11 August chart overview for EURUSD and GBPUSD

11 August chart overview for EURUSD and GBPUSD

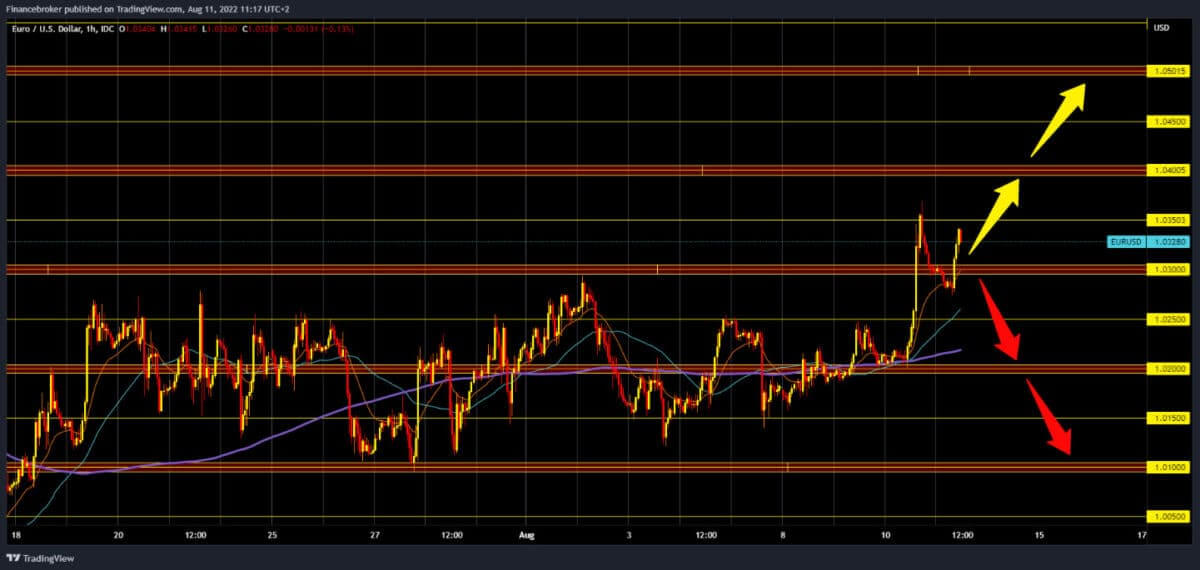

EURUSD chart analysis

Yesterday was a very positive day for the euro. At the beginning of the trading day, the pair was at 1.02000, and everything was calm in the first half of the day. In the second half of the day, everyone was waiting for the US inflation report. The report showed that there was a slowdown in inflation, which immediately reflected on this pair, and soon, we saw a jump above the 1.03000 level. Yesterday’s high was at the 1.03660 level, which was our one-month high. The last time we were there was on July 5. The euro retreated during today’s Asian session and fell to 1.02750 levels. It finds today’s support there and starts a new bullish impulse. We again cross above the 1.03000 level and target the 1.035000 level. A potential higher target is the 1.04000 level. by climbing to that level, we would form a new higher high, which is a sign of the continuation of the bullish trend. We need a negative consolidation and a new pullback below the 1.03000 level for a bearish option. After that, an additional weakening of the euro could occur. Potential lower targets are 1.02500 and 1.02000 levels.

GBPUSD chart analysis

The pound also took advantage of yesterday’s weak dollar to climb above the 1.22000 level. Yesterday’s maximum was at the 1.22750 level, then a pullback followed, and the pair stopped at 1.21800 during the Asian trading session. Since then, the pound has begun a new bullish impulse and once again crossed above the 1.22000 level. Today’s maximum is at the 1.22500 level; for now, we encounter some resistance. We need a continuation of the positive consolidation for the bullish option, and our first next target is the 1.23000 resistance zone. If we manage to move above, potential targets are 1.23500 and 1.24000 levels. We need a negative consolidation and a new pullback below the 1.22000 support zone for a bearish option. Potential lower targets are 1.21500 and 1.21000 levels.

Market overview

Market overview

Consumer price inflation in China jumped to the highest level in two years in July at 2.7% in July from 2.5% in June, the National Bureau of Statistics reported. The rate was still below the forecast of 2.9%. Inflation is approaching the government’s target of 3%. It is very low by global standards, according to Capital Economics economists.

Today there is no important news from the European market.

The post 11 August chart overview for EURUSD and GBPUSD appeared first on FinanceBrokerage.

0 Response to "11 August chart overview for EURUSD and GBPUSD"

Post a Comment