EURUSD, GBPUSD and NZDUSD charts overview for April 05

EURUSD, GBPUSD and NZDUSD charts overview for April 05

- During the Asian session, the euro strengthened slightly against the dollar.

- Pair GBPUSD is still in consolidation and has supported the bottom line since March 14.

- Looking at the NZDUSD chart on the daily time frame, we see that PR has consolidated above the MA200 moving average after a long time, and now we can test the upper trend line and make a break above.

- The Central Bank of Australia held its key interest rate at a record low and signalled the hawk’s position in the future.

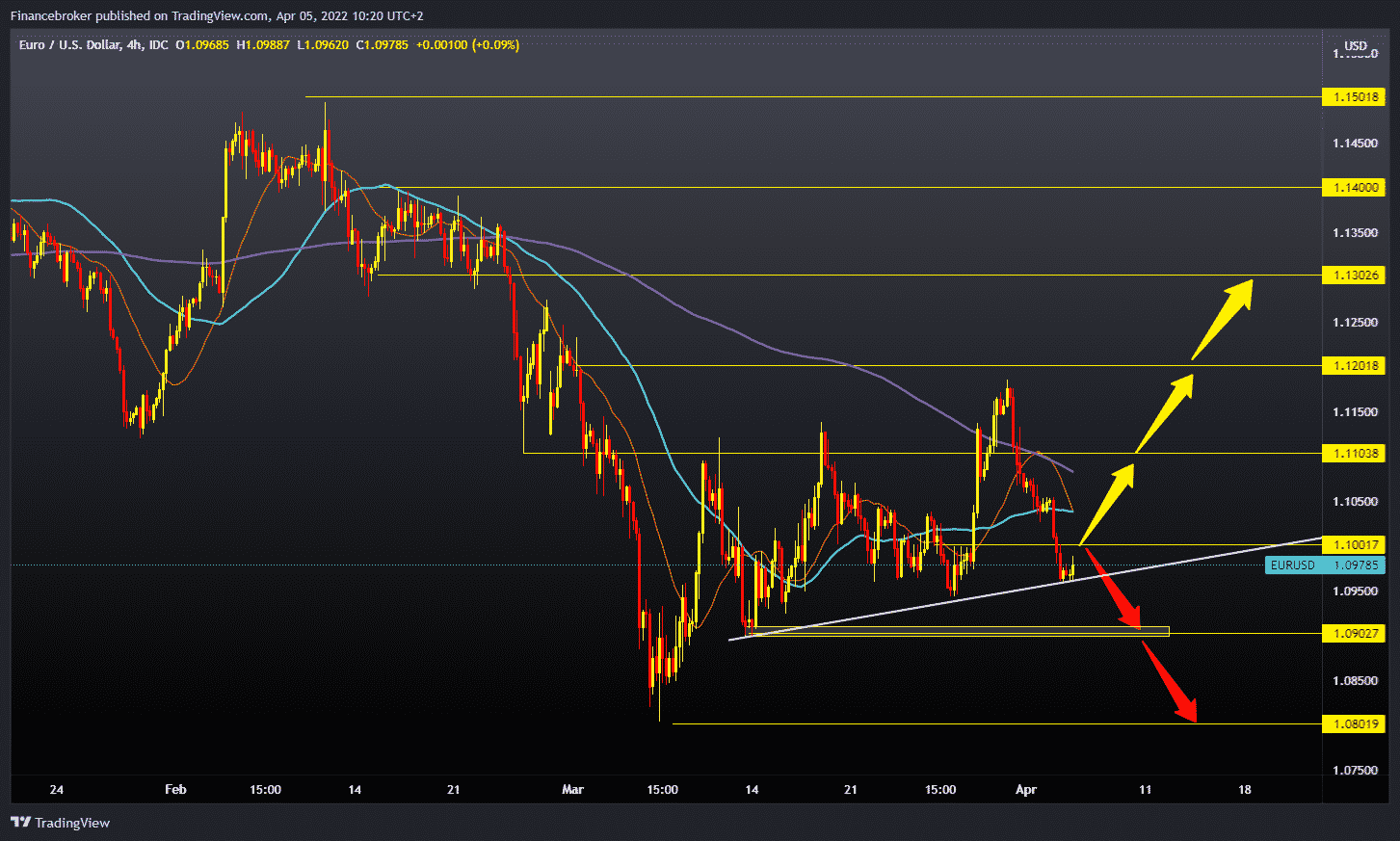

EURUSD chart analysis

During the Asian session, the euro strengthened slightly against the dollar. A report from the American labour market for March showed a solid state of the American economy on Friday, strengthening the dollar. A report from Germany showed that the trade surplus fell to 11.5 billion euros in February from 11.6 billion euros in January, compared to market expectations of 9.6 billion euros. The news failed to help the euro recover. Optimism for a breakthrough in the negotiations between Russia and Ukraine is at a minimum, and the rhetoric of high-ranking officials remains harsh, which strengthens the dollar as the main transaction “safe haven” currency. The euro is now being exchanged for 1.09810 dollars, which is slightly strengthening the common European currency by 0.08% since the beginning of trading tonight. EURUSD fell to 1.09500 last night, but it managed to find support there. Additional support at that level is in the bottom trend line. If there is a break below the support line, the target for the next support is our previous low on the 1.09000 level, and if it does not last, we go further down to the March low at 1.08000. We need the continuation of this small positive consolidation for the bullish option, and our first potential resistance is at the 1.10500 level. Additional resistance at that level is in the MA20 and MA50 moving averages. The following bullish targets are 1.11000, then 1.12000 as a potential new higher high. If EURUSD manages to form a new higher high on the chart, it would be a sign that we can expect the bullish trend to continue.

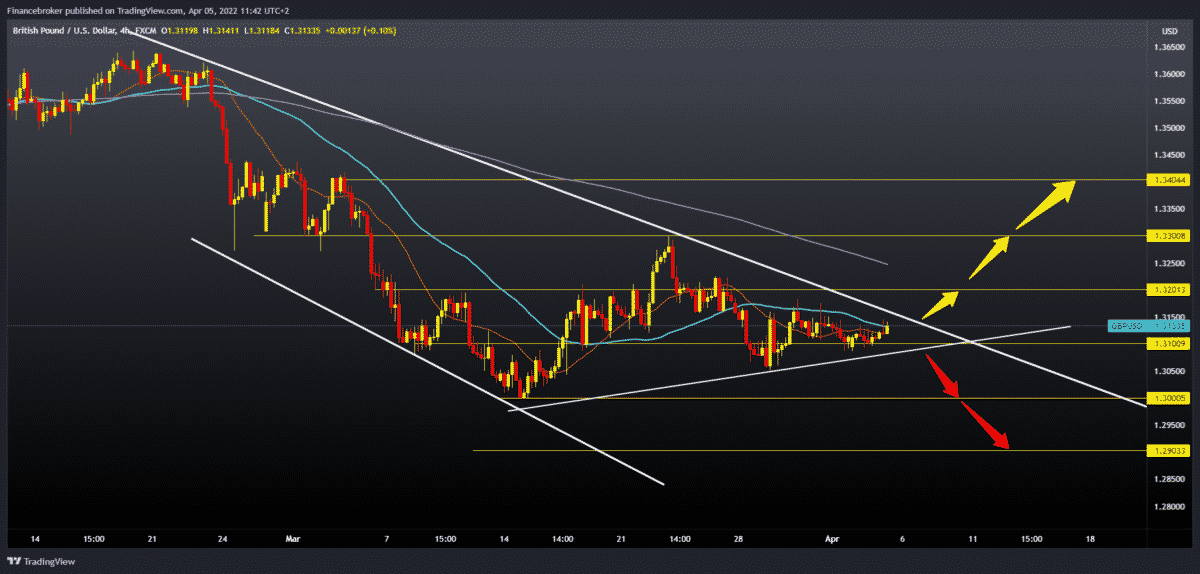

GBPUSD chart analysis

Pair GBPUSD is still in consolidation and has supported the bottom line since March 14. The problem for the pound may be because we will soon come to the upper trend line, which may be a potential resistance on the chart. Looking at moving averages, we see that if a break occurs above the upper trend line, they move to the bullish side and increase bullish optimism. Our first bullish target is 1.32000, and then at 1.32500, we have resistance in the MA200 moving average. Our next target is the previous high at 1.33000. If further positive consolidation continues, then there is a probability that the pair will climb to 1.34000, the zone of the March maximum. We need a negative consolidation below 1.30500 and a lower support line for the bearish option. If she does not endure, the next potential support is this year’s minimum and psychological level at 1.30000.

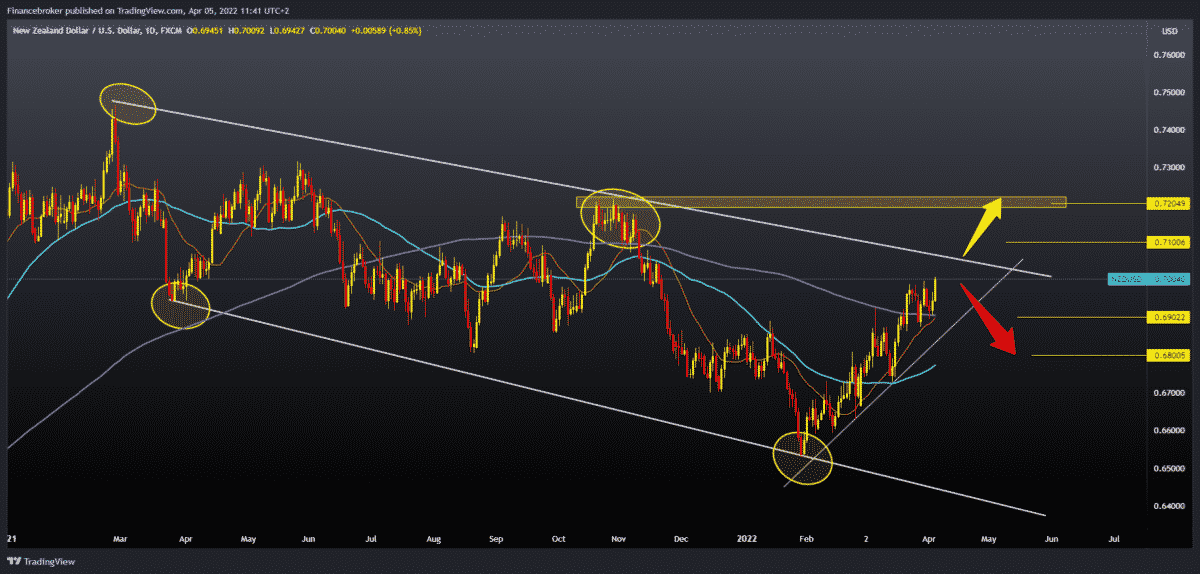

NZDUSD chart analysis

Looking at the NZDUSD chart on the daily time frame, we see that PR has consolidated above the MA200 moving average after a long time, and now we can test the upper trend line and make a break above. This bullish impulse has been going on since the beginning of February. Our main target is now the previous high from November at 0.72000. We need a break below the trend line and below the 0.69000 level for the bearish option. Potential supports at that level are the MA200 and MA20 moving averages. The pullback below would increase the bearish pressure, which could lower us further to the MA50 moving average to 0.68000.

Market overview

The Central Bank of Australia held its key interest rate at a record low and signalled the hawk’s position in the future. The Reserve Bank of Australia’s policy committee, headed by Governor Philip Lowe, has decided to keep its interest rate at 0.10 percent. The board said inflation had risen and further increases were expected, but labor cost growth was below rates likely to be in line with sustainable inflation at the target level.

Important additional evidence on inflation and the evolution of labor costs will be available to the board in the coming months, Lou said in a statement.

The governor added that the board will evaluate this, and other information received as its policy to support full employment in Australia and inflation in line with the goal.

“Today’s policy statement was not entirely hawkish, and we are confident in our forecast that the Bank will start raising interest rates in June,” said Marcel Tillian, an economist at Capital Economics.

The post EURUSD, GBPUSD and NZDUSD charts overview for April 05 appeared first on FinanceBrokerage.

0 Response to "EURUSD, GBPUSD and NZDUSD charts overview for April 05"

Post a Comment