NFTX Platform (NFTX) – All You Need to Know

NFTX Platform (NFTX) – All You Need to Know

In the past two years, the NFT marketplace has flourished, attracting massive attention from crypto enthusiasts. Given that it is increasingly worthwhile to invest in NFT, it is no wonder that there is great interest, especially when it comes to platforms, such as NFTX, which you will learn more about in this text.

More and more individuals and crypto devotees are interested in the NFTX platform. Primarily, to be successful with Non-Fungible Tokens, it is crucial to choose a platform of the highest quality and with the best ratings from users. This is the only way that the creation of liquid markets for NFTs and ERC20 tokens will be successful!

More and more individuals and crypto devotees are interested in the NFTX platform. Primarily, to be successful with Non-Fungible Tokens, it is crucial to choose a platform of the highest quality and with the best ratings from users. This is the only way that the creation of liquid markets for NFTs and ERC20 tokens will be successful!

However, what is an NFTX platform anyway? Why has she been the focus of severe NFT enthusiasts lately? Let’s find out from experienced professionals, shall we?

Understand the NFTX platform

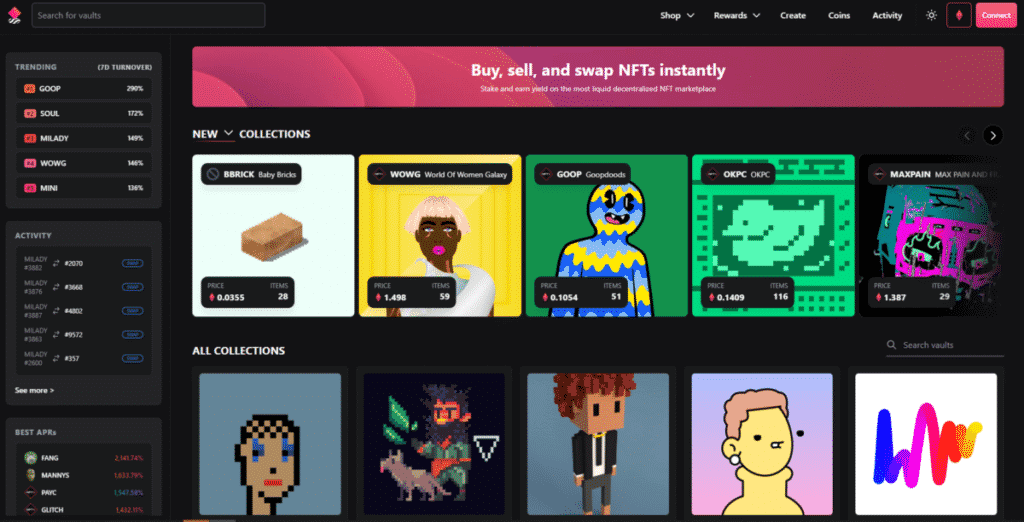

NFTX platform represents a platform and a community-owned protocol for creating NFT-backed ERC20 tokens that are known as “funds.” Like any other ERC20, these tokens, or “funds,” are composable and fungible. We can also say that the NFTX platform is responsible for creating liquid markets for liquid Non-Fungible Tokens.

In other, more simple words, the NFTX represents a protocol built on top of Ethereum. It lets users deposit their Non-Fungible Token collections into vaults. So, users of the NFTX platform deposit their NFT into an NFTX vault and then mint a fungible vToken, or ERC20 token, that’s best described as a claim on a random asset from within the vault.

It’s important to note that vTokens are also used in order to redeem a specific NFT from a vault. Right from a DEX, like Uniswap, on the NFTX platform, it’s possible to trade and create funds that are based on collectibles such as:

- Avastars

- CryptoPunks

- Axies

- CryptoKitties

When was the NFTX platform launched?

NFTX platform was launched in early January 2021. The main goal was to provide high-quality service to the evolving NFT sector through the indexing of projects. Even though these specific tokens refer to index funds, don’t forget they’re both fungible and composable.

The term “fungible” is always used to describe the interchangeable ability for other tokens. That’s the main reason for standard NFT protocols. These “funds” are traded on DEXs, decentralized exchanges such as Uniswap and Sushiswap.

Two different types of funds on the NFTX platform

You should be aware that there are two different types of funds on the NFTX platform:

- D1 funds (input): Include 1:1 backing between a single NFT contract and an ERC20 contract.

- D2 funds (top-level): Include Balancer pools that combine D1 funds.

When it comes to D1 funds, for example, if Alice owns 1 AXIE-MYSTIC-2, she’ll have the ability to redeem one random Axie along with two Mystic parts. Another example of D1 funds is supposing Alice owns 2 PUNK-ZOMBIE. Thus, we can expect her to redeem exactly two random zombies CryptoPunks practically any time she wants.

The best example of D2 funds is AVASTR being a D2 fund that combines three different D1 Avastar input funds as:

- AVASTR-BASIC

- AVASTR RANK-30

- AVASTAR-RANK-60

The point behind D1 and D2 funds

The main goal of all this is to offer disparate exposure without any need for users to hold multiple tokens. It’s important to note that the account will be designed as the fund manager once a new fund is created. That is an account that sends the transaction.

It all allows creators to change fund parameters such as NFT eligibility. Once the creator modifies the fund, they can finalize it.

What is NFTX Coin?

Those who are wondering “What is NFTX Coin,” or NFTX token, as we’ve mentioned above, it’s a fungible ERC20 token or vToken that can be used to redeem a specific NFT from a vault. In general, the NFTX Coin represents a claim on a random asset from within the vault.

NFTX price statistics

The current NFTX price is $93.49. However, the price varies from one day to the next, so it’s essential to check it every time you need to know the exact price that day. Here is the NFTX price statistics at the moment of writing:

- NFTX Price: $93.49

- Trading Volume 24h: $173,268.50 (up 34.21%)

- Volume/Market Cap: 0.004667

- Market Rank: #610

- Market Cap: $37,128,631.03 (up 5.67%)

- Fully Diluted Market Cap: $60,896,699.92 (up 5.67%)

How Many NFTX (NFTX) Coins exist?

Currently, the NFTX’s total supply is 650,000 coins, with 10% of the token distribution allocated to the founder. On the other hand, NFT contributions account for 30%.

NFTX Hashmasks Index Explained

The NFTX Hashmasks index represents a page on the Price Index on the Crypto website. It features:

- Price ticker

- Market cap

- Price history

- Live charts from the top cryptocurrencies

For example, at the moment of writing, the NFTX Hasmasks Index’s price was 1.657,18 USD. During the previous 24h, MASK was up 4,63%.

How does the NFTX platform work?

In order to learn and understand how the NFTX platform works, it’s essential to note four things:

Vault Creation

Vault Creation

Anyone can create Vaults for any NFT asset on Ethereum. When the vault is created, users are able to deposit eligible NFTs into the vault to mint a vToken, known as the fungible NFT-backed token.

Minting Tokens

Everyone is able to deposit Non-Fungible Tokens into a vault, whether it’s an existing one or the one they’ve created previously, to mint a fungible vToken, with a 1:1 claim within a vault on a random Non-Fungible Token.

Floor Prices

Users establish a floor price by minting and selling vTokens on every possible market they think their NFT to be overvalued. The floor price stands for the lowest price for a particular Non-Fungible Token.

Along with the liquidity and trading volume establishment, the Non-Fungible Token-backed vToken enters into price discovery. Thus, the Floor price is discovered. So, users can pool their minted vTokens in AMMs, which are Automated Market Makers, to create a liquid market for all other users to trade.

Eligibilities

When it comes to eligibility, it’s crucial to remember one thing. The Mask vault allows the deposition of any Hashamsk. Nonetheless, other vaults use an eligibility list that only enables the deposition of sub-categories of NFTs.

Suppose that Kitty Gen 0 vault possesses an eligibility list with only Kitties whose metadata equals Generation 0. It means that all the other Kitties cannot be deposited into this vault.

Who benefits from NFTX?

Many interested individuals are interested in who benefits the most from this NFTX platform. To shorten the story as much as possible, we will divide those people who have the most benefits from this platform into the following three groups:

Content Creators

Thanks to the NFTX protocol launching, content creators can finally earn protocol fees inconstancy and, at the same time, improve the fairness and the reach of distribution. So, here we have:

- Earning protocol fees

- Distributing NFTs via an AMM as vTokens

- Creating instantly liquid markets that will be used for new content

Investors

Since Non-Fungible Tokens are usually highly liquid, it’s not an easy task to put a price on them. NFTX platform makes investing and speculating in the NFT market way much more straightforward process, such as:

- Accessing the majority of liquid markets for NFTs

- Tracking the liquid price of specific categories of Non-Fungible Tokens

Collectors

In their basic form, Non-Fungible Tokens don’t earn yield. Nonetheless, once they’re utilized for minting vTokens, NFTs are able to tap into the world of decentralized finance. Let’s say that collectors can use the NFTX platform to unlock more value from their Non-Fungible Tokens such as:

- Earning protocol fees and earning trading fees as a liquidity provider

What makes the NFTX Platform so unique?

As you’ve realized so far, the core business case for the project is to bridge the gap between DeFi, decentralized finance and Non-Fungible Tokens.

This platform is unique and popular because NFTX aims to replicate indexes such as CoinMarketCap and DefiPulse, but with an NFT twist. The platform expands its use case also to include representation of the following:

- In-game items

- Lottery tickets

- Digital collectibles in the NFTs form

The NFTX platform is looking for growth through NFT-ERC-20 loans offerings and on-chain liquidity. Non-Fungible Token holders are not required to relinquish ownership when it comes to loans. On the other hand, on-chain liquidity helps wash trading and curb liquidity.

Keep in mind that all these services aren’t free of charge. NFTX, for now, charges a fee of 2.5% on the mint and burn operations.

Who are the founders of NFTX?

Regarding who founded the NFTX platform, it’s essential to understand that it is a community-controlled platform. It allows all its users to place index funds on the Ethereum blockchain. Thus, we come to the conclusion that the governance of this project strictly depends on the decentralized anonymous organization known as “DAO.”

During the decision-making, in order to prevent monopoly, it’s necessary for proposals targeting new changes to garner support from 80% of all voting tokens. Don’t forget that the voting period is only 24 hours long.

Conclusion

From all the above in this text, we can conclude that this is a handy platform that enables the creation of liquid markets for liquid NFTs or Non-Fungible Tokens. The main goal behind NFTX is to offer one top-level fund that gets most of the liquidity for each significant NFT contract.

The post NFTX Platform (NFTX) – All You Need to Know appeared first on FinanceBrokerage.

0 Response to "NFTX Platform (NFTX) – All You Need to Know"

Post a Comment