What is spread trading and is it profitable?

What is spread trading and is it profitable?

Investing in the financial market can be tricky, harsh and sometimes daunting. Indeed, the vocabulary used daily by brokers and other specialists in the field is not particularly inherent to newbie traders.

If you want to invest in the financial markets and start online trading, you should therefore find out precisely about the specifics of such jargon and learn spread trading ins and outs. In this piece of writing, we help you understand the principles of spread trading. Besides, we explain the important factors to consider if you want to venture into spread trading and incur decent profits.

What is the bid-ask spread?

The bid-ask spread is another way of explaining the spread applied to assets’ prices.

The bid-offer spread or bid-ask spread represents the supply and demand for a specific asset.

If the bid and ask prices are close together, it is a tight market, meaning that there is an agreement between buyers and sellers on the asset price. In case the spread is wider, it means that there is a considerable difference in opinion.

A range of factors, including liquidity, volume, and market volatility can affect the bid ask spread.

Forex trading spread explained – Spread in Forex trading.

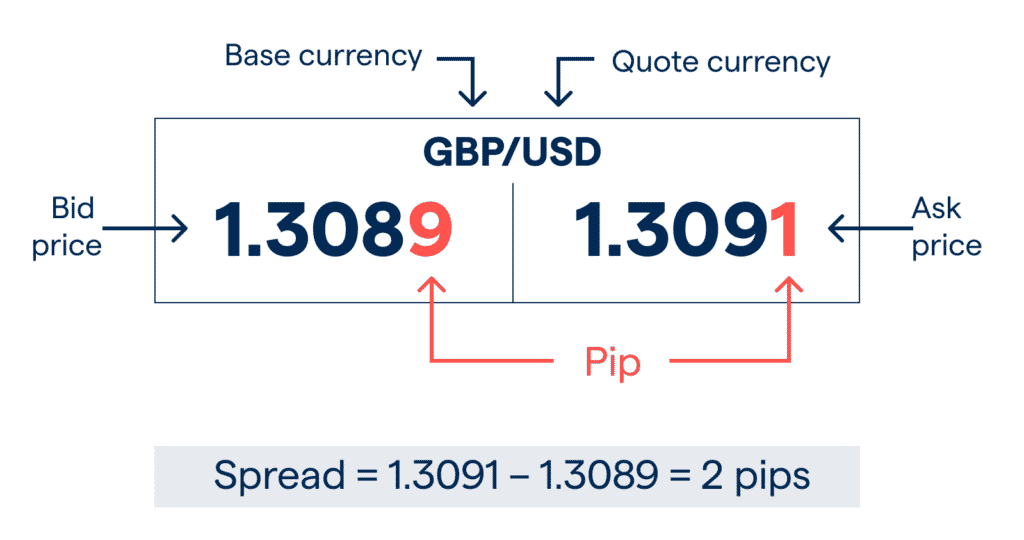

In foreign currency trading, the spread is the difference between the bid (sell) price and a currency pair’s ask (buy) price. The bid-ask or bid offer spread is basically the difference between the highest price that a buyer is going to pay for the asset and the lowest price that a seller wants to accept. Traders looking to sell will receive the bid price, while one looking to buy will pay the ask price.

There are always two prices in a currency pair, the bid price and the ask price. The first one is the price at which you can sell the base currency, while the ask price is the price you use to purchase the base currency.

The base currency is displayed to the left of the currency pair, and the variable, quote currency or counter currency, to the right. Matching tells you how much of the variable currency equals one unit of the base currency.

The quoted buy price will always be higher than the quoted sell price, with the underlying market price in between.

Most Forex currency pairs are traded commission-free, but the spread is a cost that applies to any trade you place an order for. Rather than charging commissions, all leveraged trading service providers will include a spread into the cost of placing a trade. The size of spreads can be influenced by different factors, such as the currency pair you are trading and its degree of volatility, the size of your trade and the provider you are using.

Bear in mind that spread trading is very popular in Europe, particularly in the U.K., but prohibited in the United States. The Commodity Futures Trading Commission forbids the sale of foreign security futures contracts to individuals based in the U.S.

How is the spread measured? Spread calculator

The spread is measured in pips. It is a small unit of price movement of a currency pair and the last decimal of the price (equal to 0.0001). It’s applicable for most currency pairs, except the Japanese Yen, where the pip is two decimal places (0.01).

When the spread widens, it means there is a bigger difference between the two prices, so liquidity is usually low and volatility high. In contrast, a lower spread shows low volatility and high liquidity. Therefore, a smaller spread cost will be incurred when trading currency pairs with a tighter spread.

When you trade, the spread can be variable or fixed. Indices, for example, have fixed spreads. The spread for currency pairs is variable, so when the bid and ask prices of the currency pair change, the spread also changes.

Nevertheless, in the world of trading, this term is used to designate the difference between two rates. Most of the time, it corresponds to the difference between a financial instrument’s purchase price (ask) and the sale price (bid). It is in particular thanks to this sum of in-betweens that your broker, namey trading platform you use, is paid for the services offered.

In trading jargon, this spread is expressed in quotation or “pips” units. Contrary to what these somewhat weird terms might suggest, there is nothing very complicated. Indeed, to calculate a spread, all you have to do is make a simple subtraction between the bid price and the ask price. Also, for an asset bought at €40.35 and resold at €40.30, the spread is 0.05.

A very important instrument in trading, the spread is closely monitored by the many brokers present on the market. It should be noted that the closer the spread is to zero, the more the investment is attractive and the transactions facilitated.

Can spread trading be profitable?

Spread trading can be profitable for more experienced and skilled traders who pay attention to the following aspects of trading.

- Trading Tighter Spread Securities

- Building a Structured Trading Plan

- Structuring the Entry and Exit

- Right Market and Right Instrument Selection

- Prepare, Plan, and Practice Before Entry

- Controlled Use of Leverage

Forex Spread Indicators

The spread indicator is usually displayed as a line on a chart to show the direction of the spread relative to bid and ask prices. This helps visualize the spread in the currency pair over time, with more liquid pairs having tighter spreads and more exotic pairs having wider spreads.

Factors that influence the Forex spread include market volatility, which can cause fluctuations. Major economic news, for instance, can cause a currency pair to strengthen or weaken, thus affecting the spread. If the market is volatile, currency pairs may experience spreads, or the currency pair becomes less liquid, so the spread will widen.

Keeping an eye on an economic calendar can help you prepare for the possibility of wider spreads. By staying informed about events that could make currency pairs less liquid, you can make an informed prediction about the possibility of their volatility increasing and, therefore, the spread widening. However, preparing for breaking news or unexpected economic data can be difficult.

There will also be a lower margin for currency pairs traded in large volumes, such as major pairs containing the dollar. These pairs have higher liquidity but may still be exposed to the risk of spread widening in the event of economic volatility.

During large trading sessions, such as those in London, New York and Sydney, spreads are likely to be lower. In particular, when there is overlap, for example, when the London session ends, and the New York session begins, the spread can be even tighter. The general supply and demand of currencies also affects the spread- if the demand for the Euro is high, the value will increase.

Spread and margin

If the Forex spread widens significantly, you run the risk of receiving a margin call. And, in the worst case, being liquidated. A margin call notice occurs when your account value falls below 100% of your margin level, indicating that you may no longer be covering trading requirements. All your positions are at risk of liquidation if you reach 50% below the margin level.

The importance of choosing the right broker

To make the most profitable investments, you should choose your broker carefully. Therefore, you should not make your choice lightly and you should only make it after you have acquired enough info.

Today, there are many online brokers that all offer different spreads. Therefore, the main thing is to study the market to select the best spread broker. In other words, the broker who offers the margin closest to zero.

You should also pay attention to the additional fees that different brokers charge to make the best choice. These may be account opening fees, account management fees, deposit or withdrawal fees or inactivity fees. All these criteria are of paramount importance and you must firmly take them into account to be able to anticipate all your costs.

While paying close attention to numbers is essential, the quality of customer service is also important. Make sure to choose a reputable and serious broker who is available for his clients. To start, prioritize a broker who speaks your language in an intelligible way. And who takes the time to explain to you concretely and effectively how trading works.

Be careful. The rules are strict in the world of the financial markets. If your broker has the duty to inform you about the state of the market and his own services, he is strictly forbidden to manage your money for you and to give you investment advice!

Although illegal in the United States, spread trading is very popular in European countries. It enables opportunities for high profits. But most traders are at risk to lose their money when they start due to inexperience and lack of knowledge. Building sufficient knowledge, selecting the right instruments, the right broker, backtesting a trading system can help generate profits.

The post What is spread trading and is it profitable? appeared first on FinanceBrokerage.

0 Response to "What is spread trading and is it profitable?"

Post a Comment