08 August chart overview for Oil and Natural Gas

08 August chart overview for Oil and Natural Gas

Oil chart overview

In the first part of the day, the oil price was unstable. The price managed to move from the six-month low at the $88.00 level during the Asian trading session. Later, we saw the price rise to $90.00, but we did not stay there for long, and another pullback to the support zone followed. Oil is moving in the $87-00-$90.50 range for the third day, thus intensifying the bearish pressure on the price to make a new lower step. We need a continuation of the negative consolidation and a break below the $88.00 level for a bearish option. If that happens, potential lower targets are $87.50, $87.00, $86.50 and $86.00 levels. For a bullish option, we need another positive consolidation and a return to the $90.00 resistance zone. A break above would be a positive step towards further oil price recovery. Potential higher targets are $91.00 and $92.00 levels.

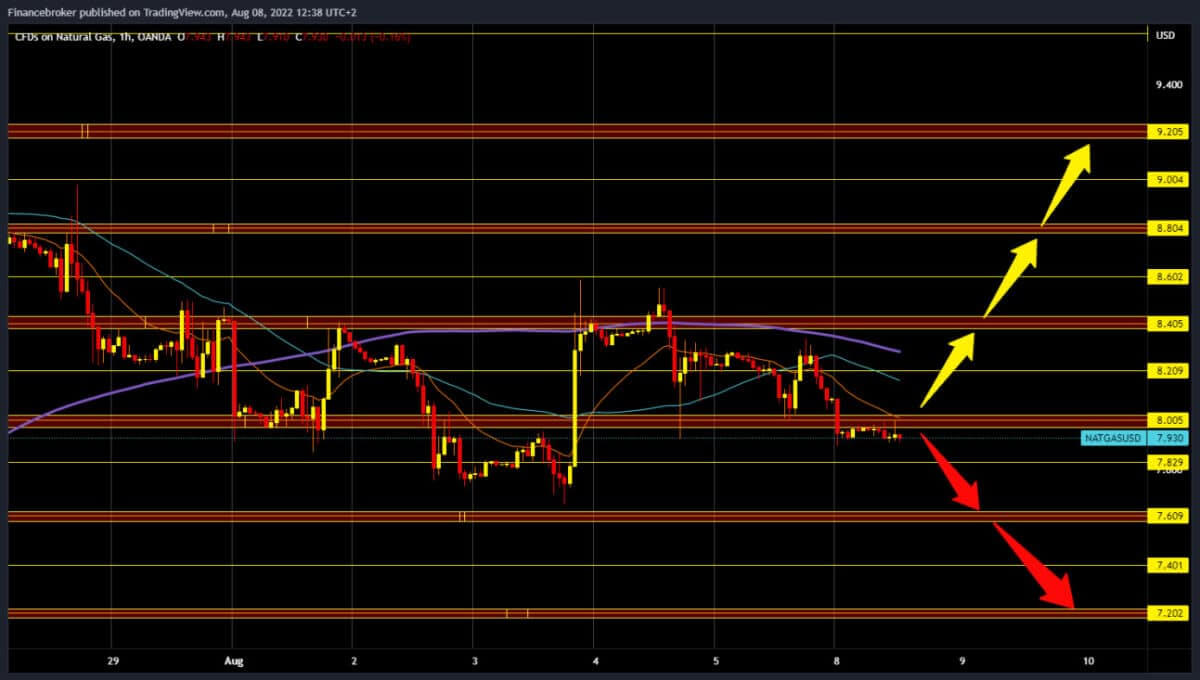

Natural gas chart analysis

Natural gas chart analysis

During the Asian trading session, the price of natural gas was in the range of $7.90-$8.00. Bearish pressure is present on the chart for the third day in a row after the price jumped to the $8.60 level on Wednesday last week. Since then, the price has been retreating. For the bearish option, we need a continuation of the negative consolidation towards the $7.80 level. Then we could expect a further drop in gas price to support at the $7.60 level. Potential lower targets are $7.40, $7.20 and $7.00 levels. For a bullish option, the price should rise above the $8.00 level first. After that, we would have better chances to continue the recovery of gas prices. Potential higher targets are $8.20 and $8.40 levels. And additional resistances in that zone are MA50 and MA200 moving averages. If the price of gas rises above $8.40, a bigger recovery could happen.

Market overview

On Friday, Turkish President Tayyip Erdogan and Russian President Vladimir Putin agreed to improve cooperation. Turks agreed to pay for Russian gas in Russian rubles. Turkey paying for Russian natural gas in rubles would protect the economy from inflation and could improve matters with Moscow, which objects to the Turkish military’s activities in Syria. Russia would not consider Turkey an enemy nation because enemy countries pay for Russian gas imports in Russian rubles.

The post 08 August chart overview for Oil and Natural Gas appeared first on FinanceBrokerage.

0 Response to "08 August chart overview for Oil and Natural Gas"

Post a Comment