The MACD and RSI strategy – How to Combine the Signals?

The MACD and RSI strategy – How to Combine the Signals?

The moving average convergence divergence (MACD) and the relative strength index (RSI) represent some of the most popular indicators used in the financial markets. When combined with other indicators within MACD and RSI strategy, they can offer value in confirming trade opportunities and to optimize your risk management practices.

Many technical indicators can play a significant role in technical analysis in trading, such as time indicators or the RSI. But today, we are going to talk about very particular, reliable and very precise indicators, the MACD and RSI. These indicators effectively analyze an asset, such as stocks, commodities or currencies, so most traders like to use them. In this article, we explain everything you need to know about the MACD and RSI indicators so that you can use them in MACD and RSI trading strategies.

MACD and RSI strategy – The basics of MACD

MACD is one of many technical indicators that helps in carrying out technical analysis. The latter is widely used in trading because it is particularly appreciated for its high precision and efficiency.

The MACD will help you with your technical analysis, as it will also allow you to identify opportunities when they arise. The MACD consists of two different moving averages. One of them is short, while the other is long. That’s the difference between the two that we use to perform our technical analysis.

Key MACD Indicators to Watch

The two significant formations that develop from a MACD are the “golden cross” and the “death cross.” These formations are virtually mirror opposites. However, identifying them is crucial to make the most out of MACD in your strategy:

- Golden cross: It’s a bullish indicator that we can see taking place after a price dip marked by high volume selling. Once the selloff is over, the price begins to rise, and the crossover takes place with big upward momentum that increases the price above the crossover line. It results in a sizable profit for a trader who identified the preceding dip.

- Death cross: It’s a bearish indicator inverse of a golden cross. Prices are puffed up as buyers gobble up the specific currency. However, the price decreases once the demand is satisfied, resulting in a crossover with significant downward momentum.

How to use a MACD indicator?

The MACD indicator is very simple to use, even for a beginner trader. Also, it can be used as an alternative to the Ichimoku indicator. At first, it had to be calculated before it could be interpreted, but today, forex trading platforms take care of it.

You just need to find a platform that uses this kind of index so that you can use it to perform your technical analysis. However, to use it well, you will have to follow the following steps, namely:

Find the MACD indicator

- The MACD indicator is found in most trading platforms found on the internet. However, some brokers do not use this type of technical indicator, so you must check this before registering. Make sure that the online broker you are about to sign up with uses the MACD indicator. Note that if you work at the broker Coinbase, you will have a hard time detecting this indicator.

Calculate the MACD indicator:

- It is very easy to calculate the MACD indicator since its result is the difference between the two moving averages, the short and the long. However, there is no need to know how the MACD is calculated since your trading platform will do it for you automatically. Nevertheless, it is still good to know how to calculate the MACD indicator so that you can check in case the broker makes a mistake.

Interpret the MACD indicator:

- Once you are done with the calculation of the MACD, you will have to interpret the result. Again, there is nothing easier to interpret the MACD. However, you must still succeed in this operation so that your chart analysis is correct. In reality, to interpret the MACD indicator, you need to see its positioning. For this, you need to check the location of the histogram and the signal line. If these are above 0, it means that it is an uptrend, and if, on the contrary, the histogram and the signal line are below the 0 line, it means that the trend is bearish. In the end, knowing how to interpret this indicator is one of the essential steps to becoming a good trader.

What are the advantages of the MACD indicator?

The MACD technical indicator has many advantages. This is why it is very popular with traders worldwide, whether beginners or experts.

The latter is very effective in detecting opportunities, very easy to use but also simple to interpret.

Therefore, if you need a simple technical indicator to use in these trades, which is accessible even to beginners, the MACD technical indicator is the one for you. Here are some of the different advantages of the MACD, namely:

Ease of use:

- The first advantage of the MACD indicator is that it is very easy to use, even for the most novice. Its operation is very simple, and its interpretation is even more so. However, you should still document how to use it before using it for the first time. You have to find a trading platform that uses this kind of indicator and then calculate and interpret it according to the result.

Time-saving:

- In addition to being very easy to use, the MACD technical indicator also allows you to save considerable time since you get your result in a fraction of a second, and it is possible to interpret it in no time. By using this technical indicator, you can quickly perform your chart analysis and save time. However, traders who work at the broker Binance will not be able to take advantage of it.

Reliability and precision:

- Reliability and precision: the MACD technical indicator is known to offer a very precise and reliable result. It’s also the reason why it is very popular with traders. However, you must interpret it well in order to have the precise result you want to have. Thus, it can be said that the MACD indicator is very reliable, which will help you a lot in making good trades.

MACD and RSI strategy – The basics of RSI

Created in 1978 by Welles Wilder, the relative strength index, commonly called the RSI, is an oscillator type technical analysis indicator. The relative strength index is used to gauge the strength of a move and identify potential trend reversals.

The RSI is a momentum indicator that always displays a value oscillating between 0 and 100. The two important limits to watch for asset traders are the 30 and 70 levels.

When the RSI drops below 30, it means the asset is at the oversold level.

When the RSI crosses above 70, it means that the asset is in the overbought zone, i.e. the asset is considered overbought.

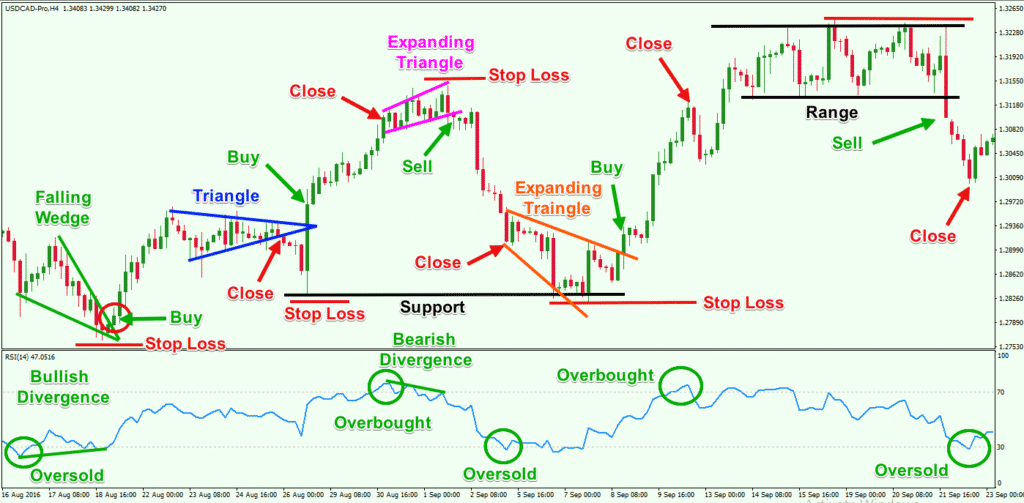

Another interesting point is the divergence between the trend of the asset price and the direction of the RSI value. Indeed, in an uptrend scenario, if the price of a security reaches a new high, but the RSI does not create a new high as well, this translates as a bearish divergence. We consider such divergence as a strong signal for a trend reversal.

Trading strategy with RSI

The relative strength index is not suitable for assets whose price is moving in a strong trend because, in such an environment, this indicator will give you false signals to buy or sell. Like other oscillators, the RSI is most effective when used on securities that display high volatility.

If the RSI is below 30, it means that the indicator considers the asset to be oversold, and the asset price could bounce higher.

It is crucial to understand that the trend reversal is confirmed once the RSI returns upwards, crossing the 30 bar again. In such a case, the relative strength index sends you a buy signal to bet on the rise in the share price.

If the RSI is above 70, the indicator believes that the asset is overbought, and the price might make a downward correction.

Again, the trend reversal is confirmed when the RSI starts falling, and it crosses the 70 markdowns.

After this confirmation, the indicator gives you a sell signal, either to close your long position or to initiate a short sale.

The relative strength index can be very useful for active investors trying to profit from short-term price movements by identifying whether the asset is considered overbought or oversold. On the other hand, remember that there is no technical indicator that can predict the future with certainty, so avoid carrying out transactions relying solely on the value of the RSI or any other indicator.

Importance of combining MACD technical indicator and the RSI technical indicator

Some traders, especially beginners, tend to think that you have to choose between MACD and RSI technical indicators. Certainly, these two indicators are both reliable and accurate. However, you should know that neither of them can be better than the other from a certain point of view. We can also say that these two indicators complement each other.

For this reason, it would be best to use them together to have better results and more chances to succeed in your trade.

Therefore, once you have learned to master the MACD technical indicator and use it to do your technical analysis, think about learning to use the RSI technical indicator to perfect your technical analysis and obtain better results.

However, be aware that you can also combine the MACD technical indicator with other technical indicators, such as the Stochastic technical indicator, which would be very effective in combination with the MACD. However, the most common combination that we usually see in the market is that of the RSI + MACD.

MACD and RSI strategy – Best Practices for Using MACD and RSI Together

As you include MACD and RSI into your trading macd and rsi strategy, you will identify your set of preferences when it comes to when and how you implement these indicators in your analysis. In general, you can maximize the value of MACD and RSI indicators through the following best practices.

-

Mix MACD and RSI strategy to validate price momentum.

The simplest implementation of these indicators can offer a big deal of insight regarding price momentum. If one indicator points out momentum in a specific direction, verify the other indicator to check whether it agrees. If the views are split, you may struggle to conclude should you open a position. When both agree, a trader may feel more confident.

-

Exit a position during MACD and RSI divergence.

In the same way, when traders open positions once MACD and RSI indicators confirm one another, a trader can choose to close a position when one of these indicators points out a shift in momentum.

Depending on your trading strategy, the logic behind the decision can vary. Some traders consider that the divergence of one indicator weakens the signal of the other. Others consider that one signal’s momentum change can be a harbinger of the other’s change of direction and a corresponding change in price movement.

The post The MACD and RSI strategy – How to Combine the Signals? appeared first on FinanceBrokerage.

0 Response to "The MACD and RSI strategy – How to Combine the Signals?"

Post a Comment