Bitcoin and Ethereum current price recovery

Bitcoin and Ethereum current price recovery

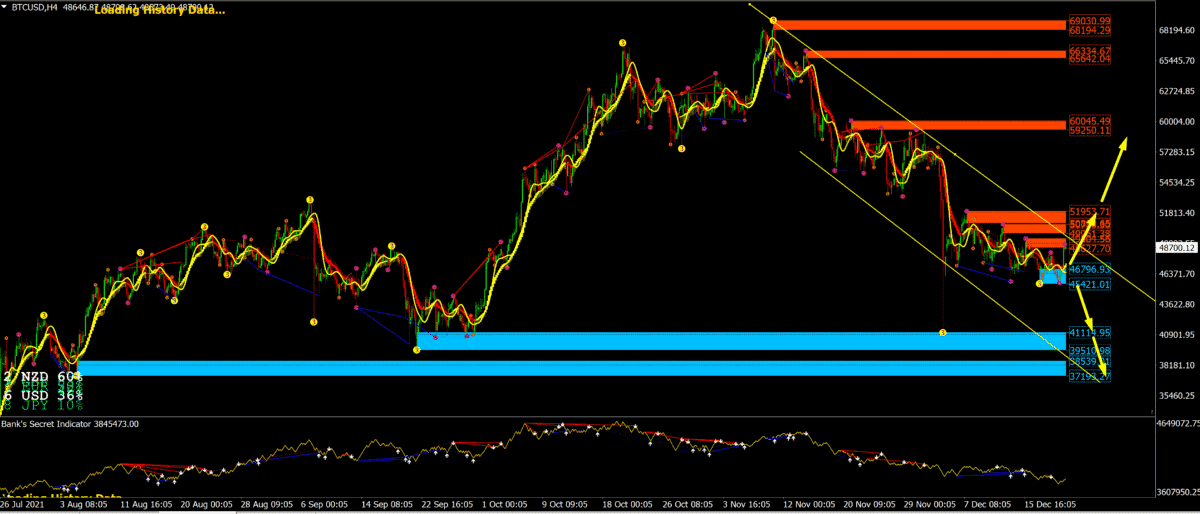

Bitcoin chart analysis

The price of Bitcoin fell to $ 45,500 yesterday and found support at that level. After that, the price recovered and climbed to $ 48,725. We are entering a zone of potential resistance and the upper trend line, and to continue and move into the bullish trend, we need a return of the price above $ 53,000.

Bullish scenario:

- We need a continuation of the current positive consolidation and a break above the upper resistance line.

- Then we expect to support in the $ 51000-52000 zone, and if the price stays there, we can expect further price recovery.

- Our next resistance zone is $ 59250-60000, the last time we were there was in the second part of November.

Bearish scenario:

- We need a new negative consolidation and a withdrawal of the Bitcoin price to the previous support zone of $ 45,420-46795.

- Breaking the price below can bring us down to the next support in the $ 39510-44115 zone.

- This is a test zone we visited on December 4, and if we go down to this zone again and with bearish consolidation, we can expect the Bitcoin price to continue to weaken.

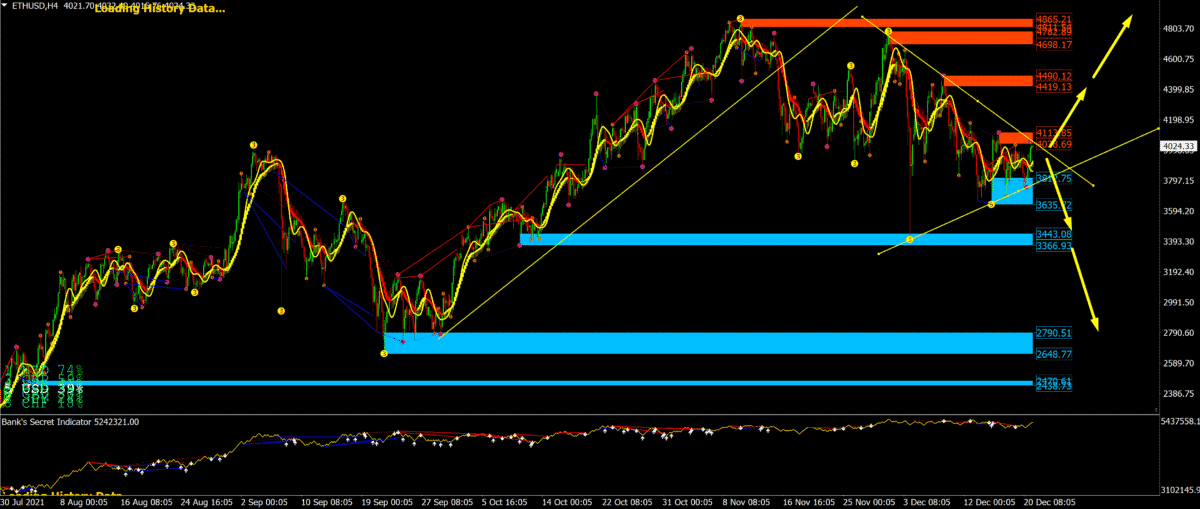

Ethereum chart analysis

Ethereum chart analysis

The ETHUSD price found support at $ 3750 yesterday, and after that, we have a price recovery to the current $ 4025. Looking at the chart, we see that we have come close to the point of intersection of two trend lines, the upper and the lower. Our resistance zone is 4038-4413 at the top and $ 3635-3812 at the bottom.

Bullish scenario:

- We need to continue this positive consolidation and a break above the upper resistance line.

- In the continuation above, the space up to 4419-4490 of the next resistance zone is open. The psychological level at $ 4,500 may represent greater resistance to the bullish trend.

- If we continue further above, we enter the potential testing zone of November’s historical highs.

Bearish scenario:

- We need new negative consolidation and price withdrawal to the previous support zone and the lower trend line.

- In further underlining, the price can be lowered to the December minimum in the zone 3366-3443 $.

- Depending on the consolidation at that level and the bearish pressure, we will go further lower to the September support zone.

Market overview

Market overview

According to a survey recently conducted by the National Bureau of Economic Research, a Wall Street Journal article states that the lucky 0.01% of Bitcoin addresses control an incredible 27% of all Bitcoins in circulation (or 19 million coins).

A study conducted by professors at MIT’s Sloan School of Management and the London School of Economics analyzed every transfer made on the BTC blockchain over the 13-year history of the coin.

They believe that BTC is a highly centralized system because of this high concentration of large amounts of BTC at so few addresses. Therefore, they believe that Bitcoin is subject to systemic risk. All the profits from the rise in BTC price are in the hands of a tiny group of people. In the cryptosphere, they are known as whales.

Although Bitcoin appeared in 2008 after the mysterious Satoshi Nakamoto created it, anyone with high IT literacy could turn their PC into a node and start mining Bitcoin. These days, BTC is highly centralized.

Bitcoin trading occurs mainly through centralized exchanges: Binance, Coinbase, Huobi, etc. Mining has become so expensive that only large companies can afford to “mint” new Bitcoins for the network by verifying blockchain transactions.

Therefore, according to the study, crypto exchanges and BTC miners saw that their wealth increased last year and this year when the price of the leading cryptocurrency rose from $ 5,000 in March 2020 to almost $ 69,000 in November.

The post Bitcoin and Ethereum current price recovery appeared first on FinanceBrokerage.

0 Response to "Bitcoin and Ethereum current price recovery"

Post a Comment