Bitcoin has no future as a payments network

Bitcoin has no future as a payments network

Exchange of cryptocurrencies According to the Financial Times, FTX’s founder believes bitcoin has no future as a payment network and has criticized the digital currency for its inefficiencies and high environmental costs.

The world’s largest cryptocurrency, Bitcoin, is created through a method known as “proof of work,” which requires computers to “mine” the currency by solving complicated problems. Large quantities of electricity are needed to power these computers.

The “proof of stake” network is an alternative to the system in which players can purchase tokens that allow them to join the network. The more tokens they own, the more mining they can do.

According to FTX Founder and CEO Sam Bankman-Fried, “proof of stake” networks will be required to evolve crypto as a payments network because they are less expensive and use less power.

Ethereum, which is home to the second-largest cryptocurrency ether, has attempted to transition to this energy-intensive network.

Bankman-Fried also stated that he does not believe bitcoin has to die as a cryptocurrency. It may still have a future as “an asset, a commodity, and a store of value,” similar to gold.

Last week, with the collapse of TerraUSD, a so-called stablecoin, Bitcoin fell to its lowest level since December 2020.

In a February investment round, FTX, which Bankman-Fried co-founded in 2019, was valued at $32 billion, and Bankman-Fried is worth $21 billion.

Bitcoin closes in Red 7 consecutive weeks

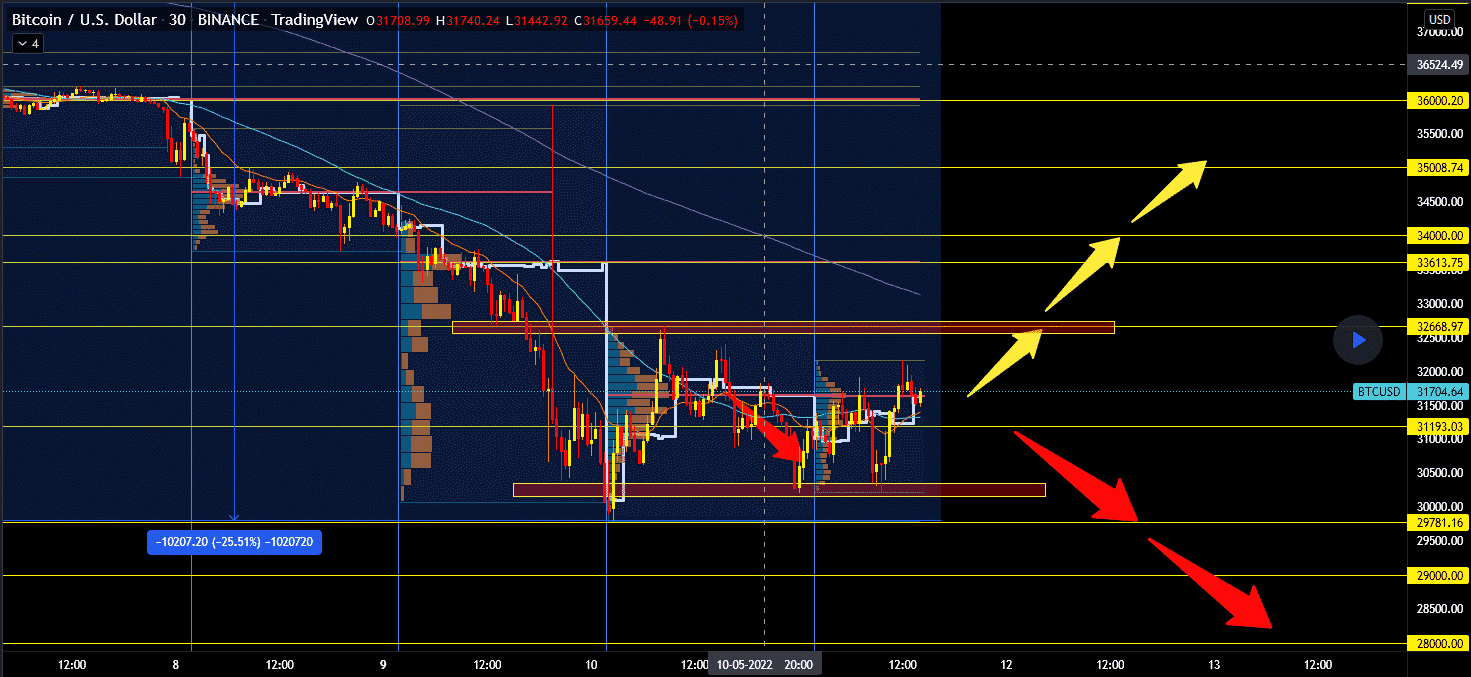

The previous seven-day rollercoaster concluded in another weekly candle closing in the red for bitcoin. As a result, the cryptocurrency made history in a pretty gloomy week by closing in the red for the first time in seven weeks. The worst trading day was on May 12, when BTC fell from slightly over $30,000 to $25,300, its lowest price since late December 2020. Despite quickly rebounding and regaining several thousand dollars in value, the cryptocurrency completed the weekly candle lower than the previous one.

With seven successive candles in the red, it had created its longest bearish weekly stretch. It’s worth noting that the fresh weekly candle, which began a few hours ago, is now red, but a lot can happen in the crypto markets in seven days. With the aforementioned bad trend, it’s not surprising that the widespread Fear and Greed Index has descended into a “severe fear” area. The statistic measures different data points, like surveys, volatility, social media comments, and so on, to assess the general sentiment of the Bitcoin community. It is worth remembering. However, that bitcoin tends to do well in times of apparent despair. For example, during the COVID-19 plunge, the Index dropped as low as eight while BTC dropped 50% in a single day.

The post Bitcoin has no future as a payments network appeared first on FinanceBrokerage.

0 Response to "Bitcoin has no future as a payments network"

Post a Comment