Gold and Silver: The Gold Price Continues Its Bearish Trend

Gold and Silver: The Gold Price Continues Its Bearish Trend

- The price of gold continues its bearish trend from yesterday, testing today’s support at the $1640 level.

- The price of silver additionally fell today from yesterday’s $19.20 level to $18.80.

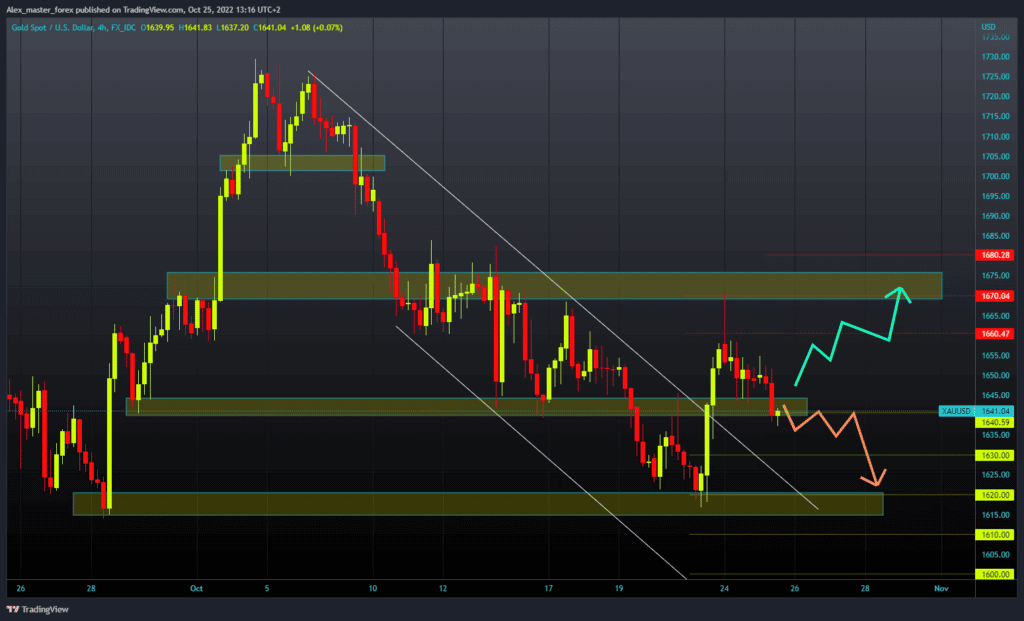

Gold chart analysis

The price of gold continues its bearish trend from yesterday, testing today’s support at the $1640 level. If we fail to hold on here, we could see a further pullback in the price of gold. With the continuation of negative consolidation, the price could drop to last week’s low at the $1620 level.

A break below would form new two-year lows, and potential lower targets are $1610 and $1600 levels. For a bullish option, we need a new positive consolidation and a return above the $1650 level. After that, the price of gold could test the $1660 level, and if it holds there, we could see a continuation of the recovery. Potential higher targets are $1670 and $1680 levels.

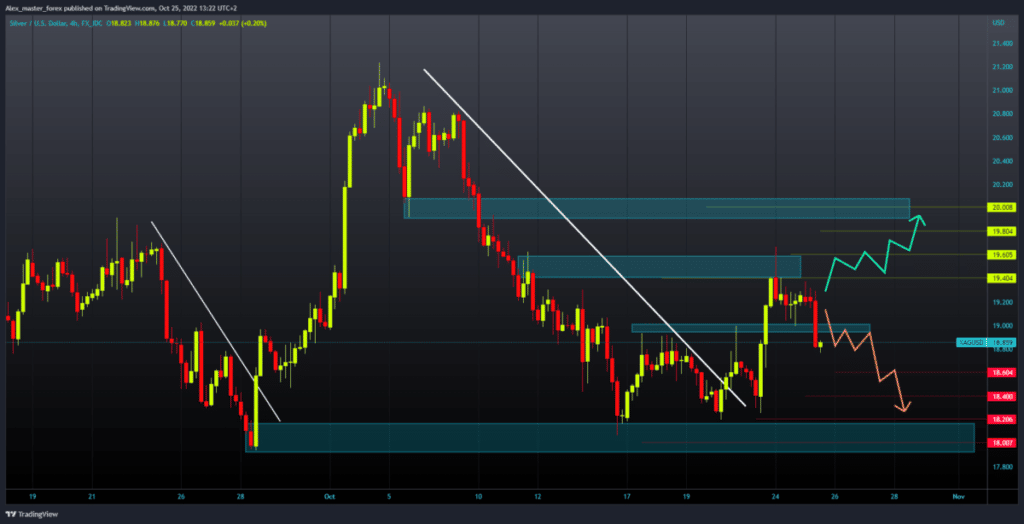

Silver chart analysis

The price of silver additionally fell today from yesterday’s $19.20 level to $18.80. A strong bearish impulse in the previous four hours could cause the price of silver to continue to weaken and revisit last week’s $18.00-$18.20 support zone.

For a bullish option, we need a positive consolidation and a return above the $19.00 level. After that, we could expect the price of silver to try to recover above the $19.40 level. This would move us into a positive zone from which a new bullish impulse could emerge. Potential higher targets are the $19.60 and $19.850 levels.

The post Gold and Silver: The Gold Price Continues Its Bearish Trend appeared first on FinanceBrokerage.

0 Response to "Gold and Silver: The Gold Price Continues Its Bearish Trend"

Post a Comment