What Is a Rally Base Rally Strategy in Trading?

What Is a Rally Base Rally Strategy in Trading?

So, what is Rally Base Rally (RBR) strategy in trading? Let’s find out!

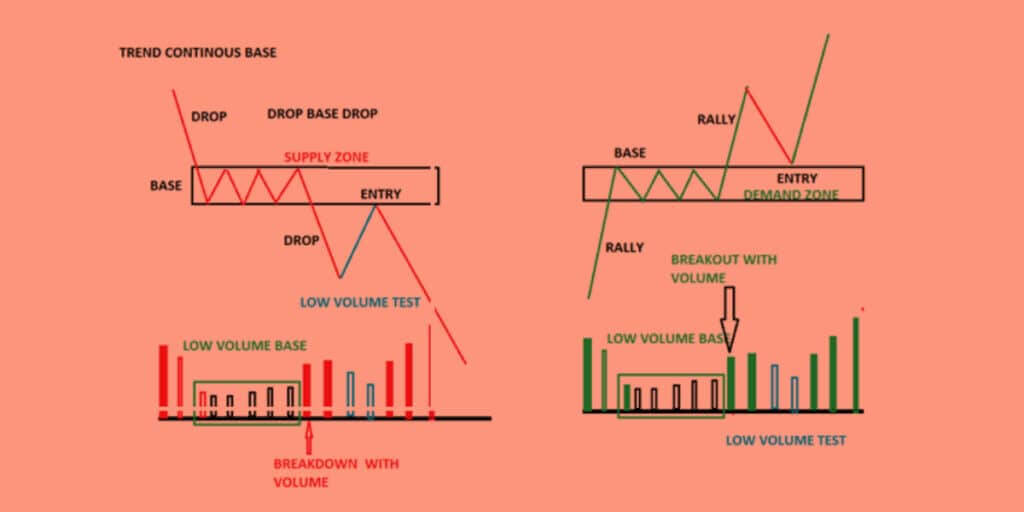

It is a price pattern that represents the creation of a demand zone. The Rally Base Rally strategy forms special zones on the chart that increase the demand/number of buyers at that zone. As a reminder, the RBR is a type of supply and demand in trading.

Do you know what it takes to identify RBR?

When it comes to RBR, a base zone is wedged between two rallies or bullish trends of price. Notably, the base zone highlights the demand zone.

What’s interesting, the basic form of this RBR pattern is made up of three candlesticks. Two of them are big bullish candlesticks and one base candlestick.

Now, let’s take a look at the simple formula. We can use it in order to spot RBR patterns in trading.

Rally base Rally = Big bullish candlestick + Base candlestick + Big bullish candlestick

What is the purpose of the RBR pattern?

The above-mentioned pattern creates a demand zone on the price chart. We need to mention that the demand zone implies that there is a lot of demand in that area. As a reminder, big institutions, as well as world-famous banks, are already willing to buy from that area. Big traders are closely monitoring the demand zone.

Thanks to the pattern mentioned above, it is easier to locate demand zones that are under the attention of big traders. Unsurprisingly, increased demand translates into the increased price.

As you can see, it is important to pay attention to the RBR pattern.

We can’t forget about the drawback of the demand zone. The main disadvantage of the above-mentioned zone is that the demand zone doesn’t show the location of taking profit level.

You have the opportunity to open an order and place a stop loss; however, you can’t forecast take profit level. So, it is better to use other chart patterns with a demand zone in order to spot take-profit levels.

It is noteworthy that the drop base drop is the exact opposite of a rally base rally strategy, with the only similarity being they both form during trending movements.

A rally base rally pattern will always create a demand zone in the market, and a drop base drop will always create a supply zone.

Rally Base Rally strategy and traders

As we have already covered the Rally Base Rally strategy, we can focus on other important topics.

One of them is the trading platform. The financial markets have evolved over the years. It is worth noting that traders can participate in the forex market utilizing forex trading platforms.

Trading platforms play an important role in the modern world. As a reminder, MetaTrader 4 and MetaTrader 5 are the most popular trading platforms in the world.

What’s important is that both of them allow you to do your trading from any electronic device. Metatrader 4, as well as MetaTrader 5, have the potential to make life easier for tens of thousands of traders. For instance, they offer a wide range of valuable charts. We shouldn’t forget about indicators and tools that help traders. Thanks to the above-mentioned trading platforms, traders have the opportunity to save a lot of time.

Interesting details about the forex market

In order to make money in the world’s largest financial market, you need to understand the basics of trading.

For instance, it is important to know what technical and fundamental analysis is.

Let’s start with technical analysis. Traders use the above-mentioned method in order to predict and determine what the possible future price movement will be by analyzing trends as well as patterns.

Short-term and swing traders use this kind of analysis in order to

This kind of analysis is mostly used by short-term and swing traders to discover entry or exit points in the market. You need to keep in mind that the above-mentioned method takes only past data into account and is carried out utilizing indicators and charts.

What about fundamental analysis? This method is used by long-term position traders. Fundamental analysis involves looking at the intrinsic value of currencies, evaluated stats, as well as available information to determine price movement and take trading decisions. It is noteworthy that fundamental analysis is mostly based on news events, industry statistics as well as economic reports.

Important question

One of the most popular questions about forex is, “Can you make money on forex?” That is a really good question.

Of course, it is possible to make money. However, the vast majority of novice traders end up on the losing side. Do you know why?

They lose money because they don’t have a strategy that takes into account various factors. So, if you want to become a successful trader, you need to come up with a strategy that takes into consideration various factors.

In order to become a successful trader, you must read articles and books about the forex market. Moreover, it makes sense to watch videos about various forex trading strategies, etc. Furthermore, it is a great idea to spend some time on a demo account to trade the forex market until you get comfortable with the market.

Is it possible to reduce risk?

As stated earlier, the forex market is the largest financial market in the world. However, we shouldn’t forget about risk factors as well.

First of all, you need to find a trustworthy broker. Fortunately or unfortunately, there is no lack of forex brokers. However, not all of them are equally good. For example, some of them offer better rates than others.

So, it is desirable to understand all advantages and disadvantages of any broker.

Moreover, it is hard to underestimate the importance of diversification.

Diversification is vital because, for instance, if you are trading strictly USD pairs and something negative happens in the United States, the issue mentioned earlier could impact your whole portfolio negatively.

So, it is vital to diversify your portfolio in order to reduce risk.

When trading, it is vital to limit your position size to only require roughly 2% of your capital; this way, you don’t become overburdened. Moreover, ensure you aren’t leveraged greatly as you can make money quickly; however, you can lose money quickly as well.

To sum up, the forex market is an endless topic. So, if you want to become a successful forex trader, you must enrich your knowledge about the forex market on a regular basis.

The post What Is a Rally Base Rally Strategy in Trading? appeared first on FinanceBrokerage.

0 Response to "What Is a Rally Base Rally Strategy in Trading?"

Post a Comment