at Florida Supercon 2021 on September 12, John Cena said it was a mistake to market his WWE John Cena NFTs as part of a package with bodily collectibles – a hat, shirt, bracelets, belt, a towel, an autographed picture and the digital collectable. The group provided 500 gold-level packages with the NFT for $1,000, but only a fraction of them was offered.

“I talk a lot about failure – that concept failed,” Cena said. “Myself and the WWE Parents thought $1,000 was an honest level of value. We had been imperfect. We had been completely imperfect.

The WWE veteran has been promoting crypto on social media long before the rise of NFTs. Prior to the Bitcoin (BTC) bull run of 2017 – when the value was in the $4,000s – he tweeted an image of the body token. Also featured in NFT Collections was retired veteran wrestler The Undertaker, who was with WWE until 1999.

It’s unclear if wrestling followers were put off by the value of the NFT. In fact, Cena himself estimated the digital paintings to be around $500 – or just by the bodily collectibles. In July, an entrepreneur launched simultaneous auctions for Apple co-founder Steve Jobs’ employment software and an NFT of the same. The physical paper ended up selling for $343,000. Meanwhile, the final bid for the NFT was 12 Ether (ETH), or around $27,460 at the time.

How to Reliably Assess the Future Value of NFTs

The popularity of non-fungible tokens (NFTs) has only increased in recent months. From simple jpegs to real-world items, artists, musicians, gamers all see the benefits of being able to make digital content truly unique. But is it really something that has a future, or is it just a fad that will fade over time?

Adam Garcia is the owner of The Stock Dork, a wealth of information for investors. Interviewed by The Fintech Times, he recently explained the indicators to be analyzed if one wishes to invest in an NFT – and resell them – all from the point of a pure investor. Here they are below.

Since the definition of the standard by Dapper Labs in 2017, NFTs have caused a lot of talks but were little used in the end. In 2021, it turned out that NFTs have more impressive potential than ever, with $1.25 billion in sales in the second quarter of the year alone. In other words, NFTs will be there in the short to medium term. But judging the value, even the relevance of an NFT is not easy as it is difficult to say what makes an NFT valuable.

To do this, it is first necessary to understand the concepts at work. Use cases, for example, are important, along with intrinsic utility. Since the beginning of 2021, many NFT applications have emerged. For example, NFTs have improved video games by offering a notion of ownership to loot. Anticipating future utilities is very important in the appreciation of NFTs.

There are also some NFTs that are more valuable with resales

This value can increase depending on user involvement and attention. By owning an asset that generates returns, the value will continue to grow.

Scarcity is another concept that can determine the value of future NFTs. Some NFTs are more distinctive than others, which contributes to their rarity. While there are thousands of different characters in one collection, like CryptoPunks, some have unique traits and qualities that make them stand out. And it is this rarity that can make their prices take off.

The value of NFTs is also determined by the identity of the owner of the identity of the creator of the NFT. For example, the web code NFT was sold by Sir Tim Berners-Lee for over $5 million.

Stopping at the value of the owner or creator to gauge its future value can be trying. The value of the NFT belonging to a personality can be directly related to the evolution of the popularity of this person. However, if a celebrity owns an NFT, the NFT’s cost and value will remain quite high.

The more liquidity an NFT has, the greater its value will be

This is one of the reasons why tokens created on the Ethereum blockchain are more valuable than others. Anyone with Ethereum can easily trade NFT ETCs through secondary marketplaces. If the market for your NFT or collection of NFTs is not bought, you may have liquidity concerns. And once nobody wants to buy your assets, they will be very hard to sell, let alone at the price you would like.

Constantly investing in NFTs with large trading volumes is often the preferred option for investors as this liquidity reduces the risks of even owning NFTs, especially NFTs that you don’t really care about.

Some NFTs are also known for their tangibility because they relate directly to real-world objects, which adds to their value. They are also known for their convenience, with tangible NFTs being quite reliable for short-term trading in the market. With tangibility, increased utility and liquidity as advantages, it is easier to predict the strong future value of NFTs and determine whether or not to invest in them.

Top Shot – Example of successful sports NFTs

There are tens of thousands of people rushing to the Top Shot platform to buy video sequences of basketball matches online, a symbol of the dazzling success of virtual “NFT” objects among collectors, from sports fans to art lovers. . For ordinary mortals, it’s a clip of about ten seconds, which shows action from LeBron James, a famous NBA star. But on Top Shot, it’s a collector’s item, selling for $208,000 on Monday.

This video sequence is an “NFT”, a “non-fungible token,” or non-fungible token: a virtual object whose identity, authenticity and traceability are indisputable and inviolable in theory, thanks to the technology known as “blockchain,” used for cryptocurrencies such as bitcoin, which is booming. Launched by Dapper Labs, in partnership with the NBA, Top Shot allows you to buy and sell these video extracts, called “moments,” at variable prices depending on their rarity. Dapper Labs designs and then sells these clips in varying quantities ranging from a single copy to hundreds of identical “moments.” Once on the platform, they can change hands, from one collector to another, ad infinitum.

The post Wrestling legend John Cena NFT: Failure or Success? appeared first on FinanceBrokerage.

0 Response to "Wrestling legend John Cena NFT: Failure or Success?"

Post a Comment