What is deadcoin and how to identify one?

What is deadcoin and how to identify one?

Have you ever wondered what deadcoin is? In the crypto market, everyone has their job. Some create altcoins, others trade them, and still, others have chosen to count deadcoins.

At the end of 2019, Brad Carlinghouse, CEO of Ripple (XRP), predicts that 99% of cryptos are doomed. 2022 will be, according to him, a period of consolidation in the world of cryptos.

We have leapt into the crypto graveyard for the macabre exercise of counting deadcoins in 2019 and previous years. So let’s see what deadcoin is and how to identify one.

Definition of deadcoin

2008 represented the year of the advent of cryptocurrencies but also the fall of the markets. It was also the period when blockchain related projects exploded. However many projects have been nipped in the bud.

A vertiginous peak followed by an inevitable fall is what the prices of almost all crypto-currencies looked like in 2018. Most of them have lost 80% of their rate. For some, this crisis in the crypto-economy has resulted in a pure and simple cessation of the project that was at its origin.

“Dead” crypto-currencies are the subject of a site, deadcoins.com. Deadcoins has teamed up with coinjanitor.io to “clean up” the crypto-sphere by cleaning up abandoned crypto projects. 2018 brought down over 1,000 altcoins.

An impressive number when you know that the Market Cap currently lists 18,000 digital currencies. A third of crypto-currency projects would therefore have already ended up in oblivion.

CoinJanitor takes a close look at discontinued cryptocurrencies

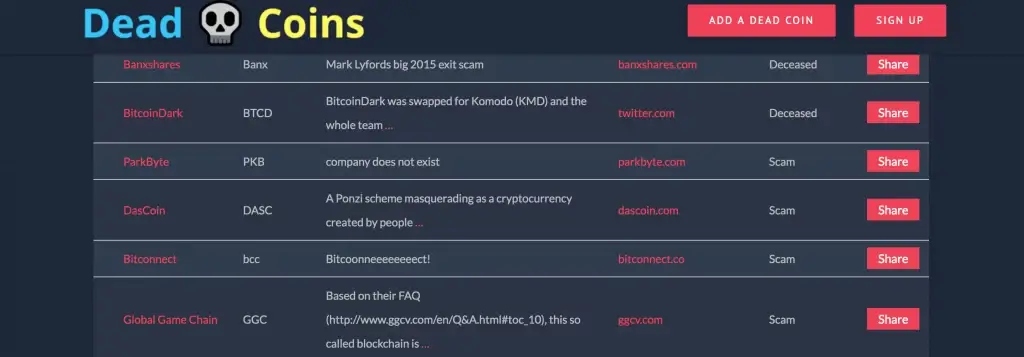

The Dead Coins site lists all the projects stopped by name but also by category.

For this, four sets have been defined:

- Deceased: for altcoins that developers and their community have abandoned.

- Hack: for altcoins that have been hacked.

- Scam: scam dead coins are projects that were just simple scams.

- Parody and joke coins: for projects that copied existing projects without adding value to them.

Dead Coins site has the advantage of collecting data on projects that did not survive. The association of Dead Coins with CoinJanitor makes it possible to value all these tokens which are no longer useful. Indeed, CoinJanitor is positioned in a very specific niche. It’s the purchase of tokens from abandoned projects from users in order to design new tools using elements that may prove useful.

The CoinJanitor team launched an Initial Coin Offering ICO for May 2018 with the sale of a token that was used to redeem “deadcoins”, the JAN.

A study by LongHash revealed that deadcoin usually represents cryptos abandoned by investors and developers, who then see their trading volume plummet.

Some deadcoins are crypto-scams or are linked to failed ICO. Others are forgotten deadcoin cryptos or joke altcoins like BieberCoin aimed for social media entertainment.

“Dead” crypto-currencies are the subject of a site, deadcoins.com. Deadcoins has teamed up with coinjanitor.io to “clean up” the crypto-sphere by cleaning up abandoned crypto projects.

Deadcoin statistics

According to DeadCoins, 674 altcoins joined the ranks of deadcoins in 2017. This number dropped to 647 in 2018 and 518 in 2019, a 20% drop in 1 year.

Coinopsy recorded two deadcoins in 2013, 209 in 2014, 235 in 2015, 169 in 2016 and respectively 223, 399 and 85 deadcoins in 2017, 2018 and 2019.

The statistics, therefore, vary from one site to another because each uses its own method to identify and list deadcoins.

For example, CoinCodeCap declares crypto dead when the project has not published a single line of code on GitHub within 90 days, which is not the case with DeadCoins.

Unlike the statistics of DeadCoins, those of CoinCodeCap thus show an increase in the number of dead cryptos since 2018.

The success of Bitcoin has spawned a global cryptocurrency boom in recent years. The coinmarketcap.com site currently lists more than 2,000 digital currencies in operation. But deadcoins.com has dedicated itself to the dark side of this trend and presents the currencies that have joined the cryptocurrency graveyard.

The page currently lists 934 defunct digital currencies, categorized by the reasons for their failure. Thus, 72.9% no longer have trading volume or were abandoned by their developers due to financial failures, and 19.4% turned out to be scams.

The LongHash crypto data analysis platform has looked at altcoins that no longer exist. It analyzes the factors that can influence the death of crypto.

Countless deadcoins

As we know, many crypto projects barely see the light of day before falling back into oblivion, not to mention the scams doomed to failure. In 2017 and 2018, the wave of ICOs also left many projects on the sidelines. LongHash explains that it is impossible to know precisely how many altcoins are dead because there is no official directory.

However, the analysis site is based on a Coinopsy database, which lists 705 abandoned projects in 2020. However, this list is not exhaustive. The DeadCoins site lists 1,779 deleted altcoins, and CoinMarketCap lists more than 1,000 projects with a trading volume below $1,000 per day.

Factors that can influence the death of crypto

Among this very substantial list of deadcoins, LongHash has identified several trends. The most common cause of death is abandonment (63.1% of projects). In this case, investors turn away from the altcoin and stop trading it, causing its volume to drop to zero.

The second large category of deadcoins includes scams, verified or not. They represent 29.9% of the projects listed on Coinopsy. Most of them took place in 2017, right at the time when the bull market carried Bitcoin and others and dangled promises of easy money to unscrupulous entrepreneurs. Scams have thus quintupled their number during this period.

The percentage of remaining deadcoins represents failed or run out of steam ICOs (3.6%), but also humorous altcoins, which represent 3.2%.

How many cryptocurrencies disappeared

LongHash’s analysis concludes by explaining that despite many deadcoins, they still manage to hang on for a while in the ecosystem before sinking. Abandoned projects thus last an average of 1.7 years, and failed ICOs have a similar duration, at 1.6 years. Unsurprisingly, these are the scams that last the shortest, with durations of a year on average. As for crypto jokes, they make you laugh for an average of 1.4 years before plunging again into the abyss…

The data offered by Coinopsy remains incomplete, but it gives an overall view of the extremely large number of crypto projects that were doomed to failure. However, the regularization of the markets and the fallout from the enthusiasm of 2017 slowed down this trend.

Many people still have tokens that have been rendered completely unusable. In principle, they can no longer do anything with them because the exchange sites have removed them from their platform or their volumes are too small.

Restoring some value to these zombies is the best of the startup CoinJanitor, which launched its ICO last May and issued the JAN token.

Under certain conditions, investors can exchange “dead” tokens for JANs and thus recover the currency of their coin…

Only Strong Cryptocurrencies Remain

Bitcoin is a typical example of a resilient cryptocurrency. Constantly put to the test since its genesis, its antifragile character is revealed test after test.

Bitcoin is a typical example of a resilient cryptocurrency. Constantly put to the test since its genesis, its antifragile character is revealed test after test.

True natural selection is taking place in the young, competitive cryptocurrency market, which is a good thing. Beyond bogus projects or scams that end up being revealed, other more serious projects also end up in oblivion.

The law of the market does nothing for the more fragile elements. Once launched in the deep end, new cryptocurrencies must have many qualities to hope to survive.

Condemned many times to die, “to float on the river like a corpse*”, Bitcoin regularly proves its detractors wrong. On October 31, 2018, the first capitalization of the market celebrated the 10th anniversary of the development of its white paper.

Perhaps one day, Bitcoin will appear to the general public as an obvious store of value. I will appear as a universal and decentralized standard in the face of inflation, imperfect fiat currencies, or the many cases of abuse of financial markets. Until then, other challenges await Bitcoin and other cryptos.

How to avoid scam deadcoin

The often very summary information provided about ICOs makes it very difficult to assess the risks. The financing of startups is also, by definition, risky; the probability of capital loss is real.

However, the hype surrounding ICOs and virtual currencies can give rise to speculative behaviour on the part of investors, who then pay very little attention to the underlying project and the risks it entails.

Some ICOs are set up to defraud investors. To identify potentially dubious ICOs, avoid investing in a cryptocurrency that has the risk of ending up in the cemetery. Choose those with promising protocols, likely to stand the test of time, state regulations, the market, and have real-world use cases.

And always bear in mind that it is ultimately important to read the white papers when investing in a new altcoin. Make sure that the services and usage behind the altcoin are promising and worth the investment.

The post What is deadcoin and how to identify one? appeared first on FinanceBrokerage.

0 Response to "What is deadcoin and how to identify one?"

Post a Comment