Three black crows pattern – how to use it while trading?

Three black crows pattern – how to use it while trading?

Have you ever thought about three black crows and how to trade them? Why is it important to understand this pattern? As a motivated trader who has a huge ambition to improve his results in the long run, you must know what the valuable patterns are.

To gain more profit from the market’s volatility, you must know all the essentials about the three black crows pattern. So, what kind of formation is this, and how can it bring you huge profits once you get all the essential information about this pattern?

Let’s find out from the very basic definition, shall we?

What does the three black crows pattern represent?

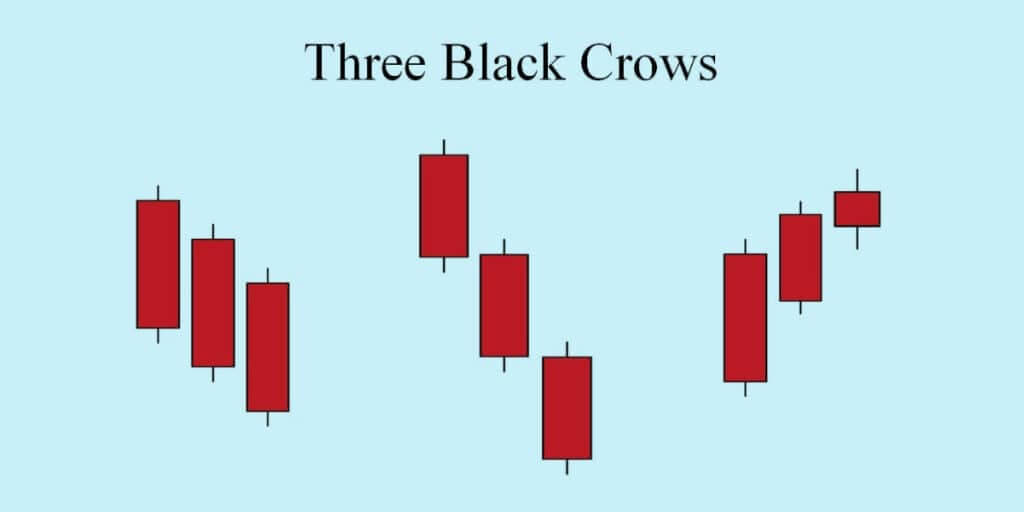

Three black crows patterns represent a specific bearish candlestick pattern that can forecast the turnaround of an uptrend. This three black crows candlestick is made up of 3 consecutive bearish candles that establish inside the uptrend.

Candlestick charts enable information about the day’s high, low, opening, and

prices that are closing for a certain security. Three black crows are able to be found in CFD and Forex markets. The candlestick gets green or white when the stocks are moving higher. On the other hand, when they’re going lower, these candlesticks are red or black.

The black crow pattern

Regarding the black crow candlestick pattern, we can see that it comprises three long-bodied consecutive candlesticks. These candlesticks are unlatched inside the body of the past candle and then closed beneath that past candle.

This indicator is frequently utilized by traders jointly with other chart patterns or technical indicators as reversal confirmation. Traders are able to spot three black crows that would probably be a shorting signal like the famous Bearish 3 bar play pattern.

For that reason, the three black crows pattern can be gladly embodied in bullish trend reversal strategies for trading.

Understanding the Three Black Crows Candlestick Pattern

We are talking about a specific visual pattern that excludes any calculation that traders potentially use to identify this indicator. Three black crows pattern happens once “bears” surpass the bulls in 3 successive trading sessions.

The prices charts reveal a pattern characterized by three long-shaped, gloomy candlesticks with hardly any upper or lower extensions. This phenomenon is referred to as the emergence of three black crows.

At the start of the session, the buyers push the prices upward, but as the day goes on, the bears overpower the bulls and push the prices downward. By the end of the session, the prices closed near the lowest point of the day as a result of the bears’ persistent pressure.

This particular type of trading activity results in minimal or no extensions. Traders usually interpret this prolonged bearish pressure throughout three sessions as an indication of a downward trend in the market.

When does this pattern usually appear?

The bearish three-black crows pattern is a common sight at the conclusion of a bullish trend. Nonetheless, it’s undoubtedly, not limited to this scenario and can also be observed following a period of price stability, much like its bullish counterpart, the three white soldiers.

While it is considered a signal of an impending bearish move, it is not as strong of an indicator as when it appears after a prolonged uptrend. Anyways, it’s crucial to note that the pattern can be overly forceful. Their large candles indicate that the bears have over-extended themselves, pushing the security into oversold territory.

In such cases, the bears must be cautious as the bulls may take advantage of the bears’ weakened momentum and cause a reversal instead of a retracement.

How does the three black crows pattern interpret?

For those wondering how does the three black crows candlestick pattern interpret, here is what they need to know:

The three black crows pattern clearly indicates a trend reversal, often appearing at the culmination of a bullish trend. This pattern is characterized by the emergence of three consecutive bearish candles, each closing at a lower level than the previous one, signifying a determined move by the bears to drive down the price and nullify gains made by the bulls.

Typically, the pattern commences with a gap down, and the subsequent candles open within the real body of the preceding candles. Furthermore, each candle displays a very short lower shadow, or ideally no shadow, revealing the bears’ dominance in keeping the price close to the session’s low.

Additionally, the candles exhibit large real bodies, roughly of the same size, which confirms the robustness of the bearish push as they force the price through a wide range without ceding any ground to the bulls.

How to effectively use the three black crows pattern while trading?

Using three black crow patterns while trading could be a piece of cake once you’ve clearly understood the black crow candlestick. Among numerous three black crows examples, here’s one example that might help you understand its best usage:

The three black crows formation is a visual representation of a trend reversal. As such, it is recommended to utilize it in conjunction with other technical indicators to comprehend the market trend better.

Ideally, it’s best for the three black crows to be elongated bearish candles that either close at the lowest cost for the interval or nearby it, with extensive bodies and tiny or no projections. The efficacy of the formation depends on its structure and the build of the candlesticks.

Nonetheless, if the projections are extended, it may indicate a temporary transfer in acceleration between the bears and bulls prior the uptrend affirms itself.

Volume – plays a crucial role in validating the precision.

Volume, without any doubt, plays a crucial role in validating the precision of the 3 black crows formation. The volume in the course of the uptrend preceding the formation is typically low. At the same time, the famous three-day black crow formation is accompanied by proportionally excessive volume through the sessions.

This scenario suggests that the uptrend was initially set up by a non-large group of bulls and then set aside by a much more extensive group of bears. It’s vital to note that the markets are complex and dynamic. This might also implicate a significant number of small bullish traders encountering a non-extensive group of large-volume bearish trades.

The genuine amount of market participants is less significant than the volume each participant brings to the market. It’s essential to remember that the three black crows formation, like any other technical indicator, should not be used alone.

Three black crows pattern examples – what you need to know

An example of the three black crows pattern can be observed in the GBP/USD weekly price chart during the third week of May 2018. This particular formation is generally seen as a bearish indication for the currency pairing, and analysts believed that it signaled a continuation of a downward trend. The reasoning behind this conclusion was based on three key observations:

- A steep upward trend characterized the preceding bullish market, abruptly halted by the appearance of the three black crows pattern.

- The lower shadows of each candle were quite short, indicating a small difference between the close and the week’s low price, which implies bears could keep prices near the session low.

- The candles did not appear gradually elongate; however, the longest candle was observed on the third day, the last day of the three black crows pattern, further strengthening the bearish indication.

All of these observations together indicated that the three black crows pattern was signaling a continuation of a downtrend.

What is the three black crows success rate?

If you were thinking about the three black crows success rate, it’s vital to know that the three black crows pattern can be a strong signal of an uptrend reversal, but it’s important to note that it’s not a guarantee of success.

While some traders assert that the pattern has a high accuracy rate, close to 80%, the pattern’s performance can fluctuate depending on the market context and the strategy used to trade it.

What are the main limitations of this pattern?

\Although you may have been convinced that this pattern is omnipotent, there are certain limitations. So, it’s crucial to comprehend that the black crows pattern isn’t a secret recipe for 100% guaranteed success. Its performance and effectiveness may strictly vary depending on the approach of a trader and the market context in general.

Also, ambitious traders need to be cautious about the oversold conditions since they might result in consolidation before any next move is lower. Tech indicators like the famous RSI indicator and the stochastic oscillator are usually utilized to access the asset’s oversold nature.

Remember that it is also beneficial for traders to utilize other technical indicators or chart patterns if they’re about to confirm a breakdown instead of solely relying on the three black crows pattern.

Furthermore, indicators such as a decline from key support levels can independently forecast the start of an intermediate-term downward trend. Incorporating multiple indicators and patterns increases the chances of an effective trade or exit plan.

Summary

The three black crows pattern represents a specific bearish indicator that’s usually utilized in technical analysis to predict a reversal of a specific uptrend. It is characterized by the appearance of three consecutive bearish candles within an uptrend. Candlestick charts display information about the day’s high, low, opening, and prices that are closing of a particular security.

This pattern is commonly found in CFD and Forex markets. When the stocks are moving higher, the candlestick appears green or white, and when they’re moving lower, it appears red or black. The black crow pattern comprises three long-bodied consecutive candlesticks that open within the real body of the previous candle and close lower than the previous candle.

It is often used with other chart patterns or technical indicators to confirm a reversal. Understanding the three black crows pattern is crucial for traders looking to improve their results in the long run.

The post Three black crows pattern – how to use it while trading? appeared first on FinanceBrokerage.

0 Response to "Three black crows pattern – how to use it while trading?"

Post a Comment