GigaFinancing Review

| General Information |

|

|---|---|

| Broker Name: | GigaFinancing |

| Broker Type: | Forex & CFDs |

| Country: | US |

| Operating since year: | N/A |

| Regulation: | N/A |

| Address: | 212 Prospect Ave, Brooklyn, New York United States |

| Broker status: | Active |

| Customer Service |

#colsapn# |

| Phone: |

N/A |

| Email: | support@giga-financing.com |

| Languages: | English |

| Availability: | 24/5 |

| Trading | #colsapn# |

| The Trading platforms: | Web |

| Trading platform Time zone: | N/A |

| Demo account: | No |

| Mobile trading: | No |

| Web-based trading: | Yes |

| Bonuses: | No |

| Other trading instruments: |

Yes |

| Account |

|

| Minimum deposit: | $250 |

| Maximal leverage: |

1:500 |

| Spread: | Floating From 1 Pip |

| Scalping allowed: |

Yes |

GigaFinancing Review – Is it a good choice for traders?

General Information & First Impressions

GigaFinancing is a brokerage company that offers a wide variety of services to online traders. It operates globally and accepts traders from many countries across the world. With few limitations, the broker positions itself as open and versatile, able to accept traders with different preferences. Our GigaFinancing review will tell you more about the broker and compare it to other options on the market.

One thing we need to touch on before we continue is that GigaFinancing is a CFDs broker. That brings it numerous advantages but also raises some eyebrows in the trading community. There’s a misconception circulating that CFD brokers are automatically scams. However, that’s a limited opinion, akin to saying all cryptocurrencies are a scam.

CFDs have numerous advantages for both users and brokers. They allow companies to lower costs and diversify trading libraries, resulting in a much better customer experience.

Unless you have a massive trading volume or want underlying asset ownership, CFDs are the more beneficial way to trade. That’s why scammers pose as CFD companies, thus creating their bad reputation. It’s a bit of a vicious cycle that can’t be interrupted.

Luckily, as we’ll discuss later on in our GigaFinancing review, it’s about as safe as you could ask from an online company. However, we’d like to discuss the user experience on the website a bit.

We looked around and were quite content with what we saw. The broker looks great, handles well, and organizes information neatly. As such, users can find whatever info they’re looking for, thus saving their time. Going the extra mile in that regard shows the broker means business and knows its customers.

So we have high hopes going into the rest of our gigafinancing.com review. Let’s look at the rest of the broker’s offer and structure.

Fund and Account Security

Whenever you’re choosing a trading company, security is one of the main factors you must judge it on. You’ve certainly read about people getting scammed online, whether it be with brokerages or crypto companies. Finance attracts scammers, or more precisely, large amounts of money do. And as such, they flock to either hack or pose as financial companies to steal from unsuspecting users.

However, with regulation being better than in the past, the landscape is slowly healing. There are still a ton of scammers, but the chances of them getting caught are much larger. And there’s manifold less than a few years ago when online trading was almost entirely unregulated.

Today, if you’re careful enough, you can nearly guarantee that you won’t get scammed. Of course, there’s always the risk of cyber breaches, but there’s not much you can do about that. Even in those cases, brokers often compensate the users damaged in the process.

However, the process of spotting a scam isn’t always straightforward. Because of that, we’ve devoted this part of our GigaFinancing review to check its security.

And just by the way the broker acts, it’s fairly apparent it’s an honest company with no ill intentions. It lays out all its qualities clearly and lets traders formulate an opinion. However, you may still feel like that’s subjective and not substantial enough.

However, the fact that the broker operates from the US should clear up all doubts. As the world’s financial hotspot, the US is the most regulated market worldwide as far as financial companies go. There’s no way a scam company could pass under the radar as a broker long enough to pull anything off. As such, we’re confident that you won’t have any security trouble on gigafinancing.com.

Account Info at gigafinancing.com

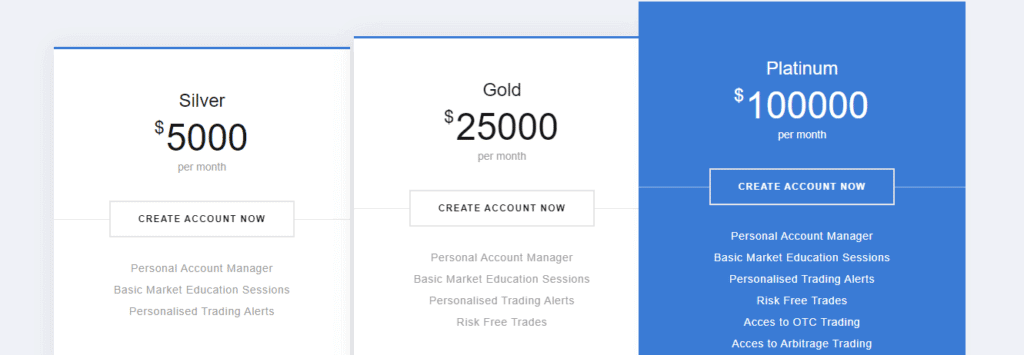

One of the hurdles every broker has to overcome is determining a target audience. It feels like most brokers alienate a part of their potential user base just by structuring their service. However, GigaFinancing has managed to avoid that issue elegantly.

It does that by dividing its service into three tiers, marked by three different account types. That way, if you’re on a budget, you won’t get affected by conditions suited towards those that invest thousands on a daily basis. Conversely, if you’re a high-end investor, you’ll still have the full suite of trading conditions without being budget-limited.

Such a setup makes the broker feel much fairer and evenly spread. The company lets traders trade the way they want and doesn’t force them into overspending. And if they’re a big spender, it doesn’t bog them down to satisfy the other end of the spectrum.

And the great thing is that all of GigaFinancing’s accounts is that they outperform competitors at similar price ranges. Namely, each account offers way above what you’d expect to get for that price. As such, beginner accounts get unexpected luxury features, which can be invaluable while you’re growing as a trader.

Here are some of the things you can expect at gigafinance.com:

Silver

- Min. Deposit: $250

- Personal Account Manager

- Basic Market Education Sessions

- Personalised Trading Alerts

Gold

- Min. Deposit: $25,000

- Personal Account Manager

- Basic Market Education Sessions

- Personalised Trading Alerts

- Risk Free Trades

Platinum

- Min. Deposit: $100,000

- Personal Account Manager

- Basic Market Education Sessions

- Personalised Trading Alerts

- Risk Free Trades

GigaFinancing’s Trading Platform

GigaFinancing has a sophisticated trading platform that caters to the needs of the modern trader. For starters, the baseline version is accessible via browsers, meaning its fully optimized. In other words, it’s not an afterthought that’s a byproduct of the downloadable platform. hat means it’s much more feature-rich, runs better, and overall offers better UX.

It’s fairly simple to use, its key features resembling many popular online trading platforms. That way, traders won’t need to relearn everything just to start trading with gigafinancing.com. That’s especially meaningful for traders that employ strategies that rely on muscle memory, such as day trading and scalping.

The platform offers traders all the analytical features they’re used to, including graphs and charts. You can use multiple visual indicators to aid you in your market predictions. As such, you can greatly increase your success rate if you get comfortable with the platform.

As we said earlier in our GigaFinancing review, the broker is entirely safe, and that extends to its platform. It’s encrypted, eliminating any potential info leaks or hacks.

With over 2,000 assets on the platform, GigaFinancing’s software offers a multitude of choices and empowers traders.

Conclusion

GigaFinancing shows us that you don’t need to be flashy to be successful. It’s one of the few brokers that simply does everything well and lets the service speak for itself. It’s versatile, but each part of its service is also solid as a standalone.

GigaFinancing doesn’t rely on gimmicks. Its wide trading library, potent platform, and low prices are its main selling points. Altogether, the features combine and create a truly fantastic experience for anyone that joins.

Needless to say, we’re quite satisfied with what we found in our GigaFinancing review. If you’re looking for a new broker, be sure to consider it, as it’s one of the market’s top choices.

FAQ

-

Is GigaFinancing in the USA?

Yes, GigaFinancing is a US-based broker. That goes a long way towards proving the company is safe and reliable.

-

Is GigaFinancing regulated in the US?

As a company operating from the US, GigaFinancing must follow all local legislation made by financial regulators.

-

Can I trust GigaFinancing?

Yes, GigaFinancing is an entirely safe brokerage. It shows no ill intent towards customers and operates from a safe location.

-

How does GigaFinancing make money?

Like all CFD brokers, GigaFinancing profits via spreads.

-

Can I use GigaFinancing in the US?

Yes, GigaFinancing’s services are available in most countries globally.

-

How to trade on GigaFinancing’s platform?

GigaFinancing offers WebTrader. That means you only need to open it in your browser and log into your account.

-

Is GigaFinancing good for forex?

Yes, forex is GigaFinancing’s specialty.

-

How do I open a GigaFinancing account?

To sign up at GigaFinancing, press the Register button and follow the steps the broker provides.

-

Can I deposit 5$ to GigaFinancing?

No, the minimum deposit at GigaFinancing is $250.

-

Can you make money with GigaFinancing?

Yes, GigaFinancing is one of the best brokers to make money with.

The post GigaFinancing Review appeared first on FinanceBrokerage.

0 Response to "GigaFinancing Review"

Post a Comment