Way of the Turtle Explained: What are Turtle Traders?

Way of the Turtle Explained: What are Turtle Traders?

In the world of trading, there are a myriad of lucrative trading strategies and systems. And every one of them has some perks and downfalls. Here we talk about the turtle way of trading, initially conducted as an experiment in the early 80s, which started as a bet.

In terms of trading strategies that enabled many to make profits, one has been talked about a lot and has been present for more than 30 years. It’s the turtle way of trading developed by trading guru Richard Dennis in the 80s. He was convinced that success in trading comes from a taught method. He believed that everyone can be a winner in the financial markets by following it.

And in the end, he was right since the people he trained generated more than 150 million in capital gains in 5 years. Let’s see the outline of the turtle way of trading.

“The Way of the Turtle: The Secret Methods that Turned Ordinary People into Legendary Traders”

In the Way of the Turtle: The Secret Methods that Turned Ordinary People into Legendary Traders – Curtis Faith lays bare one of the core strategies that work in today’s financial markets.

In their trading journey, many traders are bound to come across the term “Turtle Trader” or “way of the Turtle method.” The book reveals the reasons for the success of a secret trading system that is used by a group that goes by the name of “Turtles.”

Furthermore, in this book, traders will discover how this group made money while learning the principles that guided their trading. It also provides the step-by-step methods followed by the turtle group.

Thanks to this, traders can apply the same approaches. They can diversify their trading and limit the risk that traders are exposed to.

The “Turtle Way” reveals for the first time the reasons that have made the success of this secret trading system used by this group of novice traders universally known as the “Tortues.”

Personal Experiences

At the time, the youngest turtle, Curtis Faith, tells us all about the experience. He explains how Dennis and Eckhardt recruited 23 ordinary people from all walks of life and transformed them. In just two weeks, they became extraordinary traders.

While he only was nineteen years old at the time, which made him the youngest recruit among Dennis’ “Turtles,” Faith traded the largest trading account.

He was awarded a $2 million in initial capital. Thus, allowing him to raise 30 million dollars of gains in just four years. In fact, he takes you behind the scenes of the trial.

Turtle selection area and behind closed doors were where they taught them money-making strategies that enabled them to earn an average return on investment of some 80 percent per year and profits over 100 million.

Let’s see the whole story in detail.

The origins of the secret trading system – The turtle way

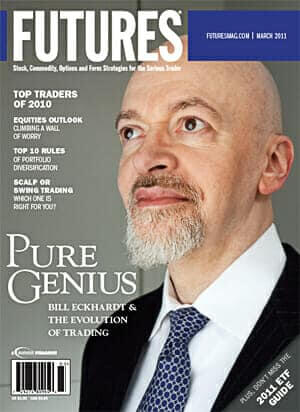

Richard Dennis and his longtime friend William Eckhardt, are the originators of the secretive turtle way of trading.

The turtle trading method was born from the confrontation of ideas between Richard Dennis and William Eckhardt, one millionaire trader and the other manager of an alternative investment fund.

At the time, in the 80s, Dennis considered that by learning a well-established method and following it scrupulously, it was possible and easy for a beginner to trade successfully in the financial markets.

His friend disagreed, saying that to get good trading results, a solid set of analysis and statistics was needed. This is where the turtle trading method was born: proving that Dennis was right.

The turtle way of trading: Millions of dollars septuple in 5 years

Richard Dennis was right. His trading method has indeed borne fruit since. After 5 years, the 23 million dollar capital managed by turtle traders has substantially increased to more than seven times: $175,000,000.

This then makes a capital gain of more than 150 million dollars. With this experience, Dennis was able to demonstrate that the rigorous application of a trading method makes it possible to perform successfully in the financial markets.

Otherwise, its success is also based on the fact that the capital used was enormous. The turtle traders felt indebted to Richard Dennis for trusting them to entrust them with part of his personal fortune. They then applied the method with great rigour.

Richard Dennis, the trader, became convinced that trading was all about method. But in fact, what is a trader? For him, a trader is a person who can be taught a method and who can perform in the markets thanks to what he has been taught.

This method can be taught to anyone. In order to test this theory, he convinced a trader friend William Eckhardt to help him. It was from there that the study began, and the movement of turtle traders was born; it was in the 80s.

Looking for turtle traders – The turtle way experiment and turtle selection process

“We will train traders like they raise turtles in Singapore.” – Guru Richard Dennis reportedly said.

To prove his theory, Richard Dennis decides to bring together 23 people, including 21 men and 2 women. The legendary trading experiment took place in 1983 over 5 years.

The goal was to teach neophytes a trading method and let them apply it for many years. The eccentricity of this study is that he did not hesitate to entrust each of these new trainees with a staggering sum as capital: 1 million dollars.

He asked them to use this money to operate in the financial markets using the method he had taught them. Thus, they were able to apply the method with real stress like that felt by a professional trader using real “money” and not just a little since a million dollars represents more than the substantial sum on the markets. For your information, this sum now represents more than 3 million dollars.

The simple method used by turtle traders – Way of the Turtle Explained

Richard Dennis’ turtle trading theory is based on a simple observation. Beginners are able to learn and apply a simple method based on trend analysis and range trading of specific products that often fluctuate, such as commodities, currencies and bonds.

What turtle traders had to remember was to buy when prices go beyond their recent range and then sell when prices go below their recent range. It is quite simple as a method and easily assimilated by neophytes in the stock market.

Turtle’s trading strategy is to develop an algorithmic or mechanical approach. This system is not based on an analysis of fundamental factors such as supply and demand. Price and timing are always decisive. The system is almost 100% systematic. This technique excludes seasonal factors, statistics, market profiles, and triangular or daily trades.

What were the gains of the turtle traders?

Reading this exciting story, the first question that comes to mind is: did it work, and how much did they win? At the end of the experiment, that is to say, after five years of trading on the financial markets with the method of Richard Dennis, they managed to accumulate 175 million dollars.

The 23 apprentice traders went from 23 million dollars to 175 million dollars. This gave them substantial gains of 152 million dollars, or a capital multiplied by more than 7.5 in 5 years. It goes without saying that this is a huge performance.

This extraordinary experiment remains undoubtedly the most famous in the history of trading. It is known for its method on the one hand and the capital used on the other – 23 million dollars. It is a hell of a sum of money for an experiment. But also for the gains accumulated by these beginners in 5 years: 152 million dollars.

What lesson can we draw from this experience?

What experience teaches about turtle traders is the importance of having a trading method and applying it rigorously. These are the essential points to consider for a winning stock market strategy.

Learning the turtle way of trading is not complicated. But most often, the application is not rigorous or continuous, leading to failure; hence the usefulness of having a debriefing method to see if the method has been followed rigorously.

On the other hand, it is certainly because they used capital that was not theirs – the capital came from the personal fortune of Richard Dennis. They then felt indebted and applied the method with great rigour, and that is what led them to success.

The turtle way of trading teaches you how to take part in major unforeseen trends in both rising and falling markets to maximize your earnings fully. Trend monitoring is based on analyzing price behaviour in the targeted markets.

Long-term trend-following strategies will require discipline and control of your emotions from you. This is required to succeed in generating an above-average income. Whether you are a trader for a large company, an individual investor, or you follow your own account, TurtleTrader offers you the solutions that have proven themselves during the first ‘Turtles’ formation.

The post Way of the Turtle Explained: What are Turtle Traders? appeared first on FinanceBrokerage.

0 Response to "Way of the Turtle Explained: What are Turtle Traders?"

Post a Comment