Oil and Natural Gas: Down 2.34%

Oil and Natural Gas: Down 2.34%

- During the Asian trading session, the price of crude oil retreated from $105.00 to $102.00.

- During the Asian trading session, the price of natural gas jumped from $6.00 to $6.38.

- Russia will raise its gas supplies to Europe if a turbine needed for Nord Stream 1, currently undergoing repairs in Canada, is returned.

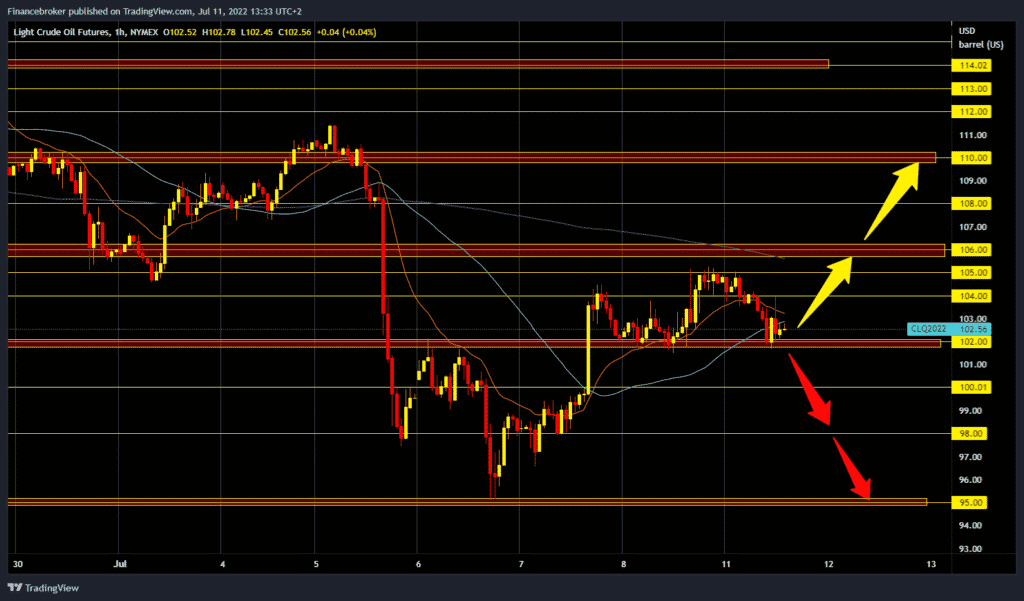

Oil chart analysis

During the Asian trading session, the price of crude oil retreated from $105.00 to $102.00. Oil prices have fallen as preparations are underway for new mass testing for Covid-19 in China, and new “lockdowns” could potentially hit demand. This week, the US president travels to the Middle East for meetings with Arab leaders. The strong strengthening of the US dollar makes the real oil price more difficult and expensive for all those for whom the dollar is not their national currency.

Crude oil is trading at $102.30 a barrel, down 2.34% from last Friday’s close. For a bearish option, we need a continuation of negative consolidation and a break below $102.00. After that, we look towards the $100.00 psychological support zone. Potential lower targets are $98.00 and $95.00, last week’s low. For a bullish option, we need a new positive consolidation and a return above the $104.00 level first. After that, we could try to climb to the $105.00 and $106.00 levels.

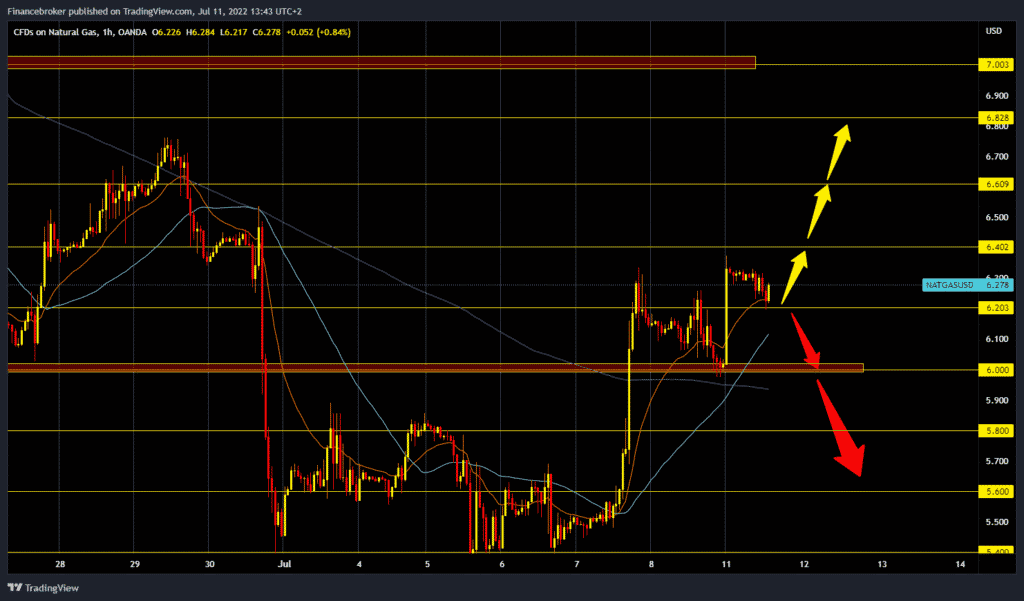

Natural gas chart analysis

During the Asian trading session, the price of natural gas jumped from $6.00 to $6.38. We then see consolidation and a minor pullback to the $6.20 support zone. The price could continue to rise due to the stoppage of gas delivery through the northern stream, which is undergoing a summer overhaul for the next winter season. Our first next resistance is the $6.40 level, and we need a break above it to continue towards the $6.60 and $6.80 levels.

We have support in the moving averages, and based on them, we expect the continuation of the bullish trend. For a bearish option, we need a negative consolidation and a break below $6.20. Next, our target is the $6.00 support zone. Additional support for that level is the MA200 moving average. The price drop below brings us down to the $5.80 level; if it does not hold, the potential lower targets are the $5.60 and $5.50 levels.

Market overview

Russia will raise its gas supplies to Europe if a turbine needed for Nord Stream 1, currently undergoing repairs in Canada, is returned.

Ukraine urged Canada on Thursday not to send back a gas turbine to Gazprom, arguing that the Russian company has enough turbines to keep gas flowing to Europe at total capacity.

According to a Reuters report citing a Ukrainian government official, if Canada returns the turbine to Gazprom, it would be in violation of its sanctions.

“The sanctions prohibit the transfer of any gas-related equipment,” a Ukrainian government source said.

“If the decision is approved, we will undoubtedly appeal to our European colleagues that their approach must be reconsidered.” Because if countries do not respect the decisions, they agreed on sanctions, how can we talk about solidarity?” he added to Reuters.

Meanwhile, German Economy Minister Robert Habeck called on Canada to release the turbine. “I will be the first to fight for a further strong package of EU sanctions, but strong sanctions mean they have to hurt Russia and Putin more than our economy,” Habeck said.

The post Oil and Natural Gas: Down 2.34% appeared first on FinanceBrokerage.

0 Response to "Oil and Natural Gas: Down 2.34% "

Post a Comment