Oil and Natural Gas: Price drop

Oil and Natural Gas: Price drop

- On Friday, the price of oil failed to break through the $95.00 level, and a new price pullback followed.

- During the Asian trading session, the price of natural gas retreated from the $8.80 level.

- Yesterday, the CEO of Saudi Aramco said that if the government asks, they will be able to increase production to a capacity of 12 million barrels per day.

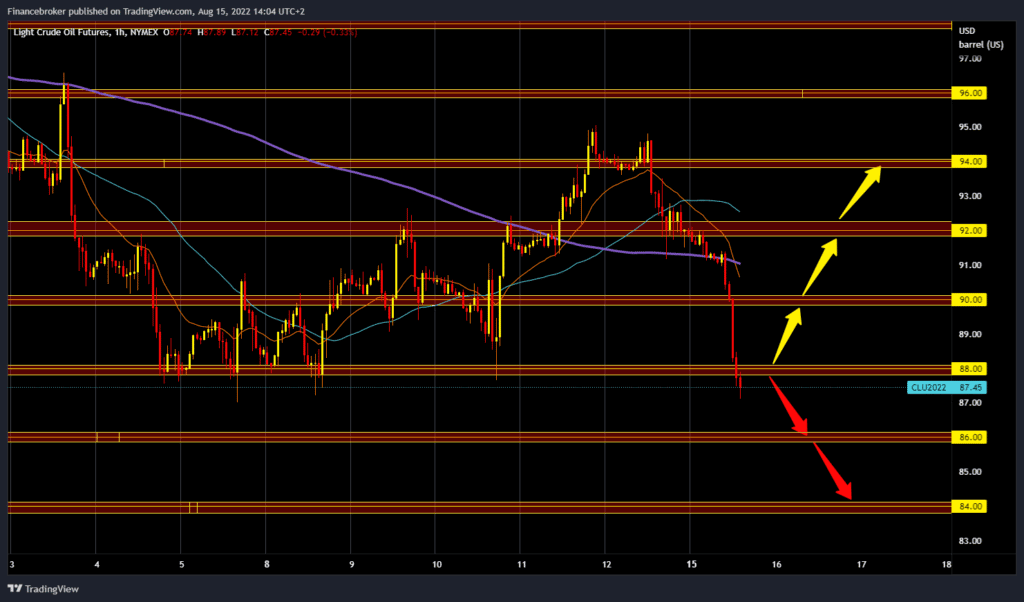

Oil chart analysis

On Friday, the price of oil failed to break through the $95.00 level, and a new price pullback followed. By the end of the trading day on Friday, the oil price had fallen to the $92.00 level. During the Asian trading session, the price continued the bearish trend, dropped below $90.00, and stopped at $87.40. The oil price is now trying to find support in the zone around the $88.00 level. From August 4 to 8, we were already in that zone from which the price of oil managed to recover in the short term to the $95.00 level. We need to consolidate above the $88.00 level for a bullish option. After that, a bullish impulse is needed to start a new price recovery. Potential higher targets are $90.00 and $92.00 levels. We need a continuation of today’s negative consolidation for a bearish option. Potential lower targets are $97.00 and $86.00 levels.

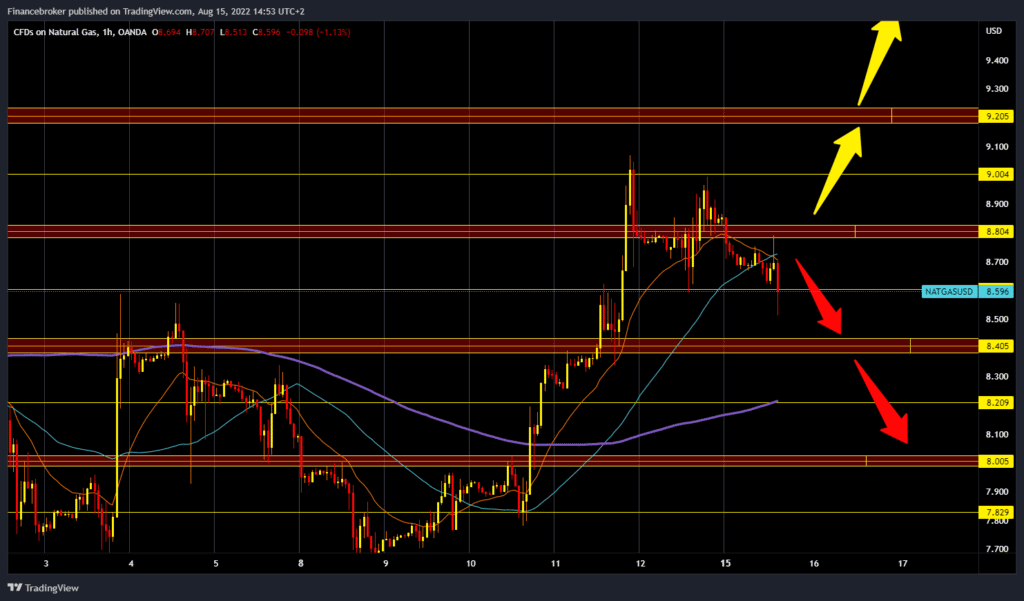

Natural gas chart analysis

During the Asian trading session, the price of natural gas retreated from the $8.80 level. The price has already fallen below $8.60 and continues towards $8.40, the next support zone. At the end of last week, we failed to break above the $9.00 level and have been in a pullback ever since. The Ma20 and MA50 moving averages are now slowly moving to the bearish side, which could increase the bearish pressure. We need a price drop below the $8.40 level to continue the bearish trend. After that, we could continue towards the $8.20 level, where the MA200 moving average is waiting for us, which could possibly stop this decline. Potential lower targets are $8.20 and $8.00 levels. For a bullish option, we need a new positive consolidation and a return of the gas price above the $8.80 level. If we managed to stay above, we would have a new chance to test the $9.00 level. A potential higher target is the $9.20 level.

Market Overview

A slowdown in China’s economy is reducing demand for crude oil, and disappointing retail sales and industrial production data from China fueled concerns about a potential global recession. Yesterday, the CEO of Saudi Aramco said that if the government asks, they will be able to increase production to a capacity of 12 million barrels per day.

The post Oil and Natural Gas: Price drop appeared first on FinanceBrokerage.

0 Response to "Oil and Natural Gas: Price drop"

Post a Comment