EURUSD and GBPUSD: The Euro Continued to Weaken Today

EURUSD and GBPUSD: The Euro Continued to Weaken Today

- During the Asian trading session, the euro continued to weaken.

- During the Asian trading session, the pound continued to retreat from the October peak.

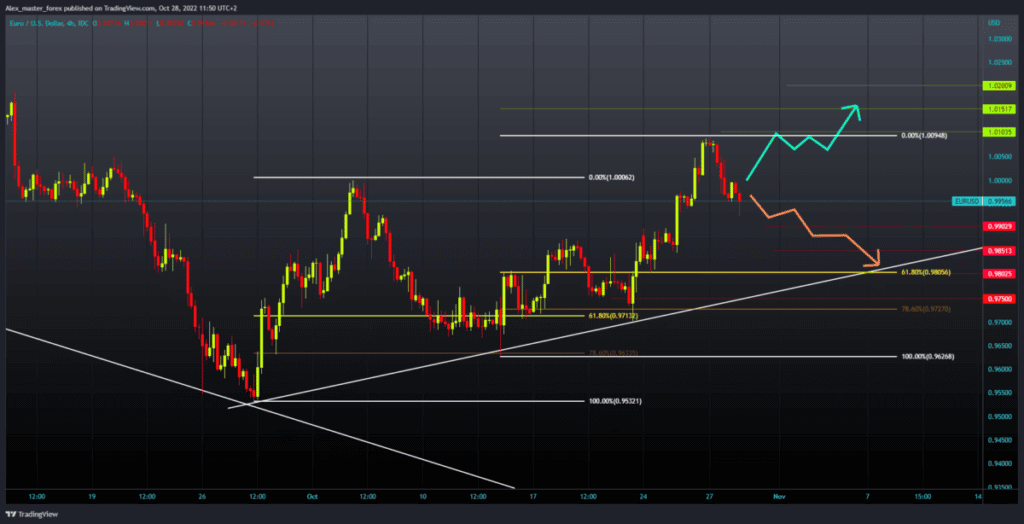

EURUSD chart analysis

During the Asian trading session, the euro continued to weaken. Today’s low is at the 0.99230 level, and we could expect a further pullback toward the 0.99000 support level. To continue the bearish option, we need a negative consolidation and a fall of the euro below the 0.99000 level. After that, increased bearish pressure would further burden the fragile euro. Potential lower targets are 0.98500 and 0.98000 levels.

For a bullish option, we need a new positive consolidation and a return above the 1.00000 level. After that, we must stay there and continue the recovery with a new bullish impulse. We could then expect EURUSD to move towards 1.01000 from yesterday’s high.

A move above would be of great importance for the European currency. Potential higher targets are 1.01500 and 1.02000 levels.

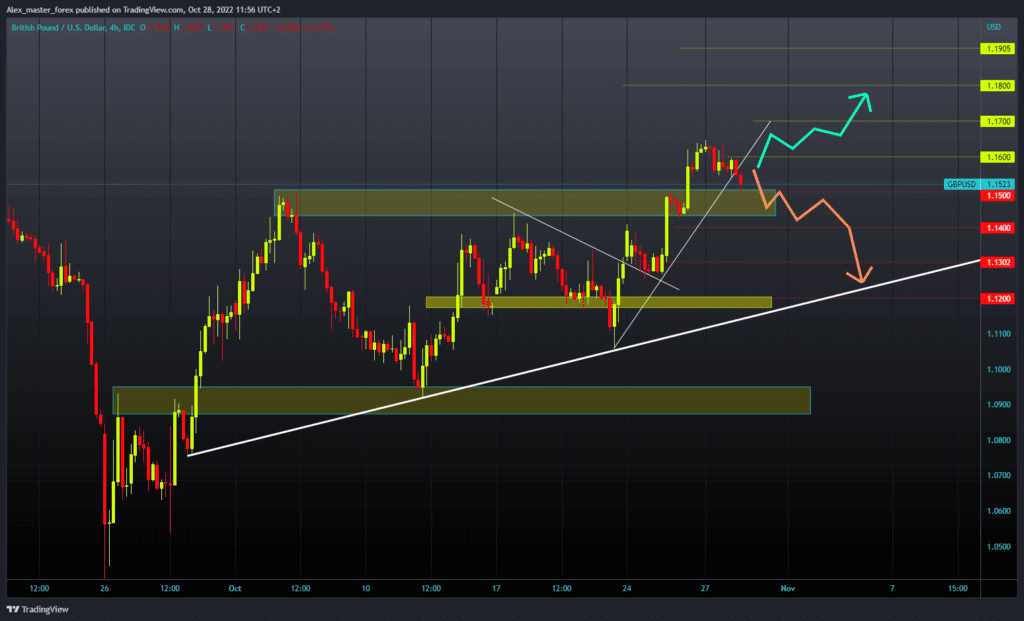

GBPUSD chart analysis

During the Asian trading session, the pound continued to retreat from the October peak. The pound fell to the 1.15000 support level this morning, and if a break below occurs, we could see a drop all the way to the lower trend line.

For such a thing, we need a negative consolidation and a break below the 1.15000 level. Potential lower targets are 1.14000 and 1.13000 levels. We need a positive consolidation and a return above the 1.16000 level for a bullish option.

After that, we would have a better chance to continue with the pound recovery with a new bullish impulse. Potential higher targets are 1.17000 and 1.18000 levels.

Market overview

The European Central Bank raised three key interest rates by 75 basis points. The ECB stated that the interest rates on the main refinancing operations would be two percent, on marginal credit facilities 2.25 percent, and on foreign currency facilities 1.5 percent. Interest rates have been increasing since November 2, 2022.

“With this third large increase in the benchmark interest rate in a row, significant progress has been made in the adjustment of monetary policy,” the European Central Bank stated. As pointed out, a further increase in interest rates is expected in order to ensure the return of inflation to the level of two percent in the medium term.

The post EURUSD and GBPUSD: The Euro Continued to Weaken Today appeared first on FinanceBrokerage.

0 Response to "EURUSD and GBPUSD: The Euro Continued to Weaken Today"

Post a Comment