Keltner Channel Strategy Explained

Keltner Channel Strategy Explained

Have you ever thought about using one of the most powerful trading strategies that could be a significant part of a technical trader’s arsenal? Are you ready to learn a completely different strategy than you’ve used before in order to increase your chances of making profits? If so, you should learn all the fundamentals of the Keltner Channel Strategy!

Whether you’re an experienced trader or at the very beginning of your Forex trading career, you should be aware of the great importance of one trading strategy in the long run. Choosing the optimal strategy according to trading goals is essential for your long*tern success.

Keltner Channel Strategy is one of these effective strategies that could turn things around and help traders achieve their goals. However, before you consider using the Keltner Channel strategy, it is crucial to understand what Keltner Channel is in the first place.

Definition and explanation of Keltner Channel

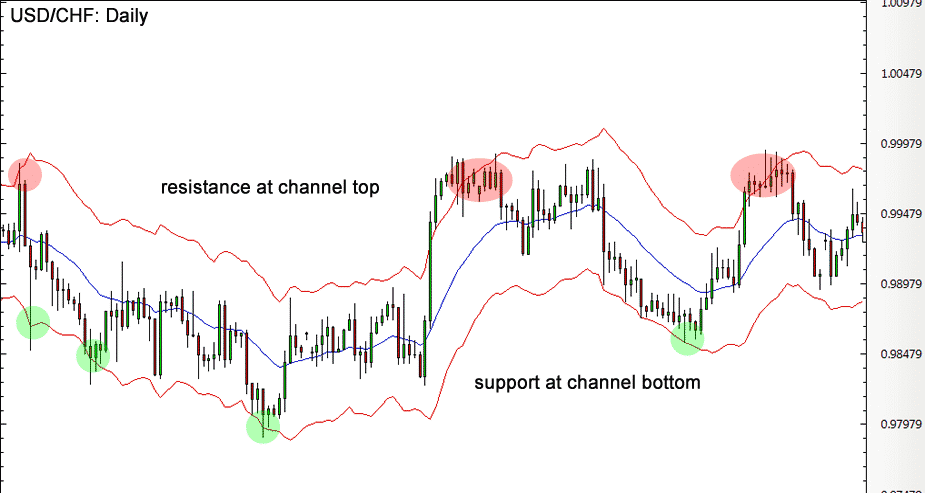

In order to truly understand what Keltner Channel strategy refers to exactly, it’s essential to know that Keltner Channels are volatility-based bands. They are placed on either side of an asset’s price and are able to determine the direction of a trend.

In other words. The Keltner Channel refers to a technical analysis indicator that assists in defining price trends and pinpoints oversold and overbought conditions present in the market. The channel utilizes ATR, which is the average true range or volatility with breaks below or above the top and bottom barriers.

It signals a continuation pattern that suggests that a particular price will continue to move in the same direction once the pattern completes as it did prior.

A brief history of the Keltner Channel

Chester Keltner introduced the Keltner Channel in the early 1960s. Its original formula used an SMA, simple moving averages and the high-low price range to calculate the bands. Twenty years after its introduction, in the 1980s, a new formula appeared that used the ATR – the actual average range, which is commonly used today as well.

Of what is the Keltner Channel composed?

So, as you’ve learned, the Keltner Channel represents a volatility-based technical indicator composed of three separate lines. We have:

- The middle line that’s an exponential moving average (EMA) of the price.

- Additional lines are placed below and above the exponential moving average (EMA)

The upper band is usually set two times the ATR above the EMA, while the lower band is usually set two times the ATR below the EMA. Keep in mind that the bands contract and expand as volatility, that’s being measured by ATR, contracts and expands.

Keep in mind that moves outside the Chanel are able to signal trend changes or acceleration of the trend. In addition to that, the direction of the channel is also able to help in identifying the trend direction of the asset.

What are the methods of this channel?

It’s no surprise that the Keltner channel has multiple uses, and the way these methods are mainly used depends on the settings one trader uses. Thus, a longer EMA means more “lag” in the indicator. The lag represents a measurable factor that is prone to changes, and it confirms the trends and changes in trends.

Therefore, channels will not respond as quickly to price changes with more lag in the indicator. When it comes to shorter EMA, it will mean that bands will react very fast to price changes. However, it will make it harder to identify the fundamental direction of a single trend. It’s crucial to know that traders are able to set their Keltner Channels in any way they want.

Reading the channel

To read the channel, it is essential to note that the channel delivers visual signals that traders could easily decipher. The channel’s slope denotes the market’s price trend. Keep in mind the following once reading the channel:

- A rising channel means that an uptrend is in place

- A falling channel indicates a downtrend

The calculation of the Keltner Channel Calculation

- 1st – Keltner Channel Middle Line=EMA

- 2nd – Keltner Channel Upper Band=EMA+2∗ATR

- 3rd – Keltner Channel Lower Band=EMA−2∗ATR

In which:

- EMA means Exponential moving average (typically over 20 periods)

- ATR means Average True Range (typically over 10 or 20 periods)

So, you are required to:

- Calculate the EMA for the asset. It is based on the previous 20 periods of the number of wanted periods.

- Calculate the ATR of the asset, which is based on the previous 20 periods of the number of wanted periods.

- Multiply the ATR by two and add that number to the EMA value to get the upper band value.

- Multiply the ATR by two or desired multiplier and then subtract the number from the EMA to get the lower band value result.

- Repeat these steps after ending of every period.

So, what about the Keltner Channel strategy examples? What is essential to know regarding the popular Keltner Channel Strategy in general? Let’s start with the most famous one – the Keltner Channel and Bollinger bands strategy.

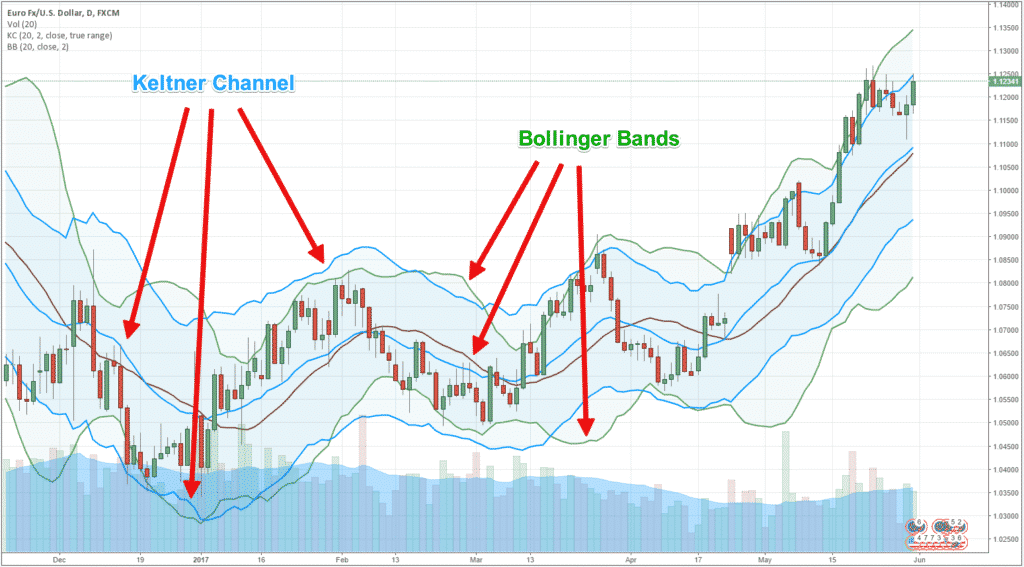

Bollinger bands Keltner Channel Strategy

When it comes to Keltner Channel vs Bollinger bands, let’s first know what this strategy is about. It is essential to know that both Keltner Channel and Bollinger bands’ strategies are two very similar indicators. Keltner Channel utilizes ATR to calculate the upper and lower bands.

On the other hand, the Bollinger Bands uses standard deviation, representing a statistic that measures a dataset’s relative dispersion to its mean. It is mainly calculated as the square root of the variance. The variance, in this case, refers to a statistical measurement of the spread between data set numbers.

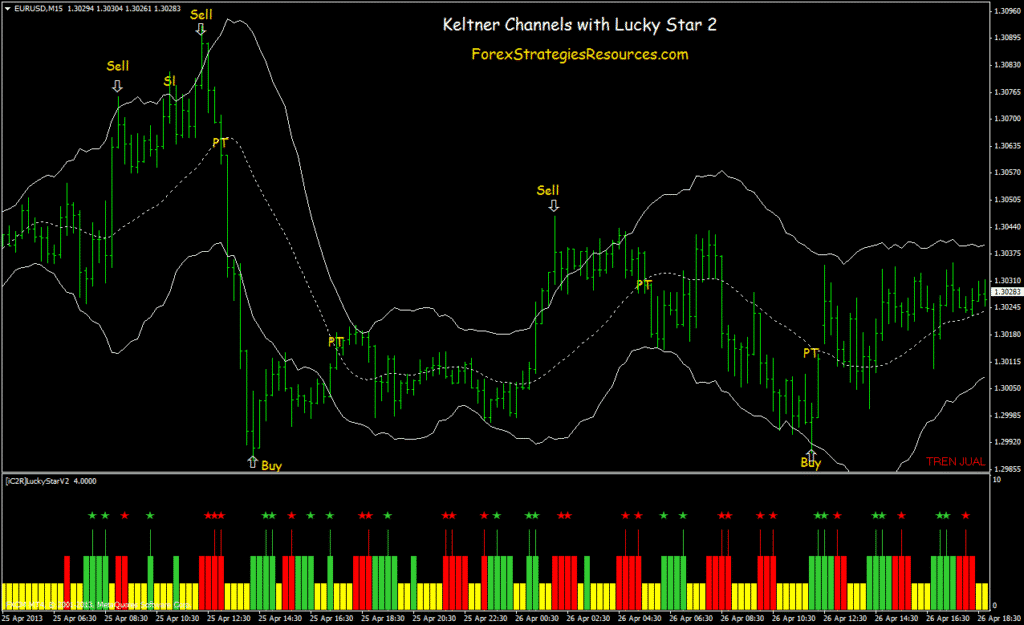

Keltner channel scalping strategy

When it comes to Keltner’s channel scalping strategy, it is crucial to understand first that Forex scalping is similar to day trading strategy, even though the positions are held for a shorter time. Some positions are only lasting for a couple of seconds or minutes.

For that reason, the Keltner channel strategy correlated with scalping means that traders can identify potential pullbacks and breakouts within the charts and spot reversals of a trend if the market is volatile.

Even though Scalping Keltner channel trading strategy examples are proved beneficial and effective for numerous traders, scalping represents a precarious strategy for professional and experienced traders. Therefore, it’s crucial to manage your risk correctly using stop-loss orders to minimize capital loss.

Keltner channel breakout strategy

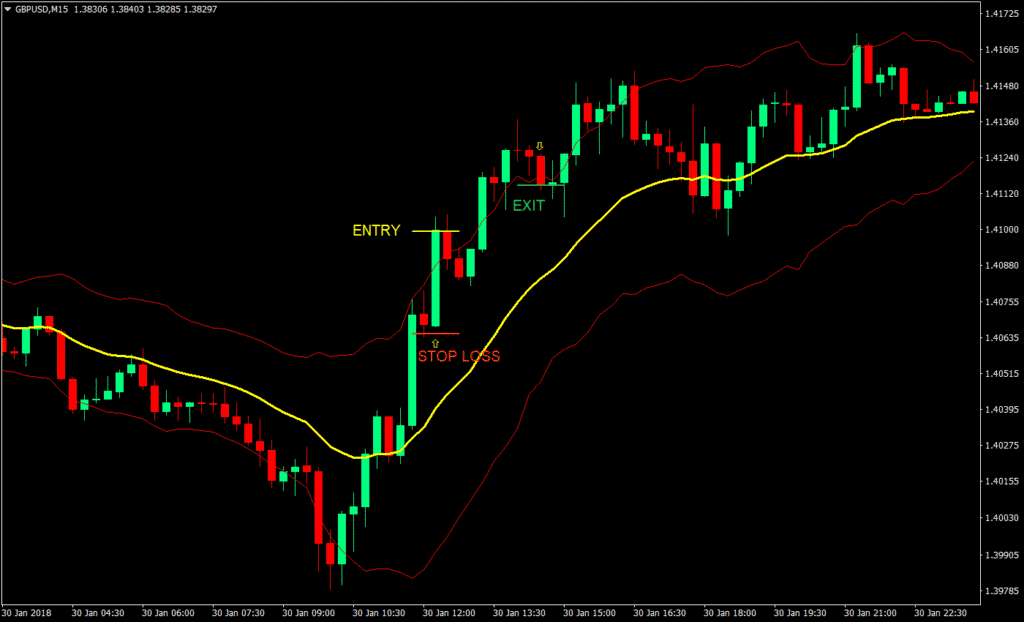

If you are interested in the Keltner channel breakout strategy, you should know that this trading breakout strategy aims to capture big moves that the trend-pullback strategy may miss. It should be near a significant market open when the most explosive movement occurs.

To understand the Keltner Channel strategy breakout, it’s essential to see it as buying in case the price cracks above the upper band or selling short in case the price drops below the lower band during the first half an hour after the market opens/

The middle band, in this case, is used as the exit, and there’s no profit target for this specific trade. So, whenever the middle band gets touched, traders need to exit the trade, regardless of whether it is a winner or a loser.

The breakout strategy, in this case, is most effectively applied to assets that tend to include sharp trending moves in the morning!

How are you able to day-trade with Keltner Channels?

So, as we have learned so far, Keltner Channels are extremely useful and popular technical indicators that day traders use to assess the current trend and enable trading signals. To day-trade with Keltner channels, here are the crucial steps to follow:

- Calculate Keltner Channels using the formula from above.

- Adjust the indicator correctly so that guidelines hold most of the time. When the price moves continually higher but does not reach the upper band, then channel lines could be too broad, and you have to lower the multiplier. If the price is trending higher but frequently touches the lower band, channels may be too tight, and you need to increase the multiplier.

- Buy during an uptrend once the price pulls back to the middle line when the indicator is set up correctly. It’s crucial to place a stop loss halfway between the lower and the middle line. After it is done, a trader should place a target price right near the upper band.

- Use the breakout strategy that’s explained above in this article.

- Combine the Trend-Pullback and Breakout strategies – Keep in mind that the trend-pullback strategy is much more applicable during the day. The breakout is designed to be used only in assets that have sharp and sustained moves during the opening of a significant market.

- Adjust your Keltner Channel strategy settings slightly in case you wish to trade with different assets. However, these settings may not be working correctly or be the best one for another asset.

Summary

What is crucial to know before using Keltner Channels to trade with real money and Keltner Channel Strategy examples is that you would practice trading on the indicator’s signals in the demo account.

Therefore you’ll be safe from risks and potential losses on the market while gaining the necessary experience and learning which trades you should take or avoid. Only in that way you will manage to achieve success once you decide you are 100% ready to trade with natural capital!

The post Keltner Channel Strategy Explained appeared first on FinanceBrokerage.

0 Response to "Keltner Channel Strategy Explained"

Post a Comment