Mixfinancing Review

| General Information | |

|---|---|

| Broker Name: | Mixfinancing |

| Broker Type: | Forex & CFDs |

| Country: | UK |

| Operating since year: | N/A |

| Regulation: | N/A |

| Address: | 22 Bishopsgate, London, England, EC2N 4BQ |

| Broker status: | Active |

| Customer Service | |

| Phone: | N/A |

| Email: | contact@mix-financing.net |

| Languages: | English |

| Availability: | 24/7 |

| Trading | |

| The Trading platforms: | Web |

| Trading platform Time zone: | N/A |

| Demo account: | No |

| Mobile trading: | No |

| Web-based trading: | Yes |

| Bonuses: | Yes |

| Other trading instruments: | Yes |

| Account | |

| Minimum deposit: | $250 |

| Maximal leverage: | 1:50 |

| Spread: | Floating From 1 Pip |

| Scalping allowed: | Yes |

MIXFINANCING REVIEW CONTENT

- General Information & First Impressions

- Fund and Account Security

- Account info at mixfinancing.com

- Mixfinancing’s Trading Platform

- Conclusion

- FAQ

Mixfinancing Review – Is this broker good or not?

General Information & First Impressions

Mixfinancing is a new brokerage that operates worldwide, although its primary audience is in Europe. It prioritizes its german clients, which should be apparent since its website is in German by default. However, it has fully-functional translations to multiple languages and is able to service traders anywhere. Our Mixfinancing review will focus on its power as a broker and what benefits it brings to the table.

One thing we need to get out of the way before progressing is that we’re talking about a CFD broker. As many traders know, CFDs are the simplest way to organize a service so that the asset selection is diverse and prices are low. That’s why many brokers opt to operate via CFDs.

However, it’s also true that CFDs aren’t for every single person. If you’re a mass-scale investor who intends to become a majority shareholder, you can’t do that. Still, that’s an extremely small group of people, and they likely aren’t using online brokerages anyway. As such, CFDs bring the largest degree of benefits to the widest groups of traders.

With that out of the way, we can shift our focus back to mixfinancing.com. Namely, we should discuss the initial impression and overall user experience on the website. When we first entered it, we were quite satisfied with how it was sectioned and how it presented information about the broker. It made it easy to explore and guided us through the important conditions without feeling overbearing.

And that wouldn’t be possible if the website didn’t run well. All the web pages function well, and it loads quickly, leading to a seamless user experience. Altogether, the broker left quite a strong impression for our Mixfinancing review, positioning itself as a smart, capable broker.

Fund and Account Security

Safety is the primary thing you should concern yourself with when choosing a new brokerage. Every broker can promise everything, but if they’re a scam, the entire service is fake, so the conditions are irrelevant.

Such brokers are especially dangerous for newer or reckless traders. It’s easy to get roped into a scam, think you’re doing well, and then losing everything. It’s not only that you lose money; it’s a defeating feeling that can dissuade someone from trading at all.

Another problem stems from the fact that recognizing scams is a different skill set from trading. Some of the investigative skills carry over, but not to a significant degree. And since trading is already time-consuming business, few traders want to take the time to develop an entirely different but related skill.

Lastly, even when you do devote yourself to learning to discover scams, you need to look at a ton of brokers and external materials. It’s not an exact science, and it’s not always a straightforward process.

That’s where this part of our Mixfinancing review comes in. As it’s our job to inspect brokers, we know what to look out for when dishonest brokers are concerned. Here, we’ll present our findings regarding Mixfinancing.

Luckily, we’re confident that the broker has honest intentions. It’s user-friendly in many regards, showing a persistent effort to educate and inform customers. Needless to say, that’s not something scammers would do.

Furthermore, the broker operates from the UK. That places it within one of the world’s major financial hubs with a significant degree of regulation. And as the company needs to comply with local laws to operate, it’s a solid guarantee of safety.

Account Info at mixfinancing.com

As we said earlier in our mixfinancing.com review, the broker is fairly open and diverse service-wise. A significant part of that comes from the way the broker chose to section and divide its accounts.

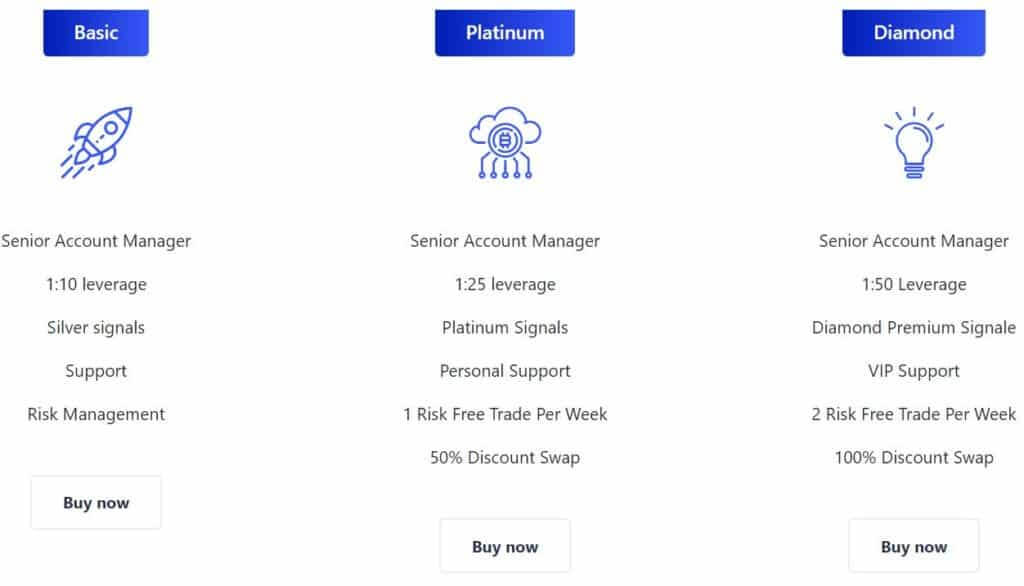

There are three key types, each with a different degree of benefit for users. The thing they all share is that they’re a potent trading tool by themselves. So even if you end up choosing the baseline account, you won’t feel like you’re missing out.

And that especially holds true because the broker included some luxury conditions even in the default account. For example, you can get trading signals right from the start, along with a senior account manager. That allows you to clear up any issues with your account and the service before they become significant. And if you require a bit of guidance, you can always take a look at what the signals suggest.

It’s worth noting a common issue with brokerages that offer trading signal services. Namely, often you don’t know the quality of the signals before you join. That means they can be entirely worthless if you don’t like or disagree with their contents. But on mixfinancing.com, you can preview some of the signals right on the home page. Again, that displays the broker’s intention to show traders exactly what they’re getting.

And to reiterate, that’s all with the cheapest account, which requires only a $250 deposit. Once you move further along, you get swap discounts, along with personal support and risk-free traders. Of course, that skews the odds in your favor, meaningfully improving your success rate while trading. Here are some more details about the conditions on mixfinancing.com:

Basic

- Senior Account Manager

- 1:10 leverage

- Silver signals

- Support

- Risk Management

Platinum

- Senior Account Manager

- 1:25 leverage

- Platinum Signals

- Personal Support

- 1 Risk Free Trade Per Week

- 50% Discount Swap

Diamond

- Senior Account Manager

- 1:50 Leverage

- Diamond Premium Signale

- VIP Support

- 2 Risk Free Trade Per Week

- 100% Discount Swap

Mixfinancing’s Trading Platform

Mixfinanding’s platform synergizes with the rest of its features to shape a well-rounded customer experience. Its focus is on easily accommodating traders of all levels, so they don’t need to take a lot of time adapting. So the trading interface is intuitive and even includes a degree of customization.

That can be an especially significant advantage for scalpers and others who use high-intensity trading tactics. Such traders largely rely on their reflexes and muscle memory to make split-second trades at precise values. Even a slight delay can throw off a trade, so it’s great that they can use the platform in a way that suits them.

Even beyond that, the platform is an invaluable tool, as it didn’t sacrifice power just to remain intuitive. Once you start exploring the platform a bit more, it becomes apparent that it packs a punch. There are numerous tools that assist you with both technical and fundamental analysis, letting you find undervalued assets.

Once you start using the platform, you’ll find a ton of assets from various CFD classes. Mixfinancing’s service includes indices, crypto, and forex, among other trading classes.

And another significant advantage that the broker’s users get is the welcome bonus, equaling 30% of their first deposit. Especially if you combine that with the risk-free trades, it makes it astoundingly easy to earn a lot of money on mixfinancing.com.

Mixfinancing Review Conclusion

Mixfinancing is a straightforward broker that gives traders the conditions they want. It doesn’t try to pull any tricks and instead relies on the power and versatility of the service. The end result is fantastic, as it isn’t gimmicky like other brokerages.

It has a fantastic foundation with an excellent platform and accounts. However, that wouldn’t be enough to stand out against the grain. But as we said in our Mixfinancing review, it also builds on that with numerous beneficial conditions. The bonus, personal support, and risk-free trades make the broker outperform competitors by a significant margin.

Mixfinancing has done more than enough to earn our recommendation. If you’re searching for a new trading hub, you’ll hardly find a service provider that offers the same level of comfort and power together.

FAQ

- Where is Mixfinancing based?

Mixfinancing operates from London, UK.

- Where is Mixfinancing regulated?

Mixfinancing operates within the legal requirements of the United Kingdom.

- Can Mixfinancing be trusted?

Yes, Mixfinancing has numerous factors that earn it a high trust rating. Find out more in the fund and account security section of our review.

- What kind of broker is Mixfinancing?

Mixfinancing is a CFD brokerage.

- Where is Mixfinancing available?

Mixfinancing is a global brokerage, accepting traders from most countries across the world.

- Can I trade crypto on Mixfinancing?

Yes, the broker offers cryptocurrency trading.

- What is Mixfinancing trading station?

Mixfinancing offers users a custom web platform.

- What is the minimum deposit on Mixfinancing?

The minimum amount you need for a live account is $250.

- How to trade on Mixfinancing?

Once you deposit at least the minimum amount, you’ll be able to trade via the platform.

- What is Mixfinancing’s leverage?

The max leverage on Mixfinancing is 1:50

The post Mixfinancing Review appeared first on FinanceBrokerage.

0 Response to "Mixfinancing Review"

Post a Comment