Types of Doji Candles and What Do They Represent

Types of Doji Candles and What Do They Represent

If you want to improve your technical analysis knowledge to better develop trading strategies, you need to grasp candlestick chart patterns and all types of Doji candles. Doji is the pattern of Japanese candlesticks that reflects indecision in the stock market. There are four major types of Doji candles. We will help you to recognize them and learn how to interpret them in financial markets trading.

Types of Doji Candles – Key Takeaways

- Dojis are used to determine the securities prices, their trend, and volatility

- Doji is a Japanese word meaning the same thing

- Japanese Doji candlestick patterns give an instant snapshot of market sentiment, trend continuation or breakouts

- It’s a neutral tech analysis indicator, very rare and unreliable if not combined with other indicators

- They are represented either as a cross or an inverted T or just a T shape, usually these chart patterns indicate indecision in the market.

What is a Doji?

Japanese candlesticks are a type of representation of market prices. Typically, a candle represents a trading session of a financial asset. It can be a commodity, a stock, a currency pair, or a crypto.

By extension, a candlestick, another name for the candle, also represents a bar corresponding to a unit of time. A candle can therefore represent a day, an hour, or a minute.

A pattern is a configuration that is frequently found and makes sense to the trader. A Japanese candlestick pattern can consist of one or more candles.

A Doji is a Japanese candlestick pattern that shows some indecision. The Japanese translation means “error, clumsiness, blunder.”

Market prices are formed by supply and demand. A transaction is completed when a buyer agrees on a price with a seller. All of this happens automatically in organized financial markets.

Buyers and sellers place orders. These orders are placed at a certain price (not all of them, but let’s not complicate things). Automated clearing houses compare supply and demand: quantities but also prices.

And when a trade is placed, a tick is issued, and the asset is quoted.

In the case of the Doji, where the close is close to the open, it means that buyers and sellers have struggled, but prices have not changed in the end. Hence the notion of indecision.

What does Doji indicate?

As we mentioned above, Doji means the same thing in Japanese, which refers to the rarity of occurrence of open and closed prices on the market.

Depending on where open and close points hit, we have four types of Dojis: star Doji, long-legged Doji, dragonfly Doji, and gravestone Doji. According to technical analysts, price is the most relevant information about the market.

However, the currency price doesn’t have to do anything with its real, intrinsic value. Analytics role is to establish the trades of the highest probability. Every candlestick has four sets of information that determine its shape.

According to that, we are able to predict the price movement. The essential components of each candlestick are open, low, high, and close prices. Doji is formed when close and open prices are pretty much the same on the market.

Generally, it represents the indecision in trading action for both sellers and buyers. Some read this as a sign of a reversal approach.

In order to confirm price breakouts and reversal trends, the traders must also collide, referring to other indicators such as RSI, MACD,

Doji Vs. Spinning top

Dojis and spinning tops are similar in many ways. Both the spinning top and the Doji candle indicate the indecisiveness of the markets. But tech analysts see some differences and read them differently. Bodies of spinning tops are larger. It indicated a slight weakness in the market trend but not necessarily a breakout in prices. If you spot these two indicators, also refer to the Bollinger band for the higher accuracy of price prediction.

Types of Doji Candlesticks

There are five types of Doji patterns:

- star Doji

- long legged Doji

- the dragonfly

- the gravestone

The Doji star

When it is a star, this pattern is composed of two line segments of approximately the same length.

Doji star’s main features are:

- Same opening and closing prices.

- High wick and short, low wicks of the same length (approximately).

- Overall it has a cross shape.

- It indicates indecision: the market hesitates between two directions.

How to interpret Doji star

When this Japanese candlestick pattern is at the top of a bullish rally or a bearish swing, it may precede a change in trend. It can be a local change (correction, consolidation) or more global.

The interpretation of this pattern is not systematic. The more it appears at the end of a swing, the greater the likelihood that it indicates change.

The long-legged Doji – long-legged Doji

This candle pattern is very similar to the previous one. Except it has long legs or wicks.

The horizontal line indicating that the open and the close are at the same level is not necessarily in the center if it is in the middle of the vertical bar.

How to interpret the long-legged Doji

As with the star Doji, we have indecision on the market. But when long-legged Doji occurs, there is greater volatility. Buyers and sellers got a little more excited back and forth during the session. Or the unit of time.

The change in price direction that can follow this pattern when it appears in a well-started swing is, therefore, potentially more violent because the volatility is greater.

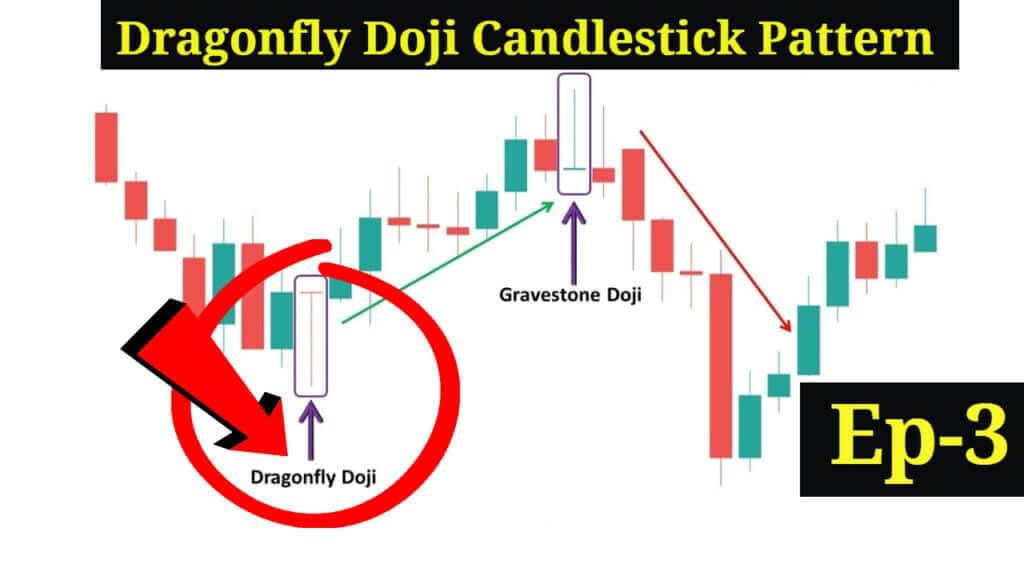

Dragonfly Doji Candlestick Pattern

Dragonfly is a Doji candlestick we recognize thanks to the wings of the dragon and its long tail extending its body. To recognize dragonfly Dojis, pay attention to the following:

- a long low wick

- No high wick.

- The open and closed are very close and located very close to the highest.

- This pattern has a T shape.

- It is more significant at the bottom of a bearish swing.

How to interpret Dragonfly Doji

In a dragonfly-like candle, it’s about selling pushed prices down for a long time in the session. And then, finally, they became scarce (the sellers). Buyers took over and drove prices back up to the open price level.

When the trading volume on the candlestick is high, it means that a maximum number of sellers have sold. There will therefore be fewer in the following candles. This increases the likelihood of a change in direction.

This is a rare Japanese candlestick pattern. When dragonfly Doji occurs, then it is necessary to monitor the volumes: if the volumes are large, this tends to validate the pattern.

If it is not at the end of a bearish rally, it is invalid. But for it to be at the end of a bearish swing, it has already been validated! Basically, you need confirmation.

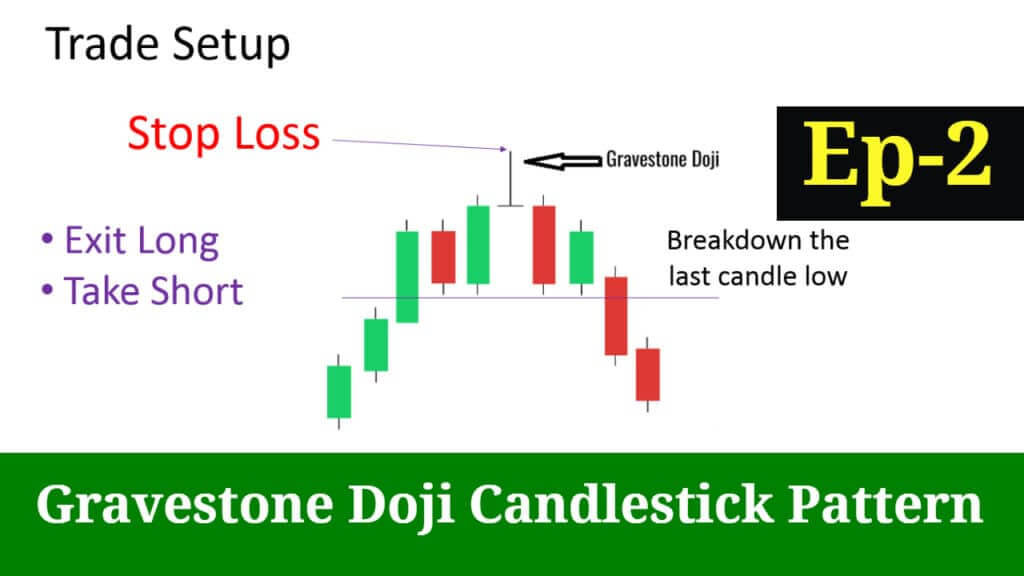

Gravestone Doji Candlestick Pattern

Gravestone Doji is a bit different. The difference from star dojis is that open–closes are at one end of the candle.

Dojis gravestone, characteristics, and recognition

These patterns can be recognized by the following characteristics:

- A long wick.

- No low wick.

- Open and close very close and located very close to the lowest.

- Overall the pattern has an inverted T shape.

- This pattern is most significant at the top of a bullish swing.

How to interpret Gravestone Doji

With these dojis, the buyers took over from the open. Prices rose under the pressure of long positions. But, during the session, the buyers became scarce. Sellers regained the upper hand and pulled prices back to the open level.

When it appears at the top of a bullish rally, it shows that there is a potential price reversal. Correction or change in trend. It is, therefore, a candlestick pattern to watch closely in these conditions.

If the trading volume on the candle is large, it means that a maximum of buyers have intervened. This increases the likelihood of a reversal.

If possible, the candlestick pattern should be validated by strong volume. But it’s not systematic either.

Likewise, this pattern needs to be on a bullish rally high. Problem: as long as the swing is not over, we do not know if we are at the end of the rally or not!

We must therefore wait for confirmation to know where we are going!

Finally, it is a rather rare pattern. Do not base your trading on the search for these patterns!

Types of Doji Patterns – Final Thoughts

It is sure that the appearance of Doji candles in your charts can be a “heads up” signal. But no more than that. Are Doji candles reliable indicators? If you observe them isolated, they will not tell you much about market trends. These patterns don’t provide accurate price targets either.

Like the rest of the chartism, these Japanese candlestick patterns are approximate. It will be more useful for you to study good technical indicators over several time frames. It is, in fact, more interesting to see the behavior of prices and indicators in the candle. And do not limit yourself to a candlestick representation but always use other indicators to determine the market trends with higher precision.

The post Types of Doji Candles and What Do They Represent appeared first on FinanceBrokerage.

0 Response to "Types of Doji Candles and What Do They Represent"

Post a Comment