EURUSD and GBPUSD new recovery attempt

EURUSD and GBPUSD new recovery attempt

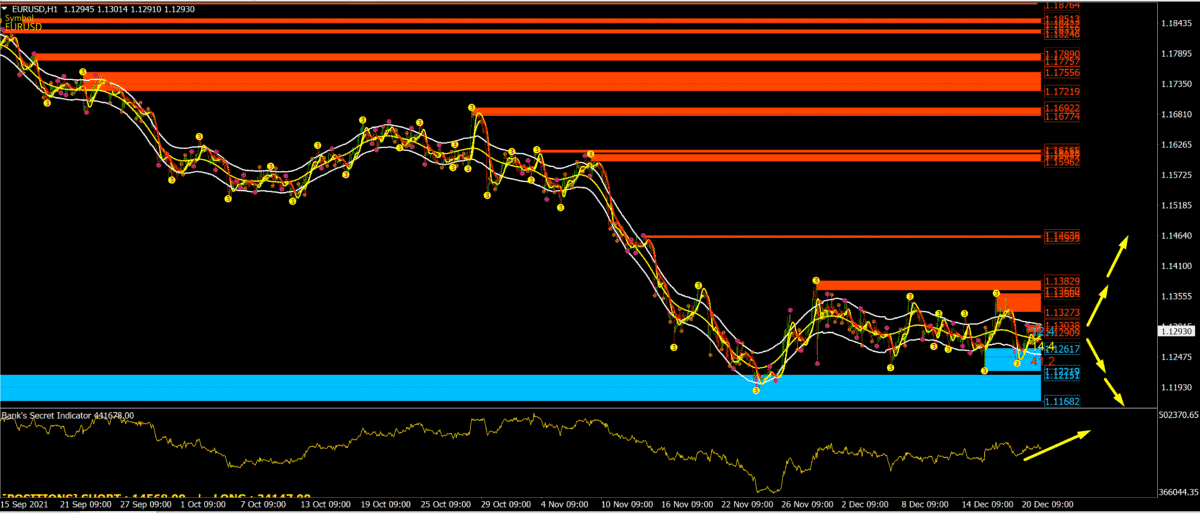

EURUSD chart analysis

Yesterday, the “risk-off” sentiment prevailed on the financial market because the “omicron” variant is unstoppably spreading through humanity. During Asian EUR/USD trade, the euro strengthened against the dollar. However, the oversold euro is holding on. On Friday and the weekend, two members of the Federal Reserve announced the possibility of raising the reference interest rate of the Fed in March (as soon as the program of buying bonds from the market is completed). That pushed this currency pair down. The Netherlands entered a strict “lockdown” on Sunday due to the large increase in the number of newly infected. The euro is currently being exchanged for 1.1296 dollars, representing the strengthening of the common European currency by 0.13% since the beginning of trading tonight.

Bullish scenario:

- We need to continue this positive consolidation and break the 1.1300 resistance zone.

- If the price continues, our next resistance zone is 1.13275-1.13604.

- In the further bullish impulse, we encounter resistance in the zone 1.13660-1.13830.

Bearish scenario:

- We need a new negative consolidation to steer the pair towards the previous support zone 1.12220-1.12620.

- If EURUSD does not stay above that support, we will go further into the zone of this year’s lows 1.11680-1.12150.

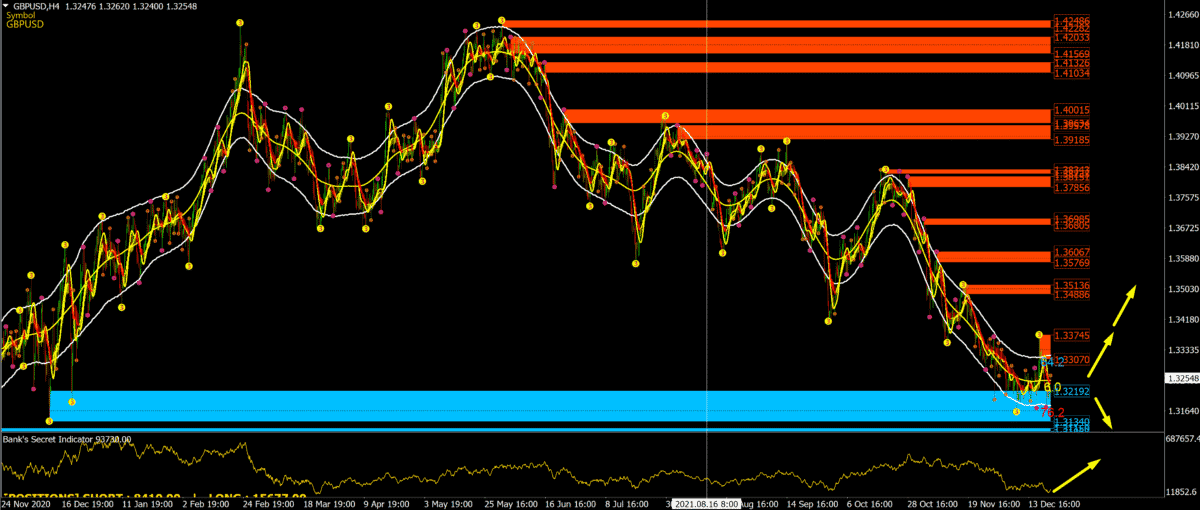

GBPUSD chart analysis

GBPUSD chart analysis

During Asian trade, the British pound strengthened slightly against the dollar. In the UK, the figure came close to 100,000 newly infected. The question is whether, after the Netherlands, a large island state will enter the “lockdown.” In addition, on Friday and for the weekend, two members of the Federal Reserve announced the possibility of raising the reference interest rate of the Fed in March. This can give strength to the dollar against European currencies. The pound is currently exchanged for $ 1.3245, which is strengthening the British currency by 0.29% since the beginning of trading tonight.

Bullish scenario:

- The pair must break away from the current support at 1.32000.

- We can expect GBPUSD to begin a more concrete recovery with positive consolidation.

- The first minor obstacle on the chart is our resistance zone 1.33070-1.33745.

- Below the next resistance is our lower low from November in 1.34885-1.35136.

Bearish scenario:

- We need to continue the negative consolidation and withdraw to a new test of this year’s low in zone 1.31340-1.32190.

- A break below would pave the way for psychological support at 1,300,000.

- Bearish pressure has been evident and dominant on the chart since May, and based on that; we can expect to visit the lower levels on the chart in the coming period.

Market overview

Market overview

British news

Retail sales growth in the UK slowed more than expected in December. Sales will probably be poor next month; the results of a monthly survey on distributive trade conducted by the Confederation of British Industry showed on Tuesday.

The retail balance fell to +8 percent from +39 percent in November in December. The forecast was for the balance to fall to 13 percent.

The UK budget deficit widened to its second-highest level since November, when records began in 1993, largely due to rising debt costs.

In the financial year to November, the budget deficit was reduced by GBP 115.8 billion compared to last year to GBP 136.0 billion. This was also the second-largest financial year of borrowing recorded until November.

German news

German consumer confidence is expected to fall sharply in January due to restrictions imposed amid the fourth wave of pandemics and rising inflation. The sentiment of future-looking consumers fell to -6.8 in January from -1.8 in December. The expected reading was -2.7.

The high frequency due to the fourth wave of the corona pandemic with further restrictions and significantly increased prices is increasingly affecting the consumer climate, according to Rolf Burkle, GfK’s consumer expert.

The prospects for the beginning of next year are negative in the background of the rapid expansion of the Omicron variant, Burkle added.

Mainly due to problems in the supply chain, the economic sentiment index fell by 13.9 points to 17.1. This was the third fall in a row.

The post EURUSD and GBPUSD new recovery attempt appeared first on FinanceBrokerage.

0 Response to "EURUSD and GBPUSD new recovery attempt"

Post a Comment