Gold and Silver: More Bearish? Let’s See

Gold and Silver: More Bearish? Let’s See

- During the Asian trading session, the price of gold again fell below the $1,700 level and stopped at the $1,690 level.

- During the Asian trading session, the price of silver fell to support at the $17.75 level.

- Price pressures in the US economy at +8.5% in July indicate that the inflation rate has now peaked and a downward cycle has begun.

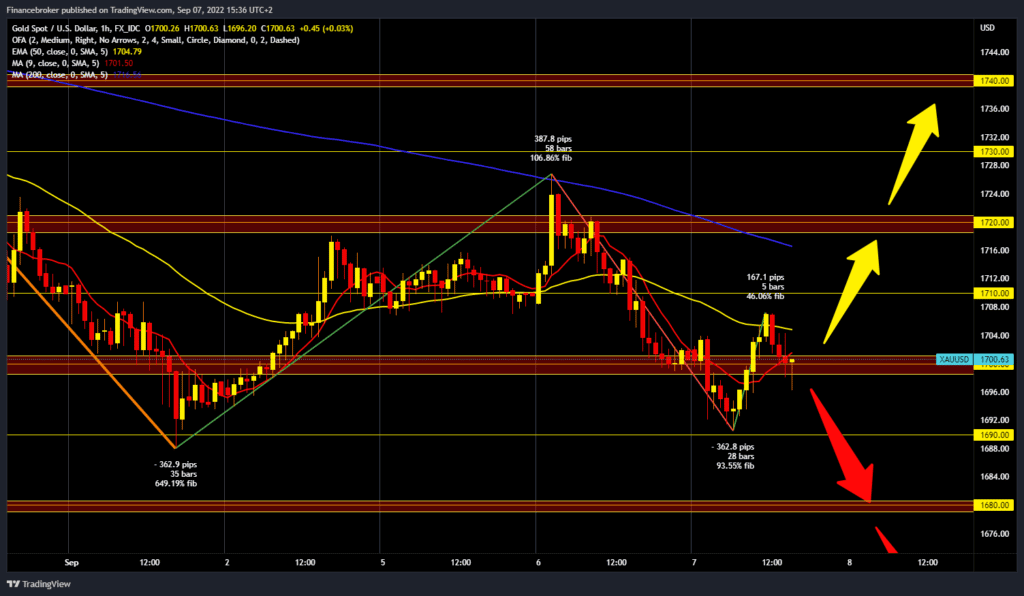

Gold chart analysis

During the Asian trading session, the price of gold again fell below the $1,700 level and stopped at the $1,690 level. After that, we saw an attempt to recover, but only up to the $1708 level. Then there was a new pullback, and the price of gold is again looking for support at the $1700 level. We need a continuation of this negative consolidation and a retest of support at the $1690 level for a bearish option. A break below would mean that we will form a new lower low and continue the bearish trend. Potential lower targets are $1680 and $1670 levels. We must first hold above the $1700 level for a bullish option. After that, with bullish consolidation, the price of gold could continue its recovery. Our main target is the $1720 level. If we succeeded in going higher, we would get additional support in the MA200 moving average. Potential higher targets are $1730 and $1740 levels.

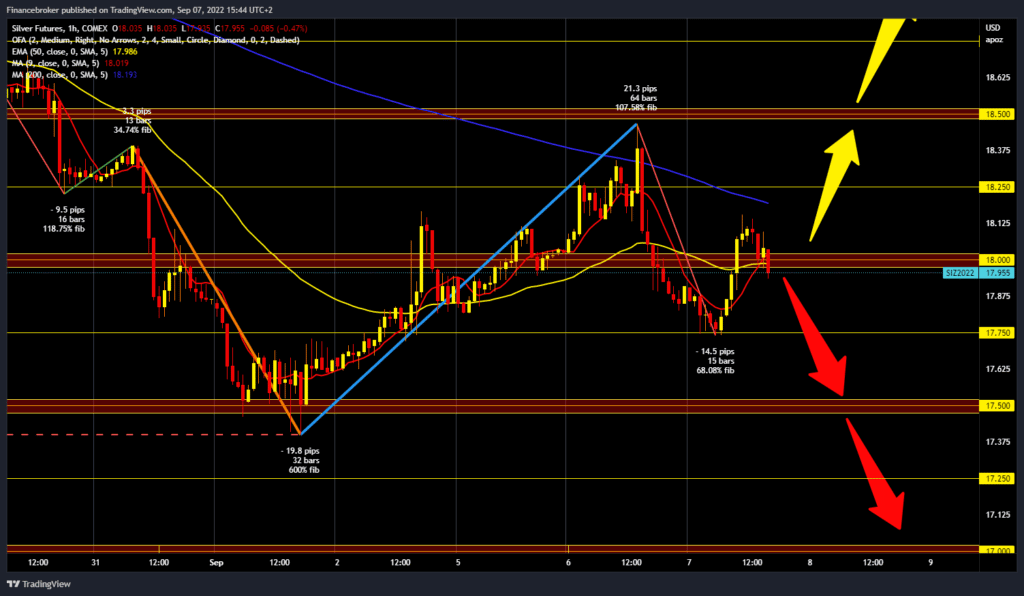

Silver chart analysis

During the Asian trading session, the price of silver fell to support at the $17.75 level. Then followed a recovery to the $18,125 level, where we encountered resistance. The MA200 moving average provides additional resistance at that level. To continue the bearish option, we need further negative consolidation and a break below this morning’s support at $17.75. Then we would go down again to the $17.50 support level. And if the pressure on the price were to continue, a break would be likely, and the potential lower targets are $17.25 and $17.00 levels. For a bullish option, we need a new positive consolidation and a return to a safer zone above the $18.25 level. After that, we could expect further price recovery. Potential higher targets are $18.50, yesterday’s high, and the $18.75 level.

Market Overview

Price pressures in the US economy at +8.5% in July indicate that the inflation rate has now peaked and a downward cycle has begun. The figure of 8.5% is far from the desired rate of 2%. This is why the Fed cannot stop the rate hike cycle until the CPI shows a significant decline.

The post Gold and Silver: More Bearish? Let’s See appeared first on FinanceBrokerage.

0 Response to "Gold and Silver: More Bearish? Let’s See "

Post a Comment