Who Made the Most Money From Bitcoin?

Who Made the Most Money From Bitcoin?

Bitcoin is the largest cryptocurrency when it comes to market cap. So, it is not surprising that a lot of people monitor any news connected to the largest cryptocurrency. Many of them have one question in mind, and the question is, “Who made the most money from Bitcoin.”

Due to the downward pressure that has been witnessed in the cryptocurrency market, which has resulted in a loss of hundreds of billions of dollars in market cap since the beginning of the year, the number of Bitcoin addresses that hold one million dollars or more has also decreased.

It is very hard, if not impossible, to determine the exact number of people who became rich thanks to Bitcoin or other cryptocurrencies. It is worth mentioning that crypto billionaires, including the founders and CEO of the largest trading platforms, have seen their personal fortunes wiped out by the latest market crash.

You don’t have to type “Nick Szabo net worth” to find out that he is not a crypto billionaire.

His net worth was $2 million as of December 2021. Nonetheless, he is a famous person in the crypto community. He is a crypto computer scientist, legal scholar, as well as cryptographer who is known for his research in digital contracts as well as a digital currency.

Last month, Ethereum’s founder Vitalik Baturin confirmed that he lost billionaire status post the crypto crash triggered by the Terra Luna wipeout. Before the latest market crash, nineteen people were billionaires because of their crypto holdings. As it turns out, not only Vitalik Baturin but several other people who had built their wealth via crypto also suffered huge losses due to the crypto crash

Bitcoin and crypto billionaires

We can have a look at the list of crypto billionaires to better understand the scale of the latest market crash.

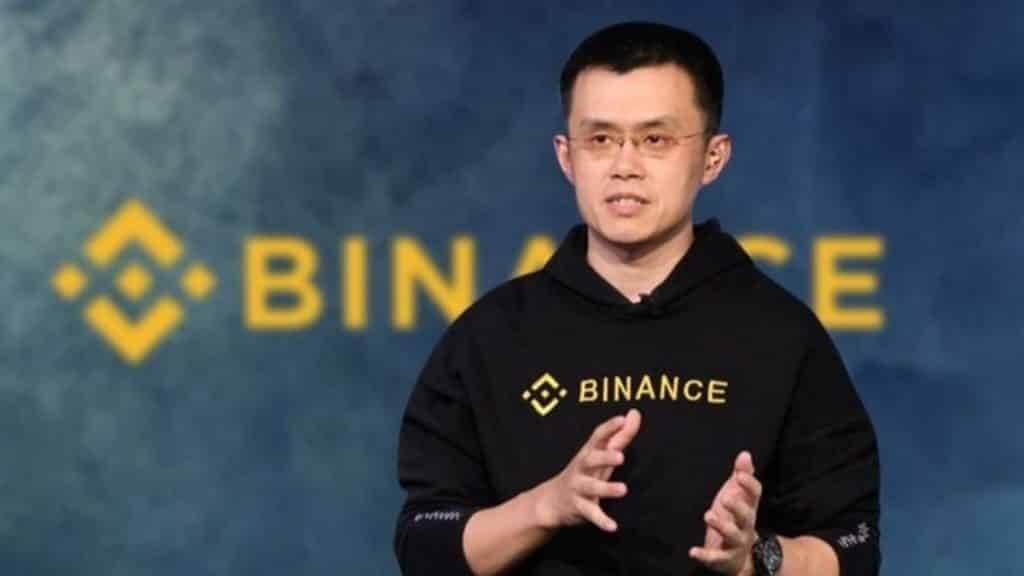

Changpeng Zhao is a very famous person. He is an influential figure, as he is the founder and chief executive officer of Binance. It is the largest crypto exchange when it comes to trading volume.

Before the crash, Changpeng Zhao’s wealth stood at $65 billion. After the crash, his wealth diminished by tens of billions to $14.9 billion as of May 23.

Sam Bankman-Fried also found himself in a difficult situation. He is the founder and CEO of cryptocurrency exchange FTX. Before the crypto crash, his net worth was $24 billion. After the crypto crash, Bankman-Fried’s wealth fell to $11.3 billion.

Brian Armstrong also lost a lot of money due to the crypto crash. As you might know, he is the founder of the crypto exchange Coinbase. Before the crash, his net worth was $6.6 billion, and after the crash, Armstrong left the Billionaire’s club.

Another person who lost his status is Gary Wang. He is the co-founder of the FTX exchange, and Gary Wang’s wealth stood at $5.9 billion before the crypto crash. Unfortunately, he is no longer a billionaire post the crypto crash.

Do you know what Gary Wang, Brian Armstrong, and Chris Larsen have in common? Let’s find out! Larsen also lost his status after the crypto crash.

Larsen is the co-founder as well as the executive chairman of blockchain company Ripple. His net worth before the crash was $4.3 billion.

Brothers Cameron Winklevoss and Tyler Winklevoss had acquired crypto fortunes worth nearly $4 billion each. After the crash, the brothers are also no longer part of the billionaire’s club.

Crypto billionaires and the latest crypto crash

Chi-hyung, the founder of South Korea’s largest crypto exchange, also lost his status. Prior to the crash, Upbit’s founder’s net worth was $3.7 billion.

Jed McCaleb is the co-founder of Ripple Labs. He left Ripple Labs in 2013. McCaleb left the project due to conflicts with Larsen and other team members and started Stellar, another crypto firm. McCaleb’s net worth was $2.5 billion before the crash, and like many others, he also lost his billionaire tag.

Nikil Viswanathan and Joseph Lau founded the Blockchain Academy, a toolbox for blockchain developers. Viswanathan and Lau had a net worth of $2.4 each before the crash, but the situation changed after the crash. As a result, they are also no longer part of the billionaire’s club.

Founders of OpenSea also suffered serious losses. Devin Finzer’s and Alex Atallah’s net worth stood at $2.2 billion before the crypto crash. However, as in the case of the majority of crypto billionaires, they too lost the tag after the crypto crash.

Fred Ehrsam is the co-founder of Paradigm Capital, a cryptocurrency investing firm. Ehrsam amassed 2.1 billion dollars in wealth which was significantly reduced in the crypto crash. As a result, he lost his status.

As in the case of other crypto billionaires, the latest crypto crash has had a huge impact on Kim Hyoung-nyon. He is the executive vice president of South Korea’s Dunamu crypto exchange. Kim Hyoung-nyon owns about a 13% stake in the exchange, which he co-founded in 2012.

His wealth, which mainly comprised cryptocurrencies, stood at $1.9 billion before the crash. After the crash, he also lost the billionaire tag.

Matthew Roszak and Tim Draper

Matthew Roszak

Matthew Roszak also found himself in a difficult situation. Roszak, an early adopter of Bitcoin, started investing in 2012. Matthew Roszak also participated in initial coin offerings of altcoins like Mastercoin, Factom, etc. Prior to the crash, Roszak’s net worth stood at $1.4 billion. Unfortunately, he is no longer a billionaire after the crash.

Venture capitalist Tim Draper also started investing in Bitcoin as well as other cryptocurrencies a long time ago. Draper’s net worth was $1.2 billion before the crypto crash. Tim Draper, too, just like several other crypto billionaires, was dropped off the index after the recent crypto crash.

MicroStrategy and its CEO Michael Saylor

Michael Saylor is a well-known figure in the crypto community. Saylor is the CEO of the tech firm MicroStrategy. He became a leading Bitcoin maximalist in 2020 when MicroStrategy started to build up its Bitcoin reserves, and its CEO himself bought 17,732 Bitcoin tokens below $10,000.

The firm is still the most prominent corporate holder of the most well-known cryptocurrency.

Based on Michael Saylor’s public disclosures about his Bitcoin holdings, his 17,732 Bitcoins were worth $640.2 million on May 6 and $531 million on May 13. In just one week, he lost $108.25 million. Last month, his net worth actually fell below the $1 billion mark.

MicroStrategy’s CEO first became a multimillionaire during the ‘90s dot-com boom before losing his place in the billionaires club after MicroStrategy revised its financial results in 1999. However, he regained his billionaire status after the first quarter of 2021 as Bitcoin reached highs above $60,000.

Saylor made his fortune from MicroStrategy, which he started more than 30 years ago in 1989. One interesting fact about Saylor is that his wealth is largely tied up in Bitcoin and MicroStrategy stock.

In March, the firm borrowed $205 million from Silvergate Bank, using Bitcoin as collateral to buy more Bitcoin. In the first quarter of the year, it bought $215 million of Bitcoin at an average price of $44,645 per coin.

However, if the price of the world’s largest cryptocurrency drops below $21,000, MicroStrategy will face a margin call that will force it to pay more cryptocurrency to back its loan with Silvergate Bank. Nevertheless, its CFO, Phong Le, said in MicroStrategy’s first-quarter earnings that the company still has uncollateralized Bitcoin that it can put up.

Barry Silbert

As the founder of Digital Currency Group (DCG), Barry Silbert built an impressive crypto portfolio. Silbert’s Digital Currency Group is a composite organization of six cryptocurrency-focused enterprises. As the head of Digital Currency Group, he is one of the most influential individuals in the cryptocurrency space.

Just type “Barry Silbert net worth” in Google Search, and you will notice one interesting detail. Before the crash, Silbert’s net worth was $3.2 billion. However, he is also no longer part of the billionaire’s club.

Silbert bought his first Bitcoin in 2012, making him one of the cryptocurrency’s early investors. With a $2 million budget, he founded the investment vehicle Bitcoin Investment Trust at SecondMarket. It is noteworthy that it was the first of its kind in the country, and it created a lot of new opportunities for Barry Silbert.

Digital Currency Group (DCG)

Apart from buying cryptocurrency in its early stages, he built his wealth by investing in crypto-focused companies. Barry Silbert did this by selling SecondMarket to Nasdaq and founding Digital Currency Group (DCG) several years ago.

It has more than 200 enterprises in its investment portfolio, spread across more than 30 countries. This includes eToro, Coinbase, as well as Kraken. The DCG also holds Ethereum, Ethereum Classic, and Bitcoin, among other digital tokens.

At the moment, it holds six subsidiaries. This includes TradeBlock, Genesis Trading, Luno Global, CoinDesk, and perhaps DCG’s most potent venture, Grayscale Investments.

It is the world’s biggest virtual currency asset manager, which provides corporate and accredited investors with private funds as well as publicly-traded funds.

Grayscale Investments also operates the Grayscale Bitcoin Investment Trust. It was the first publicly-traded security purely involved in Bitcoin’s price since its original launch.

The post Who Made the Most Money From Bitcoin? appeared first on FinanceBrokerage.

0 Response to "Who Made the Most Money From Bitcoin?"

Post a Comment