14 April chart overview for EURUSD and GBPUSD

14 April chart overview for EURUSD and GBPUSD

- During the Asian session, the euro kept gains from yesterday afternoon against the dollar.

- During the Asian session, the GBPUSD pair was stable, and the pound kept its gains made yesterday.

- Japan has yet to recover from deflation fully, but it is no longer suffering from a long-lasting drop in prices, Deputy Governor of the Bank of Japan Masazumi Wakatabe said on Thursday.

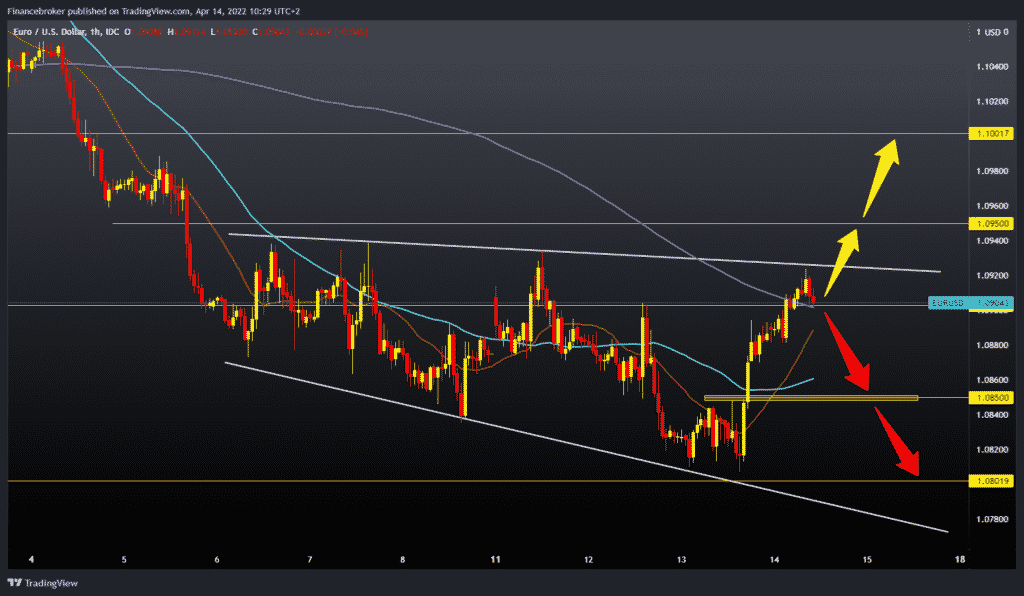

EURUSD chart analysis

During the Asian session, the euro kept gains from yesterday afternoon against the dollar. The dollar withdrawal followed a meeting of the Bank of Canada, which decided to raise the reference interest rate by 0,50 %. It was announced the day before yesterday that the inflation in the USA in the previous month increased by 8.5 % on a year-on-year level, which confirms the thesis about the “hawkish” monetary policy of the Fed at least until the end of the year. The EU is further deteriorating its relations with Russia, economically, politically and diplomatically, the meeting of ministers of EU member states showed yesterday. The euro is exchanged for 1.0910 dollars, representing the strengthening of the common European currency by 0.18% since the beginning of trading tonight. Early this afternoon, the regular meeting of the ECB ends. At 14:30, a public address by Christine Lagarde, the President of the ECB, is expected. For the bullish option, we need the continuation of the positive consolidation from yesterday, and we need a break above the upper resistance line. For now, the pair has support in moving averages, and we must stay above the MA200 moving average. Our first target is the 1.09500 level, and the next is in the zone around the 1.10000 level. We need a negative consolidation and break EURUSD below 1.09000 levels for the bearish option. The following support is in zone 1.08500, the place of yesterday’s break and the transition to the bullish trend. The maximum pullback on this time frame is up to the lower support line in the zone around 1.08000. The situation in Ukraine is unchanged, and delays in the supply chain will lead to bigger pressure on prices, inflation, and thus the euro.

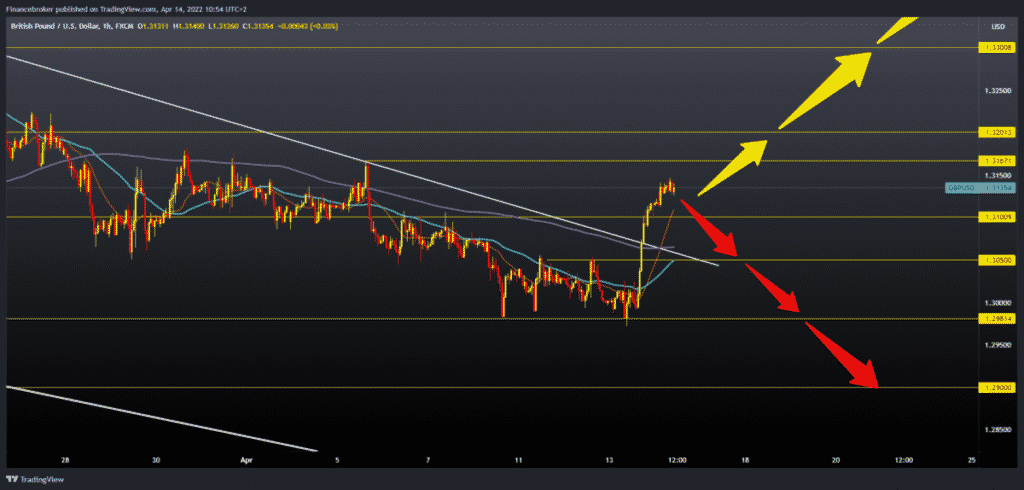

GBPUSD chart analysis

During the Asian session, the GBPUSD pair was stable, and the pound kept its gains made yesterday. The pair is currently at 1.31310, representing a strengthening of the pound by 0.11% against the US currency. Due to yesterday’s strong momentum, a smaller pullback or consolidation may now take place to find better technical support on the chart to continue the bullish trend. For the bullish option, we need to first break above 1.31500 levels, and after that, we need to climb into the zone above 1.31700 in order to try to test the 1.32000 level. We would form a new April higher high if we managed to do that. We need negative consolidation and a pullback below 1.31000 levels for the bearish option. We can expect higher support in the zone around 1.30500 because we have additional support in the MA50 and MA200 moving average and in the trend line. A drop in GBPUSD below this support would bring us down to the March support zone at 1.30000. We would also go below MA moving averages again, which would increase bearish pressure and cause a potential new lower low to form.

Market overview

Wakatabe from BOJ says that Japan no longer suffers from a permanent drop in prices

Japan has yet to recover from deflation fully, but it is no longer suffering from a long-lasting drop in prices, Deputy Governor of the Bank of Japan Masazumi Wakatabe said on Thursday.

Asked about the yen’s recent fall, Wakatabe told parliament that exchange rates should have moved stably, reflecting economic fundamentals.

Growth of Chinese exports, decline in imports

Chinese exports rose more than expected in March, and imports fell slightly, mainly due to the blockade and disruption of the supply chain.

Exports rose 14.7 % year-on-year in March, the General Directorate of Customs said. This was better than the expected growth of 13.0 % but slower than the 16.3 % expansion announced in the period from January to February.

Imports fell 0.1 % from a year earlier. Imports increased by 15.5 % in the first two months of this year.

As a result, the trade surplus amounted to $ 47.38 billion in March, well above the expected level of $ 22.4 billion.

The post 14 April chart overview for EURUSD and GBPUSD appeared first on FinanceBrokerage.

0 Response to "14 April chart overview for EURUSD and GBPUSD"

Post a Comment