EURUSD and GBPUSD: The Pressure On The Currency

EURUSD and GBPUSD: The Pressure On The Currency

- During the Asian trading session, the euro managed to hold above the 0.99500 level.

- The pound continued to retreat during the Asian trading session, stopping at the 1.13000 level.

- The current account balance of the Eurozone yesterday showed the largest deficit since the end of 2008.

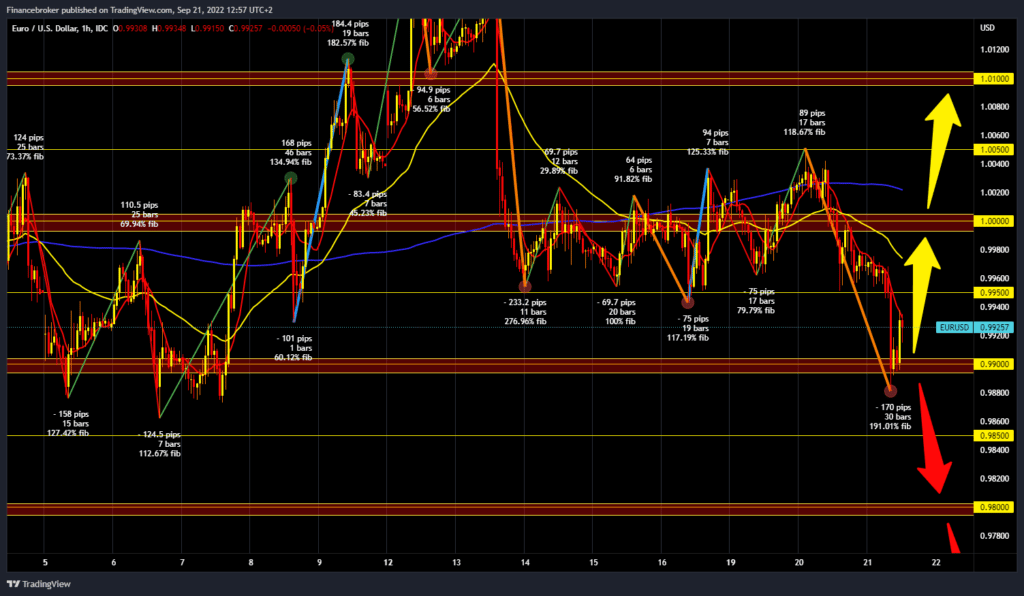

EURUSD chart analysis

During the Asian trading session, the euro managed to hold above the 0.99500 level. The pressure on the European currency was too great, and the pair EURUSD fell below the 0.99000 level. This morning’s low is at 0.98800. After that, we see the euro’s recovery and a return above the 0.99000 to 0.99270 level. We would have to climb above the 0.995000 level if we plan a further bullish rally. Our additional resistance in the zone around 0.99800 is the MA50 moving average. If we were to climb above it, we would approach the 1.00000 resistance level. And a return above it could slow down the fall of the euro and trigger further recovery. For a bearish signal, we need a new negative consolidation and a new pullback below the 0.99000 level. Then we would have the opportunity to retest the low from the beginning of the month at the 0.98600 level. Potential lower targets are 0.98500 and 0.98000 levels.

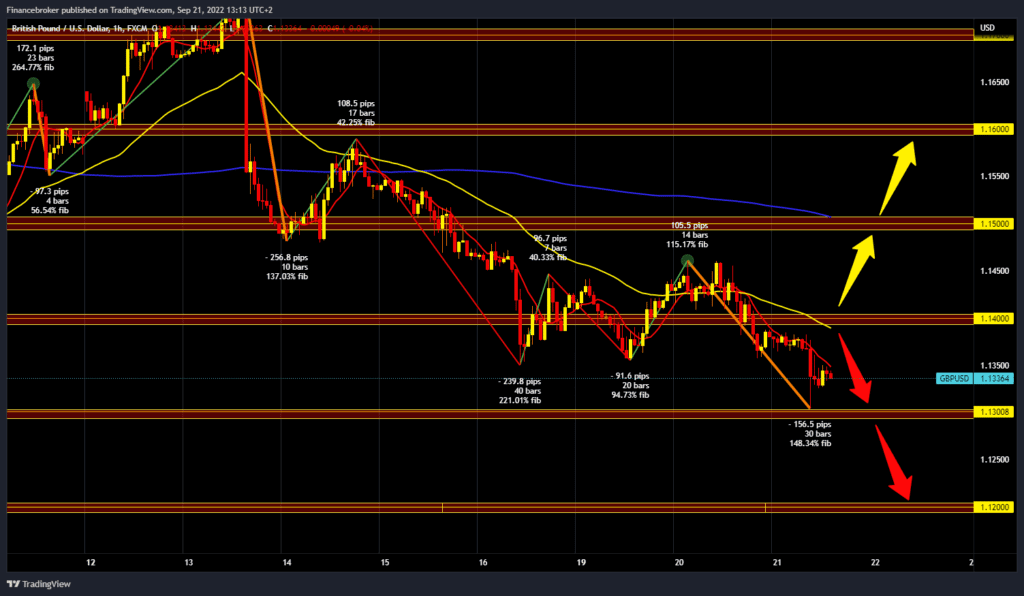

GBPUSD chart analysis

The pound continued to retreat during the Asian trading session, stopping at the 1.13000 level. Then followed a recovery to the 1.13500 level. A continuation of the recovery could take place up to the 1.14000 level. Additional resistance at that level is the MA50 moving average. To continue, we need to break above the pound and try to hold above. Potential higher targets are 1.14500 and 1.15000 levels. We need a continuation of this negative consolidation and another test of this morning’s low for a bearish option. A break below would strengthen the existing bearish trend. Potential lower targets are 1.12500 and 1.12000 levels.

Market Overview

The current account balance of the Eurozone yesterday showed the largest deficit since the end of 2008. In July, the current account recorded an unexpected deficit of 19.86 billion euros, in contrast to a surplus of 4.24 billion euros in June. This deficit was the largest since November 2008. In the twelve months to July, the current account surplus was 63 billion euros or 0.5% of the eurozone GDP.

The post EURUSD and GBPUSD: The Pressure On The Currency appeared first on FinanceBrokerage.

0 Response to "EURUSD and GBPUSD: The Pressure On The Currency "

Post a Comment